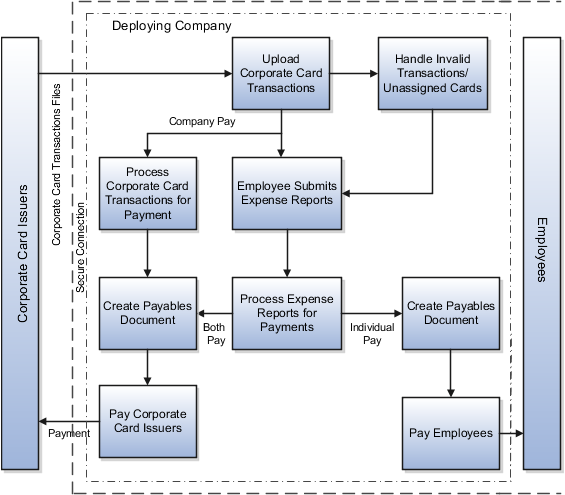

How Corporate Card Transaction Files Are Processed

Before you can begin processing corporate card transaction files, your company must establish connectivity with the corporate card issuers. You must also determine the transaction file format and the transaction file delivery frequency.

After establishing a secure connection, your company receives transaction files.

The application loads the transaction file and validates the transactions. The application loads eFolio summary and detail transactions if they're present in the file. All valid transactions are created as expense items and are available to employees for inclusion in the expense reports. All invalid transactions are available for corporate card administrators to review and correct. After correction, these transactions are validated again and become available for expense reporting.

When you implement corporate credit card functionality, you must decide whether your company or its employees are responsible for paying the credit card issuer. The three payment options that you can implement in Expenses are the following:

-

Individual Pay: The employee pays the corporate card issuer for all corporate card transactions

-

Company Pay: Your company pays the corporate card issuer for all transactions

-

Both Pay: Your company pays the corporate card issuer for business expenses and the employee pays the corporate card issuer for personal expenses

A Setting That Affects Corporate Card Transaction Files

The process flow of corporate card transaction files is based on which of the three payment options your company decides to implement. Your company can implement one, two, or all three of the payment options by geographical region, organizational hierarchy, or other criteria. For example, a global company might have Both Pay implemented in the US and Individual Pay implemented in the UK. Another company might have Both Pay for one set of organizations and Individual Pay for another set of organizations within the UK.

When creating a company account for a card program, select a payment option from the Payment Due From list on the Create Company Account page.

How Corporate Card Transaction Files Are Processed

This section provides examples of the corporate card transaction files process flow for each payment option. For each example, assume that an employee reports cash and categorizes card transactions as both business and personal when creating and submitting an expense report.

Individual Pay

The Individual Pay payment option is simpler than Both Pay or Company Pay. Whether you identify corporate card transactions as business or personal expenses, the employee pays the corporate card issuer for both business and personal expenses. When the employee creates an expense report, both business and personal transactions are reported. The employee is, however, reimbursed by your employer for the corporate card business expenses.

The following table provides an example of Individual Pay corporate card transaction files processing:

|

Action |

Description |

|---|---|

|

Set up company account and download data file. |

Obtain the corporate card transactions data file from your corporate card provider. |

|

Upload data file into Expenses. |

Upload and validate your corporate card transactions files. |

|

Create and submit expense report. |

When you create an expense report, you select the corporate card transactions that you want to submit on the report. You determine if transactions are business or personal expenses. By default, transactions are identified as Business. You're only reimbursed by your employer for business expenses. Once processed on an expense report, corporate card transactions are no longer available in the list of transactions to be added to expense reports. This rule applies to both business and personal expenses. |

|

Review and approve expense report. |

After you submit the expense report, your manager must approve it. After managerial approval, the report is verified to ensure that required receipts are attached and that the report is in compliance with your company's policies. |

|

Reimbursement. |

After the expense report has been reviewed and approved, it's ready for invoice creation in Payables to facilitate payment processing. To create an invoice with the amount due to the employee, run the Process Expense Reimbursements program. Then the payment to the employee is processed through Oracle Fusion Payments. |

Company Pay

For the Company Pay payment option, your employer pays the corporate card issuer for all corporate card transactions incurred by its employees. The employee is only reimbursed for cash business expenses. Corporate card transactions reported as business expenses have no effect on the amount that is reimbursed to the employee.

