Yearly Tax Report

This topic includes details about the Yearly Tax Report.

Overview

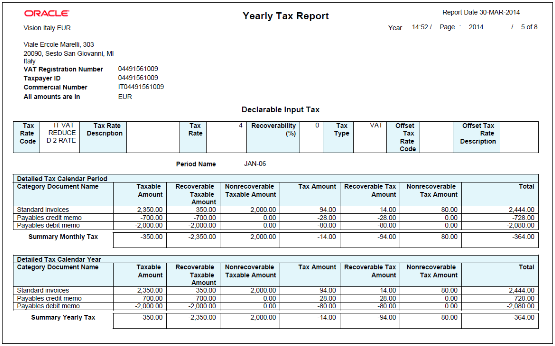

Use the Yearly Tax Report to display detailed or summarized information about tax and taxable amounts within a year. You can view information on both input and output tax for all finally reported tax periods within a year. All tax amounts are reported in the ledger currency.

The Yearly Tax Report provides countries using the Tax Reporting Selection Process the capability to analyze the annual subledgers and manual tax entry information.

Only finalized transactions in closed periods are included in the report. Use the Tax Final Reporting Process to mark transactions as final and close the tax calendar period.

You can print the report in the following levels:

-

Detail: Prints detailed tax amounts and summarized tax amounts by month and year. Includes the following sections:

-

Detailed Tax Calendar Period

-

Detailed Tax Calendar Year

-

Summarized Tax Calendar Period

-

Summarized Tax Calendar Year

-

-

Summary: Prints summarized tax amounts by tax calendar period and tax calendar year.

The following figure is an example of the report.

Key Insights

The following table displays the tax categories used to group the report:

|

Tax Category |

Grouping Criteria |

|---|---|

|

Declarable Output Tax |

Transaction type name. |

|

Declarable Input Tax |

Document category name, recoverable taxable and tax amounts, and nonrecoverable taxable and tax amounts. |

|

Manual Tax Entries |

Manually entered transactions and transactions imported from external sources into the tax repository. Includes the batch name, tax and taxable amounts. Debit tax amounts represent input tax, and credit tax amounts represent output tax. |

Within each tax category, you can also group according to other criteria, such as:

-

Tax rate code

-

Tax rate

-

Tax type

Report Parameters

The following table lists selected parameters:

|

Parameter |

Description |

|---|---|

|

Reporting Identifier |

System generated reporting entity identifier assigned when the process Select Transactions for Tax Reporting is run. The reporting entity identifier is built as a concatenation of the Reporting Level, Legal Entity, Tax Regime, TRN and the Reporting Identifier ID (for example: LE:Vision Italy-1017:IT VAT:IT12345670017:300100066356392). |

|

Tax Calendar Year |

Indicate the tax year for tax reporting and settlements. |

|

Summarization Level |

Specify the level of detail for reporting. You can print summary data or detailed data. |

|

Report Heading |

Specify the report header that must be printed on the report as a legal requirement. |

Frequently Asked Questions

The following table lists frequently asked questions about the Yearly Tax Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use this report to analyze:

|

|

What type of report is this? |

Oracle Analytics Publisher |