How User Preferred Currency Exchange Works

The simple and advanced user-preferred currency choices determine how and when your currency exchange rates are calculated. For both simple and advanced currency management, when you save or close a report, the exchange rate is set at that time.

The option you choose impacts how quickly your reports are generated at run time. Each case includes trade-offs, as detailed in the examples.

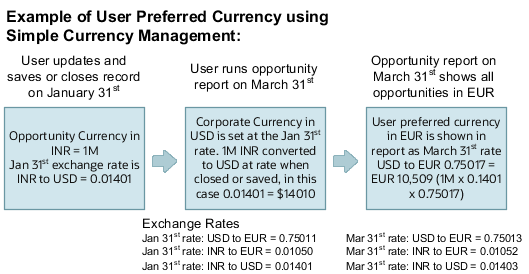

User Preferred Currency using Simple Currency Management

The advantage of this option is performance - the application doesn't have to look up the rate for each transaction because when you close or save a record, the application converts it to your corporate currency at that day's rate. When you run the opportunity report, the application multiplies that value by your preferred currency exchange rate for the date you run the report. This eliminates the need for the application to cycle through each record, and calculate the corresponding exchange rate to your preferred exchange rate at the time that record was closed or last saved. It simply takes the value on record for the original transaction exchange to corporate currency, and multiplies it by your preferred currency exchange rate at the time your run the report.

As an example of user preferred currency using simple currency management, a user updates and saves or closes an opportunity record with associated revenue of one million Indian Rupees on January 31st with an exchange rate of 0.01401 Rupees to one US Dollar. The user then runs an opportunity report in US Dollars on March 31st. In the report, the US Dollar Corporate Currency is set at the January 31st rate it was saved at, in this case reporting as $14,010, or one million multiplied by 0.01401. Finally, an opportunity report on March 31st in Euros uses the March 31st conversion rate for US Dollars to Euros of 0.75017 to convert the recorded US Dollar amount into Euros, in this example one million multiplied by 0.01401, which is the January 31st Rupee to US Dollar exchange rate, multiplied by 0.75013, which is the March 31st rate for Euros. This requires less processing, because the January 31st Rupee to US Dollar exchange rate, while not exact on March 31st, is used as the basis for the calculation of the March 31st opportunity revenue conversion to Euros at the later exchange rate.

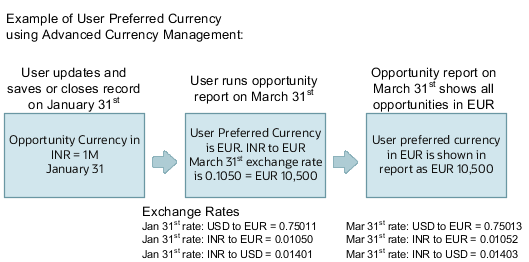

User Preferred Currency using Advanced Currency Management

This option provides a more precise exchange rate, since it goes through each record to determine the rate on the date the record was updated or closed. The downside of this option is performance. Your reports will take longer to run. The application has to cycle through each record and match currency exchange rates to the date the record was closed or updated and saved.

As an example of user preferred currency using advanced currency management, a user updates and saves or closes an opportunity record with associated revenue of one million Indian Rupees on January 31st, when an exchange rate of 0.01050 Rupees to one Euro applies. The user then runs an opportunity report on March 31st. In the report, the User Preferred Currency of Euros is applied, using the January 31st Rupee to Euro rate of 0.01050, requiring calculation during report processing to resolve the opportunity to 10,500 Euros. Note that running the opportunity report on March 31st doesn't change the calculation and the close date of January 31st is used.