Examples of Revaluation Journals When Tracking by Multiple Segments

Use these examples to understand how the application generates revaluation journals in primary ledgers and reporting currencies when you track revaluation by multiple segments.

These examples assume the accounts being revalued at month end have only one foreign currency journal for the month.

Here's the important information from the primary ledger setup.

-

Ledger Currency: AUD

-

Chart of Accounts Segments and Segment Labels

Segment

Segment Label

Company

Primary Balancing Segment

Department

Revaluation Gain/Loss Tracking Segment

Account

Natural Account Segment

Subaccount

None

Division

Revaluation Gain/Loss Tracking Segment

Product

Revaluation Gain/Loss Tracking Segment

Project

Revaluation Gain/Loss Tracking Segment

Note: The primary balancing segment (Company) is also a revaluation gain or loss tracking segment. -

Cumulative Translation Adjustment (CTA) Account: 01-000-3500-0000-000-0000-000

-

Revaluation Template:

-

Unrealized Gain Account: 01-000-7842-0000-000-0000-000

-

Unrealized Loss Account: 01-000-7844-0000-000-0000-000

-

Account Filter: Account = 1110, which is a cash account

-

And here's the important information from the reporting currency setup.

-

Currency: USD

-

Currency Conversion Level: Journal

-

Revaluation Basis: Entered Currency

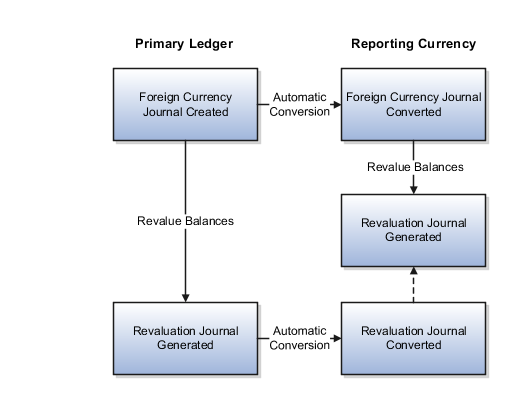

Example 1: Revaluation Journal Source Enabled for Reporting Currency

In this example, you don't change the default journal conversion rules for the reporting currency, which means the Revaluation journal source is enabled. Here's how you define the revaluation template for the reporting currency:

-

Unrealized Gain Account: 01-000-3500-0000-000-0000-000

-

Unrealized Loss Account: 01-000-3500-0000-000-0000-000

Note: Both accounts are the CTA account for the primary ledger. -

Account Filter: Account = 1110, which is the same cash account that's in the primary ledger revaluation template

Here's a high-level view of the five journals that are going to be created in the primary ledger and reporting currency.

Now let's look at the details.

You create a foreign currency journal in the primary ledger with an accounting date of January 1, 2019. The conversion rate in effect for that date is 1 Euro = 1.642883 Australian dollars. Here's the foreign currency journal in the primary ledger.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (AUD) |

Accounted Credit (AUD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

1000.00 |

1642.88 |

||

|

2 |

01-200-1110-1002-002-1002-102 |

1200.00 |

1971.46 |

||

|

3 |

01-000-1210-0000-000-0000-000 |

2200.00 |

3614.34 |

||

|

Total |

Not applicable |

2200.00 |

2200.00 |

3614.34 |

3614.34 |

The foreign currency journal is automatically converted in the reporting currency. The conversion rate in effect for January 1, 2019 is 1 Euro = 1.155463 US dollars. Here's the converted journal in the reporting currency.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (USD) |

Accounted Credit (USD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

1000.00 |

1155.46 |

||

|

2 |

01-200-1110-1002-002-1002-102 |

1200.00 |

1386.56 |

||

|

3 |

01-000-1210-0000-000-0000-000 |

2200.00 |

2542.02 |

||

|

Total |

Not applicable |

2200.00 |

2200.00 |

2542.02 |

2542.02 |

Now you run the Revalue Balances process for the primary ledger for January 31, 2019. The conversion rate in effect for that date is 1 Euro = 1.57286 Australian dollars.

