Example of Turning Tax Regulations into Tax Rules

This example illustrates how to set up tax rules based on tax regulation in the Her Majesty's Revenue and Customs (HMRC) VAT guide. It provides the detailed business conditions under which goods can be reverse charge (self-assessment) as part of the Intra-EU Supply legislation.

Scenario

You are a UK business registered for VAT in the UK. You purchase goods from other European Union (EU) countries and therefore fall under the HMRC Tax Regulation Intra-EU Purchase of Goods legislation.

HMRC Tax Regulation

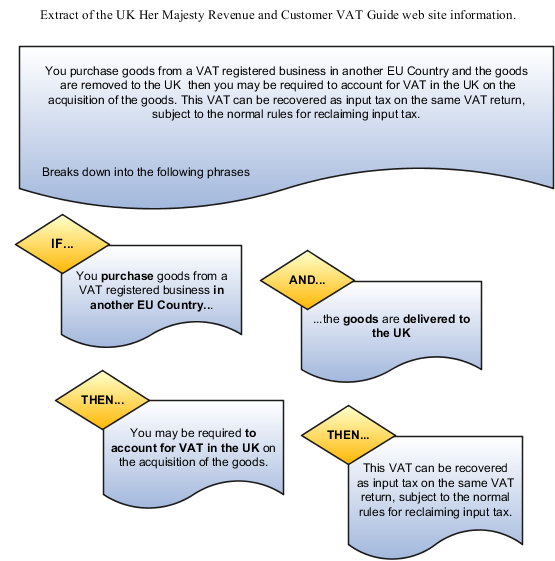

Consider that you purchase goods from a VAT-registered business in another EU country, and then move them to the UK. According to HMRC VAT guide, you may be required to account for VAT in the UK on the acquisition of goods. This VAT can be recovered as input tax on the same VAT return, subject to the normal rules for reclaiming input tax.

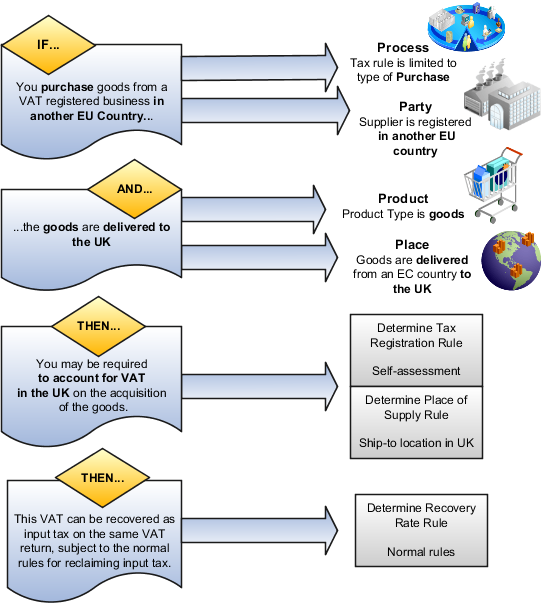

Analyze the text of the legislation and identify the key phrases in the legislation.

Break these phrases down into product, party, process, and place determining factors that describe under what conditions the legislation is applicable. Look at the legislation and identify the outcome when the legislation is applicable and determine which rule types are appropriate.

Have a look at the phrases identified in this tax legislation as represented in the previous figure:

|

Legislation Phrase |

Text |

Requirement |

|---|---|---|

|

1 |

If you purchase goods... |

The tax rule is limited to purchase transactions. |

|

2 |

...from a VAT-registered business in another European Community country... |

The tax rule requires that the supplier be registered in another EU country. |

|

3 |

...and the goods are removed... |

The tax rule is limited to the Goods product type. |

|

4 |

...are removed to the United Kingdom... |

The tax rule refers to goods delivered to the United Kingdom from another country in the EU country. |

