Model Your Financial Reporting Structure

This example uses a fictitious global company to demonstrate the analysis that can occur during the financial reporting structure planning process.

Scenario

Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the United Kingdom (UK). InFusion has purchased an Oracle Fusion Enterprise Resource Planning (ERP) solution including Oracle Fusion General Ledger and all of the Oracle Fusion subledgers. You are chairing a committee to discuss creation of a model for your global financial reporting structure including your chart of accounts for both your US and UK operations.

InFusion Corporation

InFusion Corporation has 400 plus employees and revenue of 120 million US dollars. Your product line includes all the components to build and maintain air quality monitoring systems for homes and businesses. You have two distribution centers and three warehouses that share a common item master in the US and UK. Your financial services organization provides funding to your customers for the start-up costs of these systems.

The following are elements you must consider in creating your model for your financial reporting structure.

-

Your company is required to report using US Generally Accepted Accounting Principles (GAAP) standards and UK Statements of Standard Accounting Practice and Financial Reporting Standards. How many ledgers do you plan to have to achieve proper statutory reporting?

-

Your financial services line of business has a different year end. Do you need a different calendar? Your financial services entity must report with average balance sheets. This feature of Oracle Fusion General Ledger provides you with the ability to track average and end-of-day balances, report average balance sheets, and create your own reports using both standard and average balances.

-

Your corporate management requires reports showing total organizational performance with drill-down capability to the supporting details. Do you need multiple balancing segment hierarchies to achieve proper rollup of balances for reporting requirements?

-

Legal entity balancing options: Do you produce financial statements by one or more than one legal entity? Can you record multiple legal entities in one ledger or do you require multiple ledgers? Are you upgrading to Oracle Fusion Applications or a new install? If an upgrade, is your current financial reporting structure meeting your reporting needs?

Global Financial Reporting Model

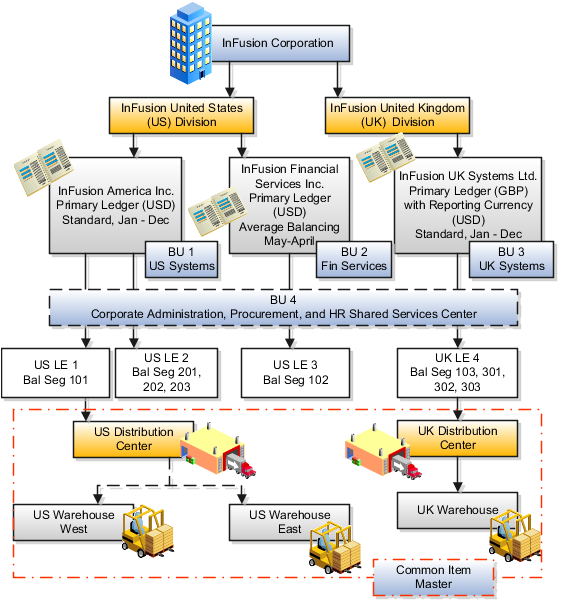

The following figure and table summarize the model that your committee has designed and uses number values to provide a sample representation of your financial reporting structure. The model includes the following recommendations:

-

Creation of three separate ledgers representing your separate legal entities:

-

InFusion America Inc.

-

InFusion Financial Services Inc.

-

InFusion UK Services Ltd.

-

-

Data security is controlled by balancing segment values using Oracle Fusion General Ledger data access sets

Recommendations for the chart of accounts design include:

-

Segments required for cost centers with hierarchical rollups to departments providing reporting at both the detail (cost center) and summary (department) level.

-

Accounts configured to provide drill down capability to the subledger transactions, enabling analysis of data.

This figure illustrates a an example of your financial reporting structure.

This table contains a summarization of the plan that your committee has designed, and uses number values to provide a sample representation of your financial reporting structure.

|

Decision |

InFusion America, Inc. |

InFusion Financial Services, Inc. |

InFusion UK Systems, Ltd. |

|---|---|---|---|

|

Type of Ledgers |

Primary |

Primary |

Primary with the use of Reporting Currency functionality |

|

Legal Entity Codes |

US Legal Entity 1: US Corporate US Legal Entity 2: US Systems |

US Legal Entity 3: US Financial Services |

UK Legal Entity 4: UK Systems |

|

Balancing Segments |

101: US Corporate 201: US Systems Components 202: US Systems Installations 203: US Systems Maintenance |

102: US Financial Services |

103: UK Systems 301: Components 302: UK Systems Installations 303: UK Systems Maintenance |

|

Currencies for Reporting |

US Dollar (USD) |

US Dollar (USD) |

Great Britain Pounds Sterling (GBP) US Dollar (USD) |

|

Calendar Ending Date |

December 31st |

April 30th |

December 31st |

|

Business Units (BU)* |

BU 1: US Systems BU 4: Corporate (Shared Service Center) |

BU 2: Financial Services |

BU 3: UK Systems |

|

Balances Storage Method |

Standard Balances |

Average and Standard Balances |

Standard Balances |

|

Locations represented by cost centers in the chart of accounts. |

Headquarters US Distribution Center (BU 1) US Warehouse West US Warehouse East |

Headquarters |

UK Distribution Center (BU 3) UK Warehouse |