The process generates the unrealized loss accounts based on the account definition in the revaluation template and the balance sheet and revaluation tracking segments. In this example, the revaluation journal records the unrealized loss for the cash accounts tracked by the Company, Department, Division, Product, and Project segment values from the original foreign currency journal.

Here's the revaluation journal in the primary ledger.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (AUD) |

Accounted Credit (AUD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

0.00 |

0.00 |

0.00 |

70.02 |

|

2 |

01-100-7844-0000-001-1001-101 |

0.00 |

0.00 |

70.02 |

0.00 |

|

3 |

01-200-1110-1002-002-1002-102 |

0.00 |

0.00 |

0.00 |

84.03 |

|

4 |

01-200-7844-0000-002-1002-102 |

0.00 |

0.00 |

84.03 |

0.00 |

|

Total |

Not applicable |

0.00 |

0.00 |

154.05 |

154.05 |

Remember that the Revaluation journal source is enabled for the reporting currency's journal conversion rules. As a result, the revaluation journal for the primary ledger is automatically converted in the reporting currency. The conversion rate in effect for January 31, 2019 is 1 Australian dollar = 0.728134 US dollars. The offset is posted to the CTA account from the primary ledger because the reporting currency is a form of translation of the primary ledger. At this stage, this journal is just accomplishing part of the adjustments to CTA for the reporting currency.

Here's the converted journal in the reporting currency.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (USD) |

Accounted Credit (USD) |

|---|---|---|---|---|---|

|

1 |

01-100-7844-0000-001-1001-101 |

0.00 |

0.00 |

50.98 |

0.00 |

|

2 |

01-200-7844-0000-002-1002-102 |

00.00 |

0.00 |

61.19 |

0.00 |

|

3 |

01-100-3500-0000-001-1001-101 |

0.00 |

0.00 |

0.00 |

50.98 |

|

4 |

01-200-3500-0000-002-1002-102 |

0.00 |

0.00 |

0.00 |

61.19 |

|

Total |

Not applicable |

0.00 |

0.00 |

112.17 |

112.17 |

Next, you run the Revalue Balances process in the reporting currency for January 31, 2019 to revalue the foreign currency journal that was converted from the primary ledger. The EUR to USD rates may have changed since January 1, 2019. The conversion rate in effect for January 31, 2019 is 1 Euro = 1.145253 US dollars.

The process records the revaluation adjustment to the CTA account (from the reporting currency revaluation template) and the balance sheet and revaluation tracking segments. The offset isn't considered a gain or loss for the reporting currency, which was already accounted for in the previous journal. Rather, the offset is adjusted against the CTA that was booked during the previous entry, to net to the final CTA amount that should be booked for the reporting currency.

Here's the revaluation journal in the reporting currency.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (USD) |

Accounted Credit (USD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

0.00 |

0.00 |

0.00 |

10.21 |

|

2 |

01-100-3500-0000-001-1001-101 |

0.00 |

0.00 |

10.21 |

0.00 |

|

3 |

01-200-1110-1002-002-1002-102 |

0.00 |

0.00 |

0.00 |

12.26 |

|

4 |

01-200-3500-0000-002-1002-102 |

0.00 |

0.00 |

12.26 |

0.00 |

|

Total |

Not applicable |

0.00 |

0.00 |

22.47 |

22.47 |

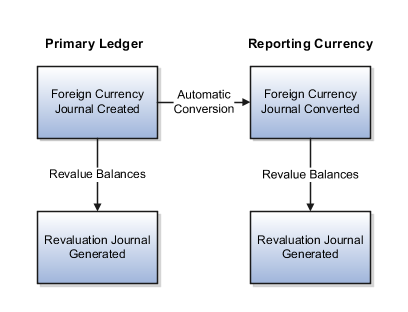

Example 2: Revaluation Journal Source Not Enabled for Reporting Currency

In this example, you disable the Revaluation journal source in the reporting currency's journal conversion rules. You set up the revaluation template for the reporting currency with these accounts:

-

Unrealized Gain Account: 01-000-7842-0000-000-0000-000

-

Unrealized Loss Account: 01-000-7844-0000-000-0000-000

-

Account Filter: Account = 1110, which is the same cash account that's in the primary ledger revaluation template.

