About the Processes to Calculate, Distribute, and Invoice Joint Venture Overhead

The Process Joint Venture Overhead process calculates overhead for your joint ventures and creates transactions with overhead amounts. These overhead transactions are an additional source of transactions, along with transactions from subledger accounting and the general ledger, that you can process to recoup the costs of running a joint venture from joint venture partners.

Schedule the following processes to periodically calculate, distribute, and invoice overhead:

-

Process Joint Venture Overhead

This process uses the details in an overhead method associated with a joint venture to calculate overhead and generate transactions with overhead amounts. The overhead method identifies which joint venture transactions, subledger accounting and general ledger transactions, or operational measures to use as the basis for the calculation. It also contains the percentage or the rate to use for the calculation of the overhead amount.

You can view transactions generated by this process in the Joint Venture Source Transactions work area. And you can update certain details in the transactions to change how they are processed. Initially, all overhead transactions in this work area have a status of “Available to process.”

-

Identify Joint Venture Transactions

Run this process over joint venture source transactions to identify overhead transactions for distribution. Joint venture source transactions identified by this process are displayed in the Joint Venture Transactions work area along with transactions identified from subledger accounting and the general ledger.

-

Create Joint Venture Distributions process

This process splits overhead transactions for a joint venture according to each stakeholder’s percentage defined in the ownership definition assigned to an overhead method. It creates distributions with each stakeholder’s overhead amount. Distributions are displayed in the Joint Venture Distributions work area with a status of “Available to process.”

-

Create Joint Venture Invoices and Journal Entries process

This process creates invoices from overhead distributions so you can recoup indirect costs from the joint venture partners.

You can run these processes over a single joint venture or over all joint ventures that have overhead methods associated with them.

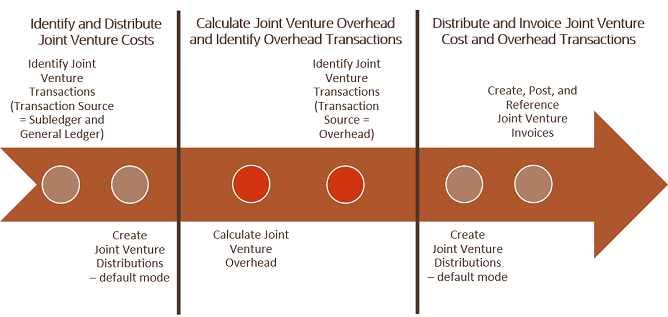

The following illustration shows the order in which you need to run the Oracle Joint Venture Management processes to process overhead: