Fiscal Document Cancellation Flow

You can cancel a fiscal document for several reasons, such as errors in the fiscal document data, cancellations by a customer, or issues in the shipment process.

To cancel a goods or services fiscal document, complete these prerequisites:

- Tax authority approves the fiscal document.

- Corresponding taxable event has not taken place yet. For example, goods were not issued or services were not provided.

- Cancellation is requested within the prescribed time limit specified by the tax authority.

- Any other tax authority requirement.

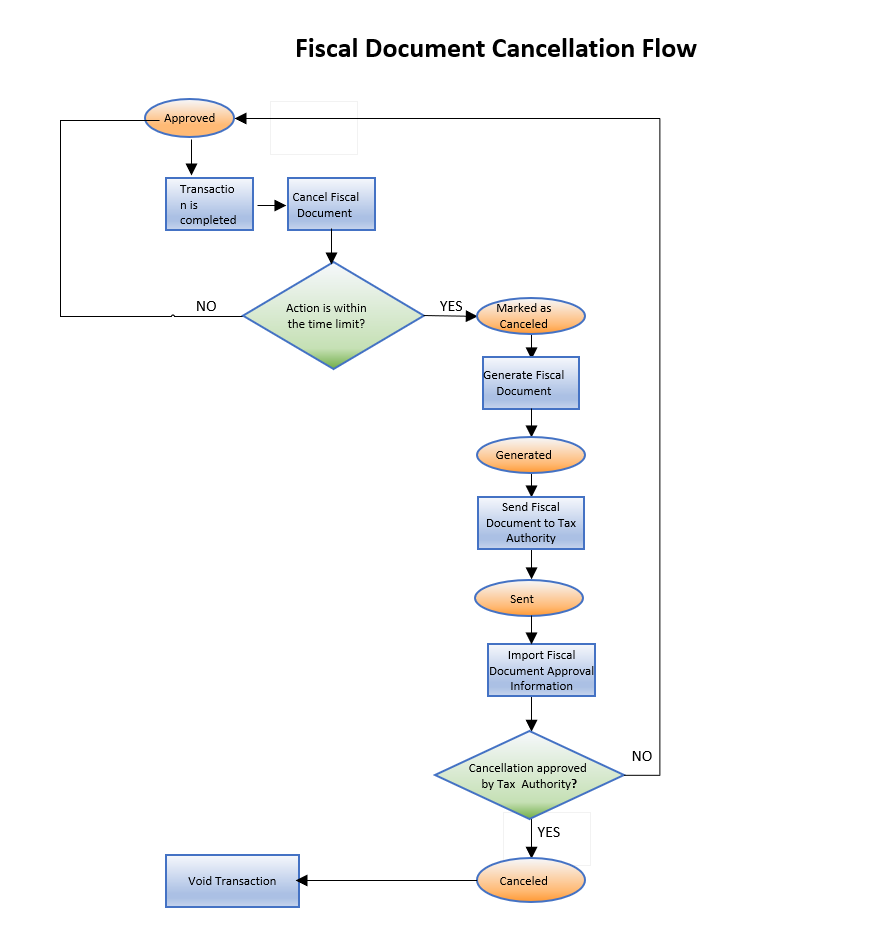

This image describes the fiscal document cancellation flow:

These steps outline the fiscal document cancellation flow:

- From the Manage Fiscal Document Generation task, select the Cancel Fiscal

Document action. Note: This action is only allowed if the fiscal document status is Approved and if it does not exceed the time limit configured for the corresponding tax authority. If the action is within the time limit, the fiscal document status changes to Marked as Canceled.

- Run the Generate Fiscal Document process to verify if the information required to cancel the fiscal document is available. If the validation is successful, the fiscal document status changes to Generated. The request for cancellation is now available for extraction and consumption by a third party, who submits the request to the tax authority.

- The Send Fiscal Document to Tax Authority process creates an extract file containing the information about the cancellation request and changes the fiscal document status to Sent.

- Partners generate the cancellation request XML file based on the extract file and communicate it to the tax authority.

- The tax authority can approve or raise validation errors for the cancellation request. Partners communicate the tax authority’s response through the Import Fiscal Document Approval Information process.

- If the cancellation request is approved, the fiscal document status changes to Canceled, otherwise it changes back to Approved. In this case, take the appropriate action according to the type of error returned by the tax authority.

- After the fiscal document is canceled, depending on the fiscal document’s

generation, take the appropriate action.

- If the fiscal document was generated in Receivables, manually void the Receivables transaction.

- If the fiscal document was generated based on the shipment, the shipment lines should be unassigned so the corresponding order lines become available for another shipment.

For more information on the fiscal document standard approval flow, see the Quick Reference for Oracle ERP Cloud Documentation for Brazil (2329725.1) on My Oracle Support at https://support.oracle.com.

To request a fiscal document cancellation, follow these steps:

- From the Manage Fiscal Document Generation task, click Cancel Fiscal Document.

Note: This action is only allowed when the fiscal document status is Approved and does not exceed the time limit configured for the corresponding tax authority. If the action is within the time limit, the fiscal document status changes to Marked as Canceled.

- The tax authority runs the Generate Fiscal Document process to verify if the information required to cancel the fiscal document is available.

- If the validation is successful, the fiscal document status changes to Generated. The request for cancellation is now available for extraction and consumption by a third party, who submits the request to the tax authority.

- The Send Fiscal Document to Tax Authority process creates an extract file containing the information about the cancellation request and changes the fiscal document status to Sent.

- Partners generate the cancellation request XML file based on the extract file and communicate it to the tax authority.

- The tax authority can approve or raise validation errors for the cancellation request. Partners communicate the tax authority’s response through the Import Fiscal Document Approval Information process.

