Examples of HCM Organization Models

You can use any of these HCM organization models.

-

Simple Configuration

-

Multiple Legal Employers and Tax Reporting Units

-

One Payroll Statutory Unit and Two Tax Reporting Units

-

One Payroll Statutory Unit with Several Tax Reporting Units

-

Multiple Payroll Statutory Units with Several Tax Reporting Units

These models include a legislative data group (LDG) that isn't an organization classification and show how you can partition payroll data by associating them with a payroll statutory unit

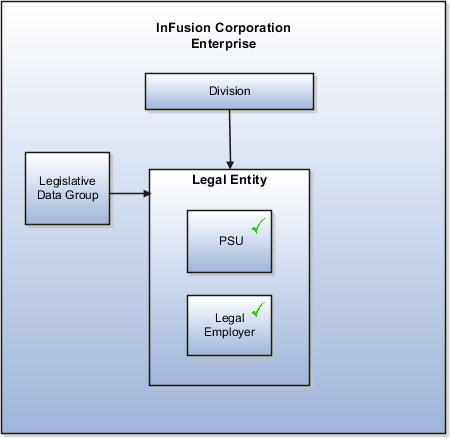

Simple Configuration

This is an example of a simple configuration without any tax reporting units. The enterprise has only one legal entity, which is both a payroll statutory unit and a legal employer, and shares the same boundaries. In this type reporting can be done only at a single level. Countries such as Saudi Arabia and the United Arab Emirates (UAE) might use this type of model, as these countries report at the legal entity level.

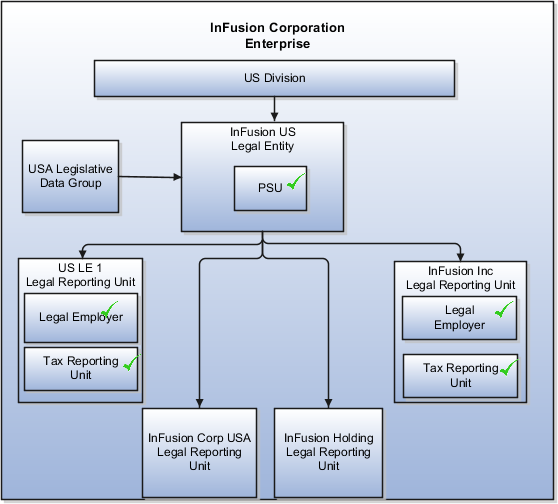

Multiple Legal Employers and Tax Reporting Units

In this configuration, you define one legal entity, InFusion US as a payroll statutory unit with two separate legal entities, which are also legal employers. This model shows multiple legal employers that are associated with a single payroll statutory unit. Tax reporting units are always associated with a specific legal employer (or employers) through the payroll statutory unit.

The implication is that payroll statutory reporting boundaries vary from human resources (HR) management, and you can categorize the balances separately as either a payroll statutory unit, legal employer, or a tax reporting unit.

This configuration is based on tax filing requirements, as some tax-related payments and reports are associated with a higher level than employers. An example of a country that might use this model is the US

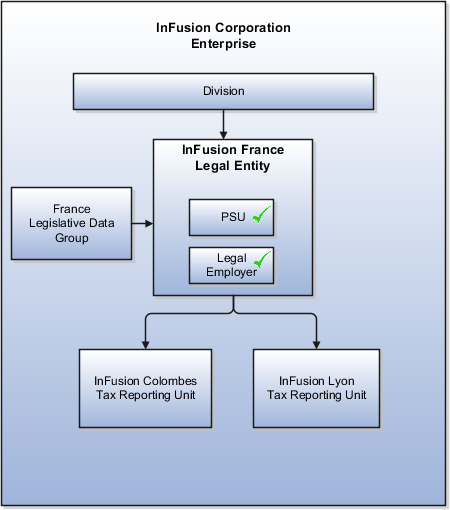

One Payroll Statutory Unit and Two Tax Reporting Units

This model makes no distinction between a legal employer and a payroll statutory unit. You define tax reporting units as subsidiaries to the legal entity.

In this enterprise, legal entity is the highest level of aggregation for payroll calculations and reporting. Statutory reporting boundaries are the same for both payroll and HR management. An example of a country that might use this model is France.

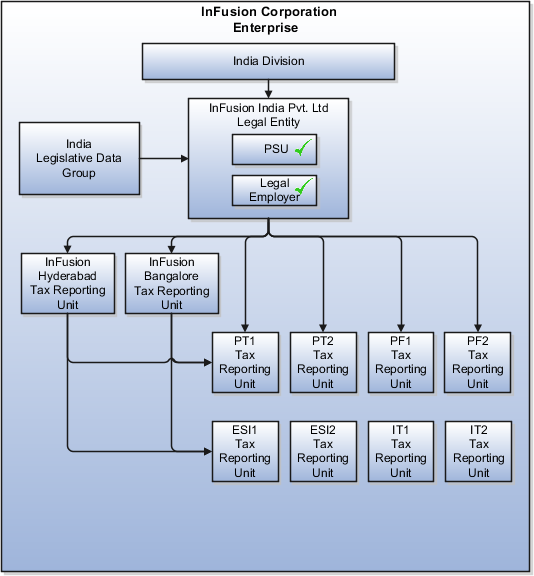

One Payroll Statutory Unit with Several Tax Reporting Units

In this model, the enterprise has one legal entity. Legal employers and tax reporting units are independent from each other within a payroll statutory unit, because there is no relationship from a legal perspective. Therefore, you can report separately on both entities

Using this model, you can't report on tax reporting unit balances within a legal employer, and categorize balances by either or both organizations, as required. An example of a country that might use this model is India.

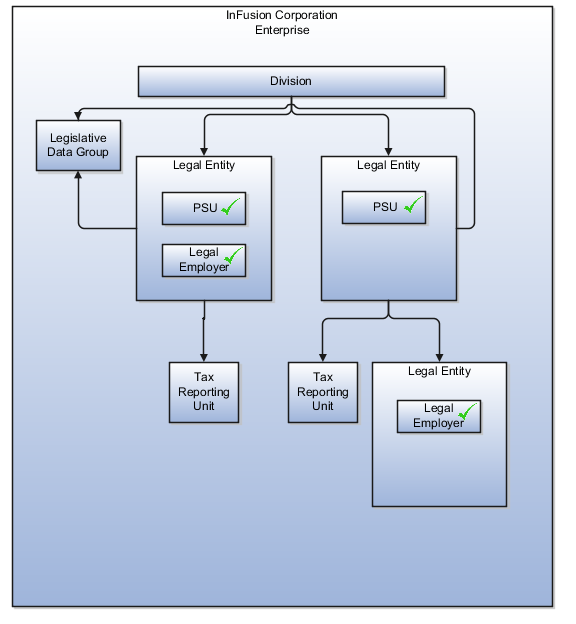

Multiple Payroll Statutory Units with Several Tax Reporting Units

In this model, the enterprise has two legal entities. The legal employers and tax reporting units are independent from each other within a payroll statutory unit, because there is no relationship from a legal perspective. Therefore, you can report separately on both entities.

Using this model, you can't report on tax reporting unit balances within a legal employer, and categorize balances by either or both organizations, as required. An example of a country that might use this model is the United Kingdom (UK).