Tax Register and Financial Tax Register

This topic includes details about the Tax Register and Financial Tax Register.

Overview

Tax registers include:

-

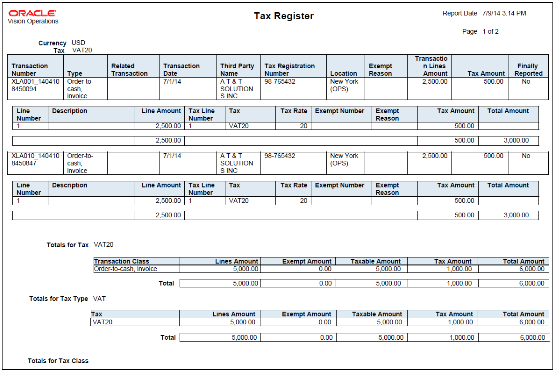

Tax Register: Identifies total tax amounts by tax type, tax class, and company from transactions created in Oracle Fusion Receivables. The report includes deferred tax accounting information and all transactions for which tax accounting is defined.

The following figure is an example of the report.

-

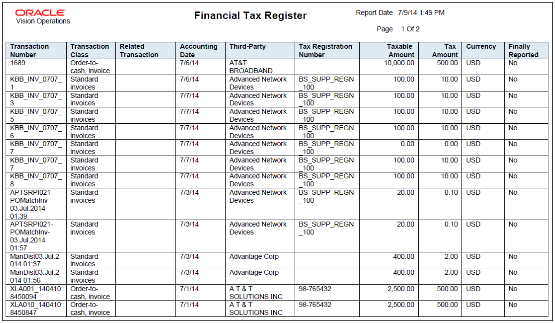

Financial Tax Register: Prints tax and accounting information created from transactions entered in Oracle Fusion Receivables, Oracle Fusion Payables, and Oracle Fusion Tax repository. The report lists input, output tax data, or both.

The following figure is an example of the report.

All amounts are printed in transaction entered currency.

Key Insights

The tax register types for the Tax Register and Financial Tax Register are:

|

Name |

Description |

|---|---|

|

All |

Use this register to include all tax transactions. |

|

Nonrecoverable Tax Register |

Use this register to show your partial and fully nonrecoverable input taxes. It also provides details on nonrecoverable taxes on:

|

|

Tax Register |

Use this register to report tax liability. It includes details on:

|

Report Parameters

The following table describes selected process parameters:

|

Parameter |

Description |

|---|---|

|

Reporting Level |

Choose the level on which you want to run the report. You can choose from three different levels, Ledger, Legal Entity, and Tax Registration Number. |

|

Reporting Context |

Specify the context for the report. The list of values for this parameter depends on the reporting level you selected.

|

|

Tax Registration Number |

Enter a tax registration number that is assigned to the legal reporting unit, when the reporting level is Legal Entity. |

|

Tax Point Date |

Include the transactions for the date range specified. Tax point date is the date on which the taxpayer becomes liable for paying the tax to the tax authority. |

|

Currency |

Select the range of currencies to include in the report. If a transaction is in a currency that is not within the specified range, it isn't included. |

|

Accounting Status |

Run the report for accounted transactions, unaccounted transactions, or both transactions. |

Frequently Asked Questions

The following table lists frequently asked questions about the Tax Register and Financial Tax Register.

|

FAQ |

Answer |

|---|---|

|

How do I find these reports? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses these reports? |

|

|

When do I use these reports? |

Use these reports to:

|

|

What type of reports are these? |

Oracle Analytics Publisher |

- Interim Tax Register

- Transaction Tax Report Features

- Example of Reporting Output Taxes for Tax Setup Options on Receivables Activities in the Tax Register and Nonrecoverable Tax Register

- Example of Reporting Input Taxes in the Nonrecoverable Tax Register and Recoverable Tax Register

- Example of Reporting Prepayments in the Tax Register