Handling the Response to the Original Request for Fiscal Document Approval

This section discusses the steps that the tax authority takes to regularize the situation of pending return fiscal documents as required by the government.

The regular tax authority is the tax authority of the ship-from state, to which the original request for fiscal document approval was submitted. After the regular tax authority returns to normal operations, fiscal document generation handles and regularizes those fiscal documents that are in the Pending return status as required by the government.

These actions are performed automatically:

- Cancellation of the fiscal documents in the Pending return status, which are approved by the regular tax authority, and has the corresponding commercial transaction registered in a contingency fiscal document.

- Void the fiscal documents in the Pending return status, which are neither approved nor rejected by the regular tax authority.

When the contingency fiscal document was initiated, only the fiscal documents in the Pending Return status were subject to this processing. In this case, the regular tax authority may or may not have processed the original request and therefore a copy of the original fiscal document is generated with a new fiscal document number as a contingency fiscal document.

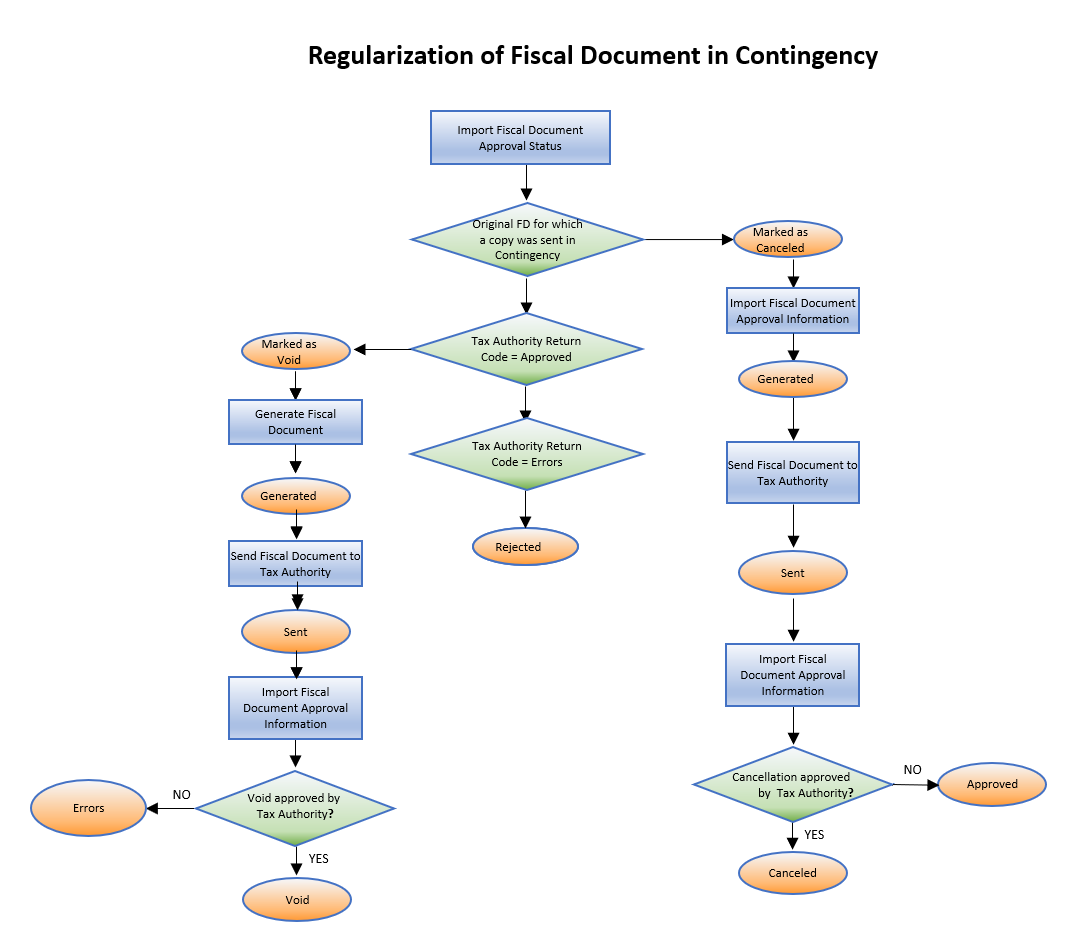

This image describes how tax authority regularizes the original fiscal documents after the communication to the regular tax authority is restored:

These steps outline the flow of regularization of a contingency fiscal document: