How You Analyze Source Systems

As a best practice, when performing the source system analysis complete the following:

1. Analyze and Identify Transaction Type Life Cycle

A source system that generates transactions as part of a business process has potential financial impact requiring creation of accounting entries. As a key step to create accounting entries, these transactions must be distinctly identified as different transaction types.

Examples of transaction types from revenue recognition or billing source systems include:

-

Complete an invoice.

-

Record a payment.

-

Record late charges.

Examples of transaction types from a point of sale source systems include:

-

Record an order.

-

Accept a payment.

-

Receive a payment.

Examples of transaction types from retail loans source systems include:

-

Loan origination.

-

Loan interest approval.

-

Loan interest accrual reversal.

-

Loan scheduled payment.

-

Loan late payment.

-

Loan charge off.

A transaction type and its associated transaction data typically relate to a single document or transaction. However, the nature of source systems may prevent them from extracting this discrete information and sending it to Accounting Hub for processing. In some cases, summarized transaction type information, such as overall customer activity for the day, is sent for accounting transformation.

2. Analyze Accounting, Reporting, Audit, and Reconciliation Requirements for Transaction Types

Some source systems may already produce accounting entries, while others may produce raw transactions with no associated accounting.

-

As part of the analysis, determine how much transformation is required to produce subledger journal entries.

-

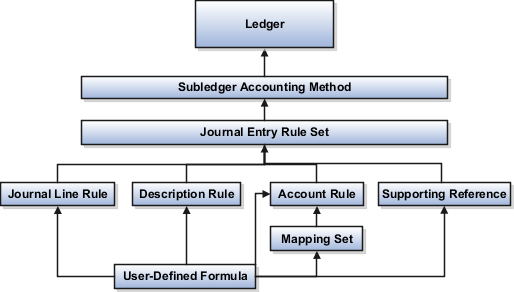

Next, examine the components of the journal entry rule set to determine what rules are required to produce the required subledger journal entries.

This exercise helps determine which subledger journal entry rule set components to define for source systems data to be transformed into subledger journal entries.

Journal entry rule set components include:

-

Description rules

-

Account rules

-

Journal line rules

-

Supporting references

Such an analysis should, at a minimum, answer the following questions:

-

Under what conditions are each of the lines in the subledger journal entry created?

-

What is the line type, debit or credit, of each subledger journal entry line?

-

What description is used for the subledger journal entry?

-

How are the accounts derived for the entry?

-

What information may be useful for reconciling the subledger journal entry to the source system?

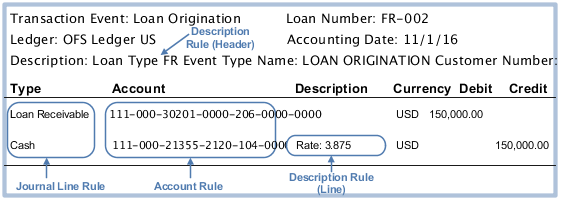

Using the example of a loan origination transaction type, determine what are the sources that store the transaction information for a journal entry? Visualize the journal entries that you would like to create for a loan origination transaction type and list all the sources for its transaction information.

This table contains a journal entry, with Side, Accounting Class, Accounting and Debit and Credit amounts.

|

Side |

Accounting Class |

Account |

Debit |

Credit |

|---|---|---|---|---|

|

Debit |

Loan Receivables |

111-000-30201-0000-206-0000-0000 |

500,000 USD |

None |

|

Credit |

Cash |

111-000-21355-0000-104-0000-0000 |

None |

500,000 USD |

-

In the table the example identifies the sources for the journal lines and accounts in a source system:

-

Each debit and credit journal line is identified and defined for each transaction type.

-

When a loan is originated, the loan receivables account is debited, and cash account is credited.

-

The cost center segment of the Loan Receivables accounts can have two values, depending on the loan type value:

-

If the loan type is adjustable rate, then the cost center is '0000'.

-

If the loan type is fixed rate, then the cost center is '2120'.

-

-

For management reporting and control, what type of information is extracted from journal entries?

For example:

-

Account group used to drill down from general ledger to subledger journal entries.

-

Total loan receivables amount booked by the loan officer.

-

Journal entry line description with loan number and transaction date.

At the end of this exercise, you have a list of transaction attributes that are required to obtain the appropriate accounting entries from Accounting Hub.

Examples of transaction attributes include:

-

Amounts including entered, accounted and conversion data

-

Dates

-

Descriptions

-

General ledger accounts

-

Customer Information

-

Transaction type information

-

Product information

3. Additional Modeling Considerations

Additional considerations when you model the subledger per your requirements.

Sample questions to ask during planning:

If you have more than one transaction type:

-

How do you report each of the transactions? This results in a number of transaction types.

-

Do you require centralized information or separate view?

-

For example, how do you plan to upload fixed and adjustable mortgage rate transactions, as one subledger source system, or as separate subledger source systems?

-

One subledger source system consolidates the transaction data upload and reporting view.

-

Separate subledger source systems enable the use of a unique accounting event class for each source system. With separate source systems, you can configure accounting rules for each accounting event class. For example, you can configure the automatic reversal on accrued subledger journal entries at a specified date or period for a specific accounting event class.

-

-

4. Analyze the Configuration of Accounting Rules in Accounting Hub

With the analyzed transaction information and subledger model completed, evaluate the usage of accounts rules. Understand the functional usage for each rule component and the requirements for accounting and reporting.

Journal Entry in Source System

This figure illustrates a journal entry.

Accounting Rule Configuration in Accounting Hub

This image illustrates the subledger flow as detailed in the Manage Accounting Rules topics.

The next implementation step will be registering your source system, as detailed in additional topics.