Calculate Joint Venture Overhead

Use the Process Joint Venture Overhead process to calculate overhead amounts for a joint venture. The process creates overhead transactions that can be viewed in the Joint Venture Source Transactions work area, where you have the option to update the status and the transaction date of the transactions if necessary. See Manage Joint Venture Source Transactions for more information.

-

From the Home page, select Joint Venture Management, and then select Process Joint Venture Overhead from the Quick Actions list.

-

On Process Details, determine when you want to run the process:

-

As soon as possible. This is the default.

-

On a schedule. Click Advanced to set up a schedule for running the process. This displays the Advanced Options, where you can create a schedule and set up a notification so you or another user are notified about the process.

-

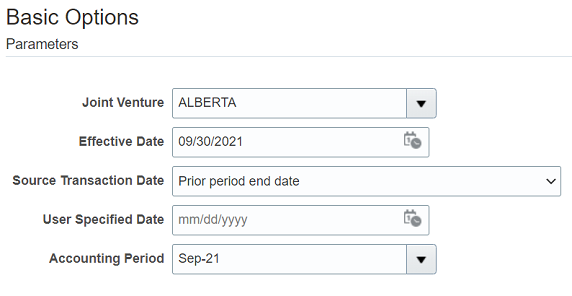

In the Basic Options Parameters section, complete these fields:

-

Joint Venture. Select a particular joint venture or leave this field blank if you want to calculate overhead for all joint ventures. Only joint ventures in an Active status will be processed.

If data security is enabled, the list includes only the joint ventures associated with the business units that you are authorized to manage.

-

Effective Date. Enter a date that coincides with the effective date range that is specified in the overhead method associated to the joint ventures. Leave this field blank to use the current date.

-

Source Transaction Date. Select the date to use for the transaction date in transactions generated from this process, or leave blank to use the current date:

-

Current period end date. The last day of the current period.

-

Prior Period End Date. The last day of the prior period.

-

System Date. The process uses the system date.

-

User specified date. To manually enter a date, select this option and enter the date in the next field.

-

-

User Specified Date. Complete only if “User specified date” is selected for the Source Transaction Date.

-

Accounting Period. If calculating overhead based on general business transactions, enter the period for which you want to calculate the overhead amount. This enables the process to calculate overhead according to the period basis specified in the overhead method: the period, year to period, or inception to period.

The following image shows an example of the parameters:

-

-

Click Submit.

-

Back on the Scheduled Processes Overview page, you can view a list of submitted processes and their statuses.

-

After the process completes, you can click the log file in the Log and Output section to view the details about the process.