Exemption Reports for Italy

This topic includes details about the exemptions reports for Italy.

Overview

In Italy, regular exporters can legally request suppliers to not charge VAT on purchase transactions. The Letter of Intent is the official letter to send to suppliers and customs for vat exemption. This letter contains:

-

Instructions to invoice without VAT.

-

Revocation or suspension of a previous letter of intent, with instructions to invoice with VAT.

The exemption limit is the total VAT exemption amount that a regular exporter can claim against suppliers, and it is monitored on a periodic basis.

The following reports support exemption handling for Italy:

-

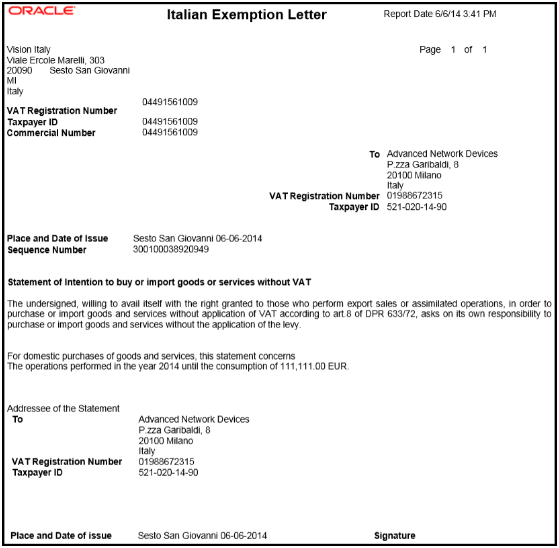

Exemption Letter Report for Italy: Produces a letter of intent for each exempt supplier in Italy instructing them not to include VAT on invoices that they submit.

The following figure is an example of the report.

-

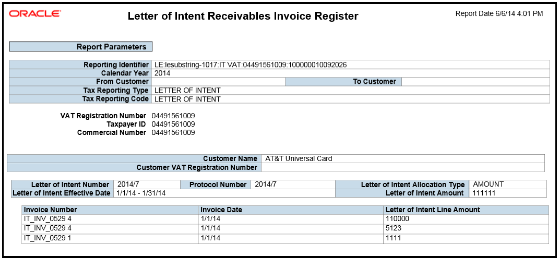

Letter of Intent Receivables Invoice Register: Lists details about receivables transactions issued with a Letter of Intent for a given calendar year. Provides letter of intent details such as protocol number, allocation type, amount, and effective dates.

The following figure is an example of the report.

-

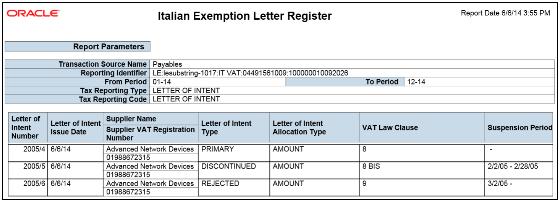

Subledger Letter of Intent Register for Italy: Lists all letters of intent issued to suppliers or received by customers in Italy within a given period range.

The following figure is an example of the report.

-

Supplier Exemption Limit Consumption Report: Lists the details of suppliers eligible for exemption in Italy and their monthly consumption of assigned exemption limit. Lists consumption details of all the suppliers, or a specific supplier. Details include all invoices exempted during a calendar period.

Key Insights

For each year, the initial exemption limit is the sum of all reported export invoices of the previous year. You can allocate the exemption limit as an annual or monthly amount and allocate the exemption limit among different suppliers. To each supplier, you send a Letter of Intent that indicates the exemption amounts, and request that they do not charge tax when they send the invoices.

Define the tax reporting type and tax reporting code with the usage as exempt for using letter of intent and reporting exemption data.

Exemption limits can be adjusted during the year to reflect an increase or decrease in export activities and changes in the VAT exemption amount as agreed with tax authorities. However, you will not be able to change the exemption limit type.

Report Parameters

The following table lists the common parameters for all the exemption reports:

|

Parameter |

Description |

|---|---|

|

Tax Reporting Type Code |

Specify the tax reporting type code as created in Oracle Fusion Tax. Select the appropriate tax reporting type created for letter of intent. |

|

Tax Reporting Code |

Specify the tax reporting code created as a part of the tax reporting type that you previously selected. Specify the tax reporting code relating to letter of intent. |

|

From Period and To Period |

Indicate the period range for the report data. |

The following table lists the parameters for the Letter of Intent Receivables Invoice Register:

|

Parameter |

Description |

|---|---|

|

Calendar Year |

Indicate the year for the report data. |

|

From Customer and To Customer |

Indicate the customer range for the report data. |

The following table lists the parameters for the Supplier Exemption Limit Consumption Report:

|

Parameter |

Description |

|---|---|

|

Calendar Year |

Indicate the year for the report data. |

|

Month |

Indicate the month for which the consumption of exemption amount must be reported. |

|

From Supplier and To Supplier |

Indicate the supplier range for the report data. |

|

Invoices with Letter of Intent |

Indicate whether all or only invoices with a letter of intent must be included in the report. |

Frequently Asked Questions

The following table lists frequently asked questions about the exemption reports for Italy.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use the exemption reports for Italy to:

|

|

What type of reports are these? |

Oracle Analytics Publisher |