|

5 |

...you may be required to account for... |

The party must reverse charge (self-assess) the tax. |

|

6 |

...for VAT in the United Kingdom... |

The tax is UK VAT. |

Resulting Tax Rules

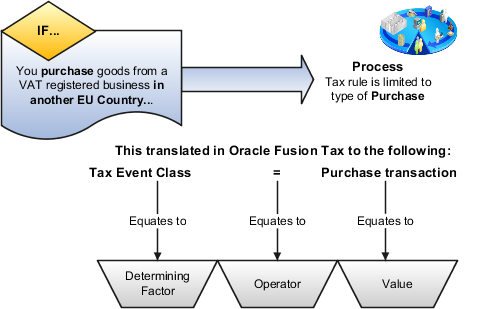

Legislation Phrase 1

Tax legislation phrase 1 indicates that the determining factor that defines this specific tax rule is only applicable to purchase transactions. This equates to a tax event class equal to purchase transactions. Use a tax event class rather than an event class as the tax event class covers other products in the procure-to-pay flow. This covers Oracle Fusion Payables and Oracle Fusion Purchasing processing with a single approach.

This table describes the contents of the tax condition set as represented in the previous figure:

|

Legislation Phrase |

Determining Factor Name |

Operator |

Value |

|---|---|---|---|

|

1 |

Tax Event Class |

Equal to |

Purchase transaction |

Determining factors like this enable you to define tax rules that are only applicable to specific types of transactions. The previous approach presents a convenient way of splitting order-to-cash and procure-to-pay transactions. By using event class, you can make a more detailed refinement so that tax rules are only applicable to specific product transactions. This flexibility drives the simplification of combining procure-to-pay tax setup with order-to-cash tax setup into a single model. In most cases, you don't have to distinguish between procure-to-pay or order-to-cash transactions within the tax rules. However, do this where you must create specific procure-to-pay or order-to-cash tax rules using this key design concept.

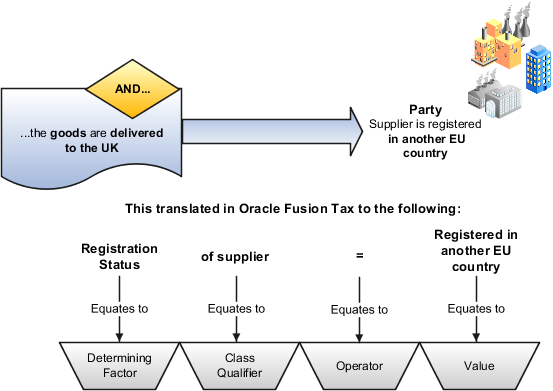

Legislation Phrase 2

Tax legislation phrase 2 indicates that the determining factor that defines the supplier is registered in another EU. You can model this in several ways. However, the recommended approach for you is to use a registration status on the tax registration record. These records are set up for the GB tax regime. Another recommendation is to have a business process in place. Retain documentary evidence to show that the supplier is validated as a true supplier registered in another EU country. Until you complete this manual business process, don't mark the supplier as registered in another EU country.

This table describes the contents of the tax condition set as represented in the previous figure:

|

Legislation Phrase |

Determining Factor Name |

Class Qualifier |

Operator |

Value |

|---|---|---|---|---|

|

2 |

Registration Status |

of supplier |

Equal to |

Registered in another EU country |

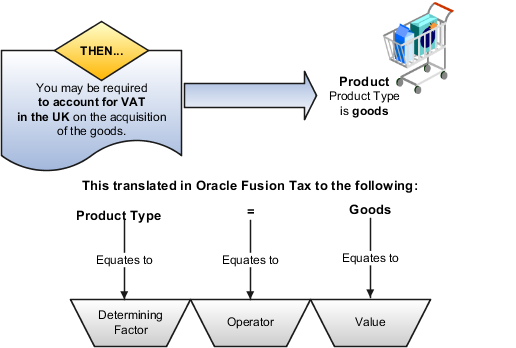

Legislation Phrase 3

Tax legislation phrase 3 indicates that the determining factor that defines the product type is goods. Another way of modeling this is to use a product fiscal classification which can automatically be derived from the item defined on the transaction. However, if an item isn't specified on the transaction, then there is no product fiscal classification derived. Consider the case where an unmatched purchase invoice gets processed. You must create additional tax rules and setup to address this situation.