Here's a high-level view of the four journals that are going to be created in the primary ledger and reporting currency.

Now let's look at the details.

Just like example 1, you create a foreign currency journal in the primary ledger with an accounting date of January 1, 2019. The conversion rate in effect for that date is 1 Euro = 1.642883 Australian dollars. Here's the foreign currency in the primary ledger. It's the same as the first example.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (AUD) |

Accounted Credit (AUD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

1000.00 |

1642.88 |

||

|

2 |

01-200-1110-1002-002-1002-102 |

1200.00 |

1971.46 |

||

|

3 |

01-000-1210-0000-000-0000-000 |

2200.00 |

3614.34 |

||

|

Total |

Not applicable |

2200.00 |

2200.00 |

3614.34 |

3614.34 |

Just like example 1, the foreign currency journal is automatically converted in the reporting currency. The conversion rate in effect for January 1, 2019 is 1 Euro = 1.155463 US dollars. Here's the converted journal in the reporting currency. It's the same as the first example.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (USD) |

Accounted Credit (USD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

1000.00 |

1155.46 |

||

|

2 |

01-200-1110-1002-002-1002-102 |

1200.00 |

1386.56 |

||

|

3 |

01-000-1210-0000-000-0000-000 |

2200.00 |

2542.02 |

||

|

Total |

Not applicable |

2200.00 |

2200.00 |

2542.02 |

2542.02 |

Again, just like the first example, you run the Revalue Balances process in the primary ledger for January 31, 2019. The conversion rate in effect for that date is 1 Euro = 1.57286 Australian dollars.

The process generates the unrealized losses accounts based on the account definition in the revaluation template and the balance sheet and revaluation tracking segments. In this example, the revaluation journal records the unrealized loss for the cash accounts tracked by the Company, Department, Division, Product, and Project segment values from the original foreign currency journal.

Here's the revaluation journal in the primary ledger. It's the same as the first example.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (AUD) |

Accounted Credit (AUD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

0.00 |

0.00 |

0.00 |

70.02 |

|

2 |

01-100-7844-0000-001-1001-101 |

0.00 |

0.00 |

70.02 |

0.00 |

|

3 |

01-200-1110-1002-002-1002-102 |

0.00 |

0.00 |

0.00 |

84.03 |

|

4 |

01-200-7844-0000-002-1002-102 |

0.00 |

0.00 |

84.03 |

0.00 |

|

Total |

Not applicable |

0.00 |

0.00 |

154.05 |

154.05 |

Now you run the Revalue Balances process in the reporting currency for January 31, 2019 to revalue the foreign currency journal that was converted from the primary ledger. The conversion rate for January 31, 2019 is 1 Euro = 1.145253 US dollars.

The process generates the revaluation journal using the accounts from the revaluation template in the reporting currency and the balance sheet and revaluation tracking segments. In this example, the revaluation journal records the unrealized loss for the cash accounts tracked by the Company, Department, Division, Product, and Project segment values from the original foreign currency journal.

|

Line |

Account |

Entered Debit (EUR) |

Entered Credit (EUR) |

Accounted Debit (USD) |

Accounted Credit (USD) |

|---|---|---|---|---|---|

|

1 |

01-100-1110-1001-001-1001-101 |

0.00 |

0.00 |

0.00 |

10.21 |

|

2 |

01-100-7844-0000-001-1001-101 |

0.00 |

0.00 |

10.21 |

0.00 |

|

3 |

01-200-1110-1002-002-1002-102 |

0.00 |

0.00 |

0.00 |

12.26 |

|

4 |

01-200-7844-0000-002-1002-102 |

0.00 |

0.00 |

12.26 |

0.00 |

|

Total |

Not applicable |

0.00 |

0.00 |

22.47 |

22.47 |