Overview of US 1099 Report

This topic includes details about the United States (US) 1099 Report.

The US 1099 Report provides the total US 1099 miscellaneous payments (MISC) and nonemployee compensation (NEC) for a US 1099 supplier and generates US 1099-MISC and US 1099-NEC forms for each tax reporting entity in an organization.

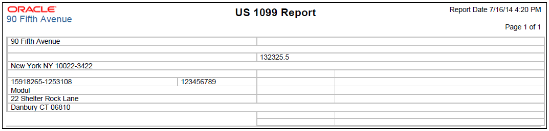

The following figure is an example of the report.

Key Insights

The report includes payments for invoice distributions that have one of the following values in the Income Tax Type field in the 1099 form:

| 1099-MISC | 1099-NEC |

|---|---|

| MISC types 1 through 18 (except for MISC9) | MISC7 |

Frequently Asked Questions

The following table lists frequently asked questions about the US 1099 Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

Financial Manager |

|

When do I use this report? |

Annually for US 1099 reporting. Note: Your 1099 report only considers the payments for which the invoices

are available in Payables.

|

|

What can I do with this report? |

|

|

What type of report is this? |

Oracle Analytics Publisher |