Overview of Managing Fiscal Documents for Returns to Supplier

You can now generate fiscal documents for returns to supplier shipments in Oracle Fusion Cloud ERP.

To return items to the supplier, you must generate a return fiscal document for transporting the returned items back to the supplier. Returns are needed when a customer rejects an item from their received shipment or a defect is found internally.

The returns process starts in Oracle Cloud Receiving and continues through to Oracle Cloud Shipping. For both the return to supplier transaction in Receiving and the return fiscal document, the reversed taxes are calculated by prorating the taxes calculated for the purchase fiscal document during the fiscal document capture.

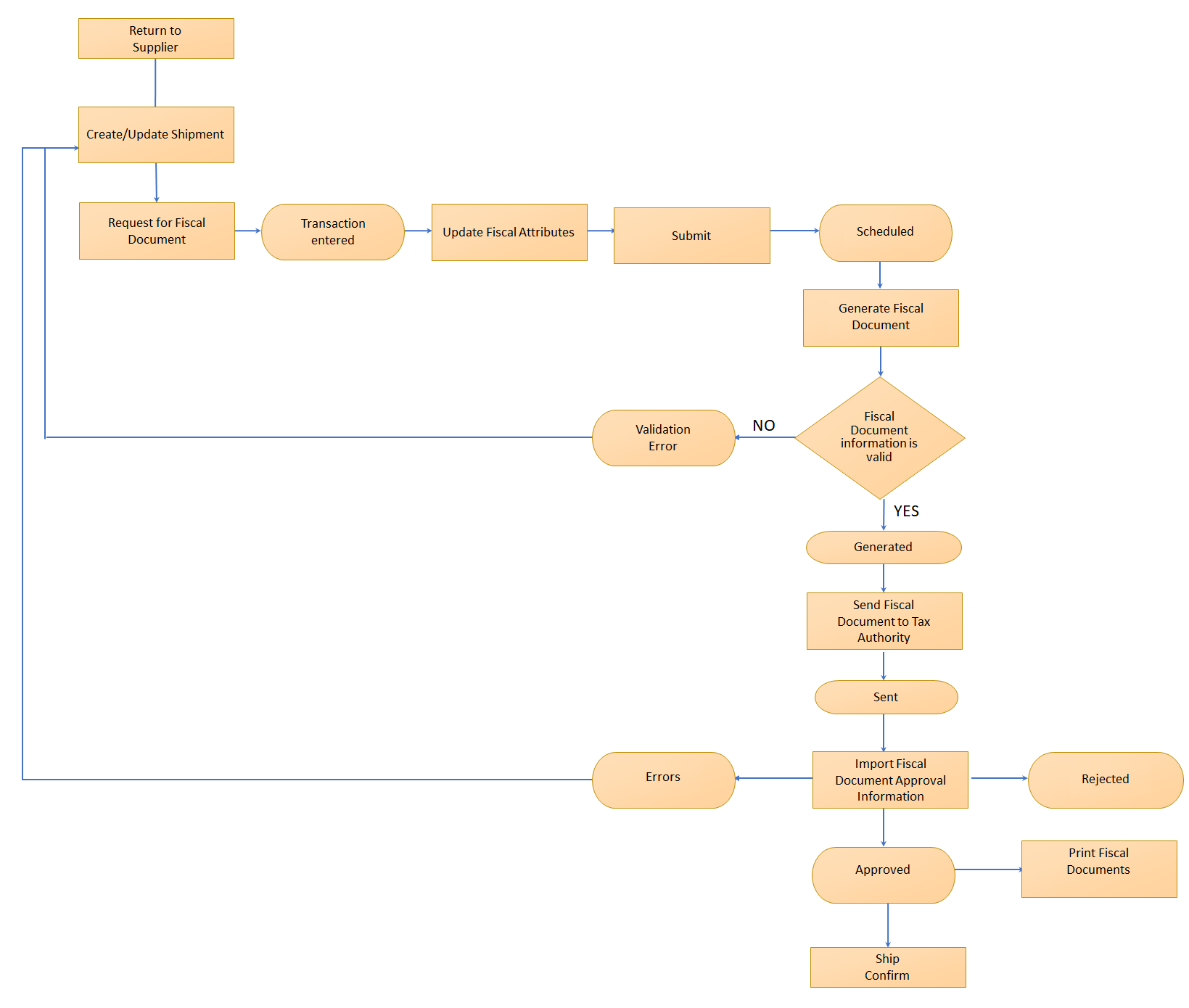

This image displays workflow of a return to the supplier:

The purchase fiscal document is automatically passed as a reference to both transactions. Pro-rata allocation is based on the returned quantity indicated in the return to supplier transaction. Additionally, the return fiscal document is generated with a reference to the purchase fiscal document in the fiscal document extract.

The legal reporting unit associated with the ship-from inventory organization can be predefined during the generation of the return fiscal document. You can configure that legal reporting unit using the Manage Associated Business Entities task.