Account Reconciliation and Subledgers

You can reconcile account balances online or through reports using integrated inquiry, reporting, and analysis tools. Drill down from account balances to journals and underlying subledger transactions through a single drill path.

Run the following types of predefined standard reports: subledger to general ledger reconciliation, intercompany reconciliation, trial balance, journals, and account analysis reports, to reconcile account balances.

Account reconciliation tools provide the following benefits:

-

Quicker period close to expedite managerial decision making.

-

Reliability of published financial results to support execution of informed and sound business strategies.

-

Automated reconciliation of key payables and receivables subledger balances to the general ledger.

-

Identification and tracking of reconciling items with insightful account analysis reports.

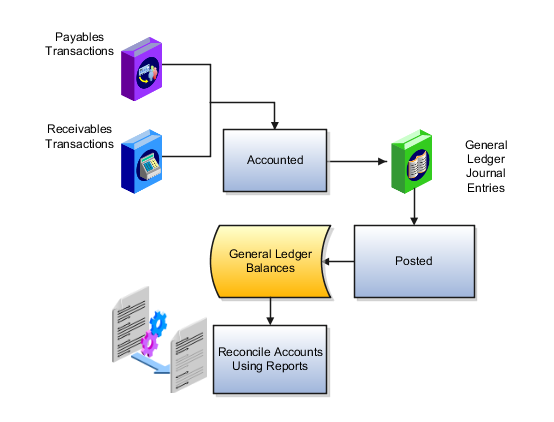

As a prerequisite to the reconciliation process, subledger transactions from Oracle Payables and Oracle Receivables are imported and accounted in Oracle General Ledger. The General Ledger journal entries are then posted, which updates the General Ledger balances. Reconciliation reports can then be run to start the account reconciliation process.

The following figure illustrates this flow from the subledger transactions to account reconciliation using reports.

Reconcile Subledger Accounts

Payables and Receivables enable you to quickly reconcile these subledgers to your General Ledger. Compare the open payables and receivables balances in the subledger modules to their corresponding account balance in your general ledger for a given accounting period. If discrepancies exist, the process of matching each transaction to its respective accounting entry is automatically performed. The process finds all transactions and accounting entries that contributed to the out of balance situation.

Exceptions are automatically identified. For example:

-

Transactions that don't have complete accounting.

-

Amounts that don't tie to the accounting entry amount.

-

Manually entered journals that posted to the general ledger account.

-

Journals that didn't come from the subledger modules.

Reconcile subledger and other balances with comprehensive Account Analysis reports and Payables and Receivables to Ledger Reconciliation reports to streamline reconciliation and increase productivity. These reports:

-

Automatically match payables and receivables transactions to subledger accounting entries.

-

Provide direct drill down to supporting journals and transactions for increased visibility.

-

Identify reconciliation exceptions for the user to take action, increasing worker productivity.

-

Permit analysis of report output in a spreadsheet, with all the conveniences of spreadsheet functionality.

Account Analysis Report

Reconcile subledger and other balances with comprehensive Account Analysis reports that:

-

Include beginning and ending account balances along with all journal entries that constitute the account's activities.

-

Contain activity source, category, and references, which are fully documented to easily trace back to the origin of the balance.

-

Identify reconciling items with amount or origin mismatches.

Payables and Receivables to Ledger Reconciliation Reports

Use the Payables to Ledger Reconciliation and the Receivables to Ledger Reconciliation reports using the interactive Oracle Transactional Business Intelligence reporting technology to:

-

Expand account balance information from summarized to detail data for optimal reconciliations.

-

Facilitate manageability and clarity for the reconciliation process.

Other Reports

Other reports aid in the reconciliation process:

-

Trial balance reports: Review summarized actual account balances and activity by ledger, balancing segment, and account segment value. Run this report for balances and activity imported from your subledgers or entered in your ledger currency, foreign currency, or statistical currency.

-

General ledger reports: Review beginning and ending account balances and journal entry lines, including those from your subledgers, affecting account balances in your ledger currency and foreign currencies.

-

Journal reports: Review journal information in your ledger currency and foreign currencies, including posted, unposted, and error journals. You can also review journal activity, including activity from your subledgers, for particular periods and balancing segments.

Best Practices

Account reconciliation best practices include the following:

-

Run the Payables and Receivables to Ledger Reconciliation reports only after the Receivables and Payables periods are closed to additional subledger transactions.

-

The summary level of the reconciliation reports contains data that is aggregated at the point in time the data extraction program is run.

-

The detail level of the reconciliation reports reflects real-time data in the transaction and accounting applications. To minimize discrepancies between the summary and detail levels of the report, run the data extraction process after the periods are closed. Running the process after the periods are closed prevents additional activity.

-

If further activity happens after the data extraction process is run, the activity is included in the Detail of the report, but not the Summary.

-

-

Reconcile receivables or payables accounts in one of these ways:

-

For the entire ledger, by running the reports for your ledger.

-

For more control, by running the reports for your individual primary balancing segment values within the ledger. Your primary balance segments must be implicitly mapped to your payables and receivables business units in your enterprise.

-

-

Restrict receivables and payables accounts in your general ledger by designating a control account and not allowing other sources to post to them.

-

Review warnings raised in the general ledger close period request log files. Verify that exceptions such as unposted journals, are intended to be excluded for the period.

-

Run your reconciliation reports with general ledger, receivables, or payables access. The responsibility for reconciling your receivables or payables to your general ledger and running the reports is done by your accounting department.