- If the cancellation request is approved, the fiscal document status changes to Canceled, otherwise the fiscal document status changes to Approved. Take the appropriate action according to the type of error returned by the tax authority.

- After the status changes to Approved, take one of these actions depending on the

fiscal document’s generation.

- If the fiscal document is generated in Receivables, you must manually void the Receivables transaction.

- If the fiscal document is generated based on the shipment, you must unassign the shipment lines so that they become available for another shipment.

Here are the steps to complete fiscal document cancellation:

- Cancel fiscal documents:

To request a fiscal document cancellation, follow these steps:

- From the Shipments work area, navigate to the Manage Fiscal Document

Generation task.Note: You can also navigate to the Manage Fiscal Document Generation task from the Billing work area.

- In the Search region, enter the selection criteria.

- Click Search.

- Select the transaction.

- In the Actions menu, select Cancel Fiscal Document,Note: You can only perform this action if the fiscal document status is Approved and the request is within the time limit. For both services and goods fiscal documents, you must configure the cancellation time limits for each tax authority in the Manage Party Tax Profiles task.

- In the Cancel Reason field, enter the reason. This reason is required by the tax authority.

- Click Save and Close. The fiscal document status changes to Marked as Canceled.

For more information on fiscal document time controls, see the Quick Reference for Oracle ERP Cloud Documentation for Brazil (2329725.1) on My Oracle Support at https://support.oracle.com.

- From the Shipments work area, navigate to the Manage Fiscal Document

Generation task.

- Cancel service invoices:

When you run the Generate Fiscal Document process for a service invoice with multiple lines, each invoice line generates a single fiscal document. When you request the cancellation of one of the fiscal documents associated with the invoice, the status of all other fiscal documents with the Approved status automatically changes to Marked as Canceled. You can void the service invoice when cancellation requests are approved and all fiscal documents are in the Canceled status.

For fiscal documents that do not have the Approved status in the same invoice, you must request the cancellation manually.

- Cancel mixed invoices:

- When you cancel a service fiscal document from a mixed invoice, these

scenarios occur:

- If the goods fiscal document is in the Generated status, the application automatically requests you to void the goods fiscal document. The status changes from Generated to Marked as Void.

- If the goods fiscal document is in the Approved status, the application automatically requests you to cancel the goods fiscal document. The status changes from Approved to Marked as Cancel.

- If the goods fiscal document is neither in the Approved nor Generated status, you can manually request to cancel or void the goods fiscal document.

- If the other associated service fiscal documents are in the Approved status, the application automatically requests you to cancel the service fiscal documents. The status changes from Approved to Marked as Cancel.

- If the other associated service fiscal documents are not in the Approved status, you can manually request to cancel the service fiscal documents.

- When you can cancel a goods fiscal document from a mixed invoice, these

scenarios occur:

- If the other associated service fiscal documents are in the Approved status, the application automatically requests you to cancel the service fiscal documents. The status changes from Approved to Marked as Cancel.

- If the other associated service fiscal documents are not in the Approved status, you cannot cancel the goods fiscal document. This situation does not exist as all service fiscal documents must be approved before requesting a goods fiscal document approval in a mixed invoice.

- When you cancel a service fiscal document from a mixed invoice, these

scenarios occur:

- Handle Tax Authority Returns:

The fiscal document event code is the request type sent to the tax authority. To submit a request for the cancellation of goods or service fiscal documents, the fiscal document event code must be Cancellation Request.

The Import Fiscal Document Approval Information process verifies each tax authority return code and updates the fiscal document to the corresponding fiscal document status.

Here's the fiscal document status. You can take the appropriate action from the Manage Fiscal Document Generation task,

This table describes how the Import Fiscal Document Approval Information process verifies each tax authority return code and the corresponding user actions that you must take:Tax Authority Tax Authority Return Codes Approved Canceled Errors Pending Return Rejected/Upload failed/Void Fiscal Document Event Code - SEFAZ - Yes Yes Yes - Fiscal Document Event Code - CITY - Yes Yes - - Fiscal Document Status after Import Fiscal Document Approval Information - Canceled Approved Pending Return - Tax Authority Return Codes Tax Authority Return Description Import Fiscal Document Approval Information User Action Canceled Fiscal Document Cancellation is approved by Treasury Office (SEFAZ) or the city tax authority. Fiscal document status changes to Canceled:- For goods fiscal documents, this process captures Event Processing Date and Time, and the Protocol Number.

- For services fiscal documents, this process captures Event Processing, Date and Time, Service Fiscal Document Date, Service Fiscal Document Number, and Verification Code of Service Fiscal Document.

Do these actions:- If the fiscal document was generated in Receivables, void the invoice. To mark an invoice void, update the invoice with a transaction type that has the transaction status as Void.

- If the fiscal document was generated in Inventory Management, unassign the shipment lines.

- To unassign the shipment lines, navigate to Manage Shipment lines, search for and select the shipment lines, and click Unassign from shipment. The order line becomes available for adding or creating another shipment.

Errors Fiscal Document Cancellation is not approved by SEFAZ or the city tax authority due to errors. Fiscal document status changes to Approved. Click Update Fiscal Attributes and review all error messages. Take the appropriate action to clear the errors and if necessary, contact the tax authority to request a late cancellation. Pending Return Request for cancellation is pending response from SEFAZ. Fiscal document status changes to Pending Return. Fiscal partner keeps trying to get a response from SEFAZ. The user has no action but to wait for the tax authority’s response as Canceled or Errors.

This document only discusses the tax authority return codes for the Cancellation Request fiscal document event code. For information about other fiscal document event codes and fiscal document integration with third party, see the Quick Reference for Oracle ERP Cloud Documentation for Brazil (2329725.1) on My Oracle Support.