Overview of US 1099 Supplier Exceptions Report

This topic includes details about the United States (US) 1099 Supplier Exceptions Report.

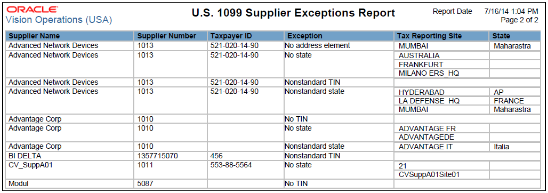

The US 1099 Supplier Exceptions Report lists suppliers with inaccurate or incomplete US 1099 income tax information.

The following figure is an example of the report.

Key Insights

Before running this report, account for the invoices.

Frequently Asked Questions

The following table lists frequently asked questions about the US 1099 Supplier Exceptions Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

Financial Manager |

|

When do I use this report? |

Before submitting the US 1099 Report. |

|

What can I do with this report? |

Review suppliers with inaccurate or incomplete US 1099 income tax information and correct them before generating the US 1099 forms. |

|

What type of report is this? |

Oracle Analytics Publisher |