Sales Listing Report for European Union

This topic includes details about the Sales Listing Report for European Union.

Overview

Use the Sales Listing Report for European Union to declare goods and services that are rendered within the European Union (EU) to VAT-registered customers in the other EU member states.

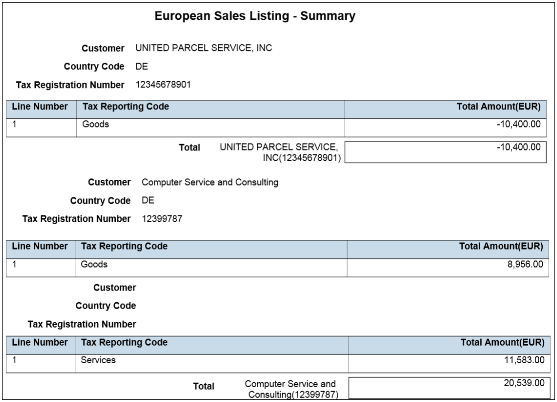

Let's take a look at the sample report in a summary format.

Key Insights

This report only includes transactions with the tax reporting code as Intra-EU transactions for goods or services tax.

Invoices, credit memos, and adjustments are reported based on the invoice tax date, the date on which goods and services are rendered.

Report Parameters

This table describes the selected report parameters:

|

Parameter Name |

Description |

|---|---|

|

Trader VAT Number |

Select the tax registration number of the first-party legal reporting unit. |

|

Country of the Tax Registration Number |

Select the site whose country code is displayed on the report when the tax registration number doesn't contain the first two characters as the country code. |

|

Include Prior Period Adjustments and Credit Memos |

Select Yes to display adjustments and credit memos that are related to transactions from a different reporting period. Select No for adjustments and credit memos to be included in the regular totals. |

|

Rounding Rule |

Select the rounding method for the calculated taxes to the minimum accountable unit. The available options are Up, Down, and Nearest. |

|

Minimum Reportable Amount |

Enter the smallest unit used for the ledger currency amounts. |

|

Tax Reporting Type Code |

Select the appropriate Intra-EU transaction tax reporting type code. |

|

Tax Reporting Code for Intra-EU Goods |

Specify the tax reporting code created for goods. If you don't want to include goods in the report, select the value as null. |

|

Tax Reporting Code for Intra-EU Services |

Select a tax reporting code associated with the tax reporting type that you have previously selected. |

|

Additional Tax Reporting Code 1 |

Select a tax reporting code associated with the tax reporting type that you have previously selected. If required, specify the tax reporting code created for triangulation of goods or goods and services. |

|

Additional Tax Reporting Code 2 |

Select a tax reporting code associated with the tax reporting type that you have previously selected. If required, specify the tax reporting code created for triangulation of goods or goods and services. |

Frequently Asked Questions

This table lists frequently asked questions about the Sales Listing Report for European Union.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use this report to declare goods and services that are rendered within the European Union (EU) to VAT-registered customers in the other EU member states. |

|

What type of reports are these? |

Oracle Analytics Publisher |