Centralized Payment Processing Across Business Units

Centralized payment processing enables you to implement a shared payment service model.

In this model, a single payment business unit provides payment services to multiple invoice business units. That is, any business unit with the Payables Payment business function can provide payment services to other business units with the Payables Invoicing business function.

The designated payment business unit processes invoices from multiple invoice business units and generates a consolidated payment for a given supplier. Because payment processing is centralized, you can exercise better control of supplier payments and reduce the cost of payment processing.

Payment Processing and Invoice Business Unit Setup

The payment business unit groups standard invoices, prepayments, and credit memos for the same supplier name and site, from all of the invoice business units that the payment business unit services.

Although invoices are grouped into a single payment, the payment business unit honors the setup values that apply to each of the invoice business units. For example, the US Headquarters payment business unit provides payment services to invoice business units US West and US East.

This table shows how the Discount Allocation Method invoice option is set for each invoice business unit.

|

Business Unit |

Discount Allocation Method |

|---|---|

|

US West |

Single distribution |

|

US East |

All invoice lines |

This table shows invoices for the same supplier and supplier site, along with whether discounts apply.

|

Invoice Number |

Business Unit |

Discount Applicability |

|---|---|---|

|

INV-West-001 |

US West |

Yes |

|

INV-West-002 |

US West |

No |

|

INV-East-001 |

US East |

Yes |

|

INV-East-002 |

US East |

Yes |

While processing the payments, US Headquarters groups the invoices together and generates a single payment for all four invoices. However, when accounting for the invoices the:

-

Discount on invoice INV-West-001 is allocated to a single distribution.

-

Discounts on invoices INV-East-001 and INV-East-002 are allocated to all of the invoice lines.

So even if a single payment is made, setups for the applicable invoice business units are respected.

This table shows setup tasks for invoice and payment options and the business unit that the tasks apply to.

|

Setup Task |

Applicable Business Unit |

|---|---|

|

Manage Common Options for Payables and Procurement |

Invoice |

|

Manage Invoice Options |

Invoice |

|

Manage Payment Options |

Payment |

|

Manage Tax Reporting and Withholding Tax Options |

Invoice |

Payment Service Models

The different models of payment services that you can implement are:

-

Dedicated

-

Self-Service

-

Dedicated and Self-Service

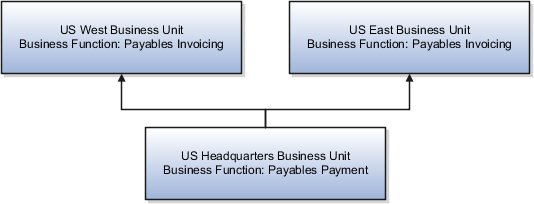

In a dedicated payment service model, the payment business unit works solely as an outsourced payment processing unit to service other invoice business units.

The following figure is an example of a dedicated payment services model.

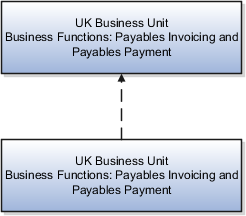

In a self-service model, the invoice business unit services itself, acting as its own payment service provider.

The following figure is an example of a self-service payment services model.

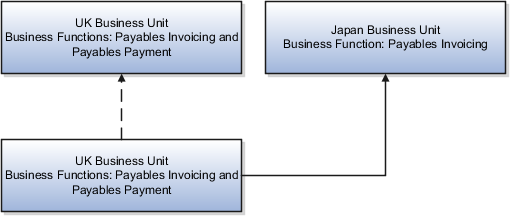

In a dedicated and self-service model, the payment business unit, in addition to servicing itself, also services other invoice business units.

The following figure is an example of a dedicated and self-service payment services model.

Benefits of Centralized Payments

When you centralize payments you:

-

Have better control of supplier payments. You can:

-

Effectively manage supplier payments by grouping credit memos from one invoice business unit with standard invoices of other business units, thereby reducing net cash flows.

-

Effectively communicate and reconcile any disputes with your suppliers.

-

-

Develop and use organization skills effectively.

-

Reduce processing costs, such as administration and transaction costs by generating consolidated payments for invoices across multiple invoice business units.

- Why do I get a permissions error when I click on a payment number link from the Manage Invoices page?

- Why do I get a permissions error when I click on an invoice number link from the Manage Payments page?

- What's the difference between the currency conversion settings on the common options page and the payment options page?