This table describes the contents of the tax condition set as represented in the previous figure:

|

Legislation Phrase |

Determining Factor Name |

Operator |

Value |

|---|---|---|---|

|

3 |

Product Type |

Equal to |

Goods |

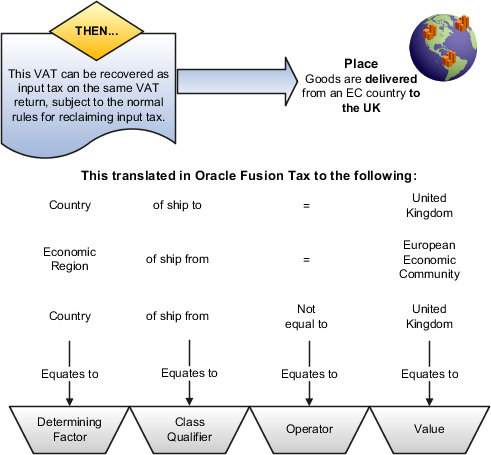

Legislation Phrase 4

Tax legislation phrase 4 indicates that the determining factors that define the supply is from another EU country. Here's how this is modeled:

-

Goods are being shipped to UK

-

Goods are being shipped from an EU country

-

The shipped-from country isn't UK

You can take items 2 and 3 to ensure that the goods are being sent from another EU country outside the UK.

Have a look at the tax condition set represented in the previous figure:

|

Legislation Phrase |

Determining Factor Name |

Class Qualifier |

Operator |

Value |

|---|---|---|---|---|

|

4 |

Country |

of ship to |

Equal to |

United Kingdom |

|

4 |

Economic Region |

of ship from |

Equal to |

European Economic Community |

|

4 |

Country |

of ship from |

Not equal to |

United Kingdom |

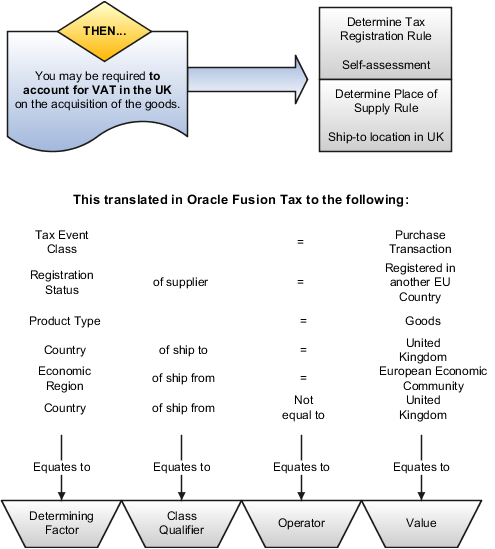

Legislation Phrases 5 and 6

The determining factors discussed previously are brought together as the basis for the Tax Registration tax rule. Tax legislation phrase 5 indicates how the rule is defined. This rule tells you to use the bill-to party registration in preference to the normal default bill-from party registration. This bill-from party registration triggers the reverse charge (self-assessment) for the type of transaction.

Tax legislation phrase 6 indicates how the determining factors discussed previously are brought together as the basis for the Place of Supply tax rule. This tax rule changes the normal place of supply to be the ship-to location. As a result, at least for the reverse charge (self-assessment) side of this transaction, it's deemed to have occurred in the UK.

Here's the tax condition set for the Tax Registration and Place of Supply tax rules as represented in the previous figure:

|

Legislation Phrase |

Determining Factor Name |

Class Qualifier |

Operator |

Value |

|---|---|---|---|---|

|

5 and 6 |

Tax Event Class |

Equal to |

Purchase transaction |

|

|

5 and 6 |

Registration Status |

of supplier |

Equal to |

Registered in another EU country |

|

5 and 6 |

Product Type |

Equal to |

Goods |

|

|

5 and 6 |

Country |

of ship to |

Equal to |

United Kingdom |

|

5 and 6 |

Economic Region |

of ship from |

Equal to |

European Economic Community |

|

5 and 6 |

Country |

of ship from |

Not equal to |

United Kingdom |