The following table provides an example of Company Pay corporate card transaction files processing:

|

Action |

Description |

|---|---|

|

Set up company account and download data file. |

Obtain the corporate card transactions file from your corporate card provider. |

|

Upload data file into Expenses. |

Upload and validate your corporate card transactions files. |

|

Create and submit expense report. |

When you create an expense report, select the corporate card transactions that you want to submit. You determine if transactions are business or personal expenses. Cash expenses aren't charged to the company corporate card but are considered business expenses. Cash expenses aren't reimbursed as corporate card business expenses. Corporate card transactions designated as personal expenses reduce the amount you're reimbursed. You are only reimbursed by your employer for cash business expenses. Once processed on an expense report, corporate card transactions are no longer available in the list of transactions to be added to expense reports. This rule applies to both business and personal expenses. |

|

Review and approve expense report. |

After you submit the expense report, your manager must approve it. After managerial approval, your report is verified to ensure that required receipts are attached and that the report is in compliance with your company's policies. Any corporate card transactions designated as personal expenses are also displayed to the managers for review. |

|

Export the expense report from Expenses to Payables. |

After the expense report has been reviewed and approved, it's ready for invoice creation in Payables to facilitate payment processing. To create the invoice with the amount due to the employee, run the Process Expense Reimbursements program. Then the payment to the employee is processed through Oracle Fusion Payments. To create an invoice with the amount due to the card issuer, run the Create Corporate Card Issuer Payment Requests process. Then the payment to the employee is processed through Oracle Fusion Payments. The card issuer can be paid at any time, regardless of the status of the expense report. |

Both Pay

For the Both Pay payment option, your company pays the corporate card issuer for transactions that are categorized as business expenses. The employee pays the corporate card issuer for all corporate card transactions reported as personal expenses. An invoice can't be created for the corporate card issuer until the expense report is exported to Payables as an invoice.

The following table provides an example of Both Pay corporate card transaction files processing:

|

Action |

Description |

|---|---|

|

Set up company account and download data file. |

Obtain the corporate card transactions data file from your corporate card provider. |

|

Upload data file into Expenses. |

Upload and validate your corporate card transactions files. |

|

Create and submit expense report. |

When you create an expense report, select the corporate card transactions that you want to submit. You are reimbursed only by your employer for cash business expenses. Once processed on an expense report, corporate card transactions are no longer available in the list of transactions to be added to expense reports. This rule applies to both business and personal expenses. |

|

Review and approve expense report. |

After you submit the expense report, your manager must approve it. After managerial approval, your report is verified to ensure that required receipts are attached and that the report is in compliance with your company's policies. When the Payables review process is complete for an expense report, a new expense report containing only corporate card transactions is created. The new report is based on the existing report by copying only the business transactions, which are used to pay the card issuer. If the expense report contains transactions charged to two corporate cards, two reports are created to pay the corporate card issuers. These reports are named 1 and 2 respectively. |

|

Process expense reimbursements. |

After the card issuer expense report is created, it's ready for invoice creation in Payables to facilitate payment processing. To create the invoice with the amount due to the employee and to the card issuer, run the Process Expense Reimbursements program. Then the payment to the employee and the corporate card issuer is processed through Oracle Fusion Payments. The invoice due to the employee contains accounting distributions and project accounting, when applicable, for both the cash and corporate card expenses. The corporate card issuer invoice contains a single accounting distribution for all corporate card expenses against the expense clearing account. |