Overview of Payables Withholding Tax Letter

This topic includes details about the Payables Withholding Tax Letter.

The Payables Withholding Tax Letter is a letter that you can mail to a supplier periodically. The letter contains a list of withholdings made for the supplier summarized either by tax type and tax rate, or by supplier site

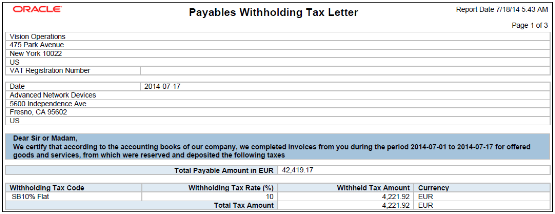

The following figure is an example of the report.

Key Insights

The letter provides details of the withholding amounts for various withholding codes that were deducted for a period.

Frequently Asked Questions

The following table lists frequently asked questions about the Payables Withholding Tax Letter.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

Financial Manager |

|

When do I use this report? |

Periodically to send suppliers details of withholdings that were deducted for a period. |

|

What can I do with this report? |

You can run this report for an individual supplier, all suppliers, or for a supplier type. You can also specify a date range for the withholding information. |

|

What type of report is this? |

Oracle Analytics Publisher |