Set Up Average Balance Processing

You can enable average balance processing by selecting the Enable Average Balances option when defining a ledger. Average balance setup includes a transaction calendar, net income account, and posting controls.

In the Setup and Maintenance work area use the Specify Ledger Options task:

-

Offering: Financials

-

Functional Area: General Ledger

-

Task: Specify Ledger Options, with the ledger scope set

When you enable average balance processing, by default it's enabled only for balance sheet accounts. If you want to also include income statement accounts, you must explicitly enable the Include Income Statement Accounts option.

Once your accounting setup is complete, the application automatically begins to store the balances that are used to calculate average and end-of-day balances for your ledger.

Transaction Calendars

Use a transactional calendar to indicate which days in an accounting calendar are business days or nonbusiness days. In the Setup and Maintenance work area, use the Manage Transaction Calendars task:

-

Offering: Financials

-

Functional Area: Financial Reporting Structures

-

Task: Manage Transaction Calendars

When you first define the calendar, you specify a name and optionally, a description. The application uses this information to create the calendar, which includes an entry for every calendar day in the range of dates from all your existing accounting calendars. Therefore, you must first define an accounting calendar before you can define a transaction calendar. Each entry includes these items:

-

Date: The actual calendar date.

-

Day of Week: The day of the week.

-

Business Day: An indicator that shows whether the entry is defined as a business day. The business day defaults to Yes for Monday through Friday and No for Saturday and Sunday. You can change the initial default values to suit your own needs.

After the transaction calendar is created, you should specify your holidays by changing the Business Day indicator to a nonbusiness day.

Here are some points to note for nonbusiness days:

-

Nonbusiness days can't be used for posting, unless you explicitly indicate that posting is allowed.

-

Nonbusiness days are included in determining the number of days in a period range.

-

Even though transactions aren't generally posted to accounts on nonbusiness days, the application still maintains aggregate and average balances for nonbusiness days, as well as business days.

Transaction calendars and accounting calendars are completely independent of each other. For example, you might have one accounting calendar, shared by your parent company and all its subsidiaries. However, each subsidiary might use a separate transaction calendar to accommodate their different holiday schedules.

Ledgers

You define the attributes of a ledger, such as accounting calendar, ledger currency, chart of accounts and subledger accounting method in Functional Setup Manager. You can define a ledger with average balance processing enabled.

In a typical ledger where average balance processing is enabled, the standard and average balances are linked, since the average balances are derived from the standard balances. To enforce this linkage, the application prevents you from creating journal entries that directly manipulate average balances.

If you choose to enable average balance processing, you must specify additional information when defining the ledger, such as:

-

Transaction Calendar: A calendar used to ensure that transactions are posted only to valid business days.

-

Net Income Account: An account the application uses to capture the net activity of all revenue and expense accounts when calculating the average balance for retained earnings. If you decide to include income statement accounts for average balance processing, then you don't need to specify the Net Income Account.

Note: If you enable the option to include income statement accounts, the Net Income Account field won't appear.

Net Income Account

If you decide not to include income statement accounts for average balance processing, then you must specify the net income account when you enable the ledger for average balance processing.

Retained earnings contains two components for any interim accounting period:

-

Current account balance, which is equal to the final ending balance from the previous year.

-

Net income, which is the net of all revenue and expense accounts.

The application calculates the average balance for retained earnings the same way that it calculates average balances for any other account. However, since the application doesn't maintain average balances for revenue and expense accounts, some special processing takes place to handle this particular component of retained earnings.

The application uses a special nonpostable net income account to capture the net activity of all revenue and expense accounts. The account is treated as a balance sheet account, with an account type of Owners' Equity. It's used to calculate the net income impact on the average balances for any given period, quarter, or year.

Posting Controls

You can configure controls to prevent future-dated journals from posting to an open period in average daily balance ledgers.

Specify a cutoff date within an open period for which journal batches with an accounting date after the cutoff can’t be posted. Accurate as-of-date ledger balances serve as the basis for processing daily accounting calculations, such as the revaluation of foreign currency balances, translation of ledger balances to a different reporting currency, allocation of balances from one account to another, and the transfer of one ledger's balance to a different ledger.

Posting controls are set for a primary ledger and apply to its related secondary ledgers and reporting currencies, regardless of whether the secondary ledgers are enabled for average balance processing.

Here’s how you set it up after you first enable average balances.

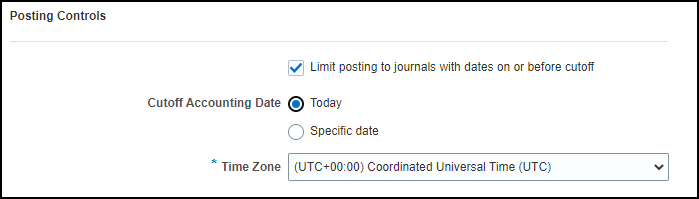

- In the Posting Controls subsection, select the Limit posting to journals

with dates on or before cutoff check box.Note: When you enable average balances for a new ledger, this check box is selected by default.

- You can set the cutoff accounting date to either Today or

Specific date. A journal batch becomes eligible for posting

only when the accounting dates for all journals in that batch are on or before the

cutoff date.

Today is the default value with a default time zone of Coordinated Universal Time (UTC), as shown in this image.

You can change the time zone to any other time zone from around the world. The time zone is used to determine when the clock passes 12:00 a.m. for that specified time zone. This indicates the eligible date for posting journal batches with accounting dates on or before that date.

This table shows how the value for Today can vary based on the time zone setting.

Example of Values for Time Zone, Date and Time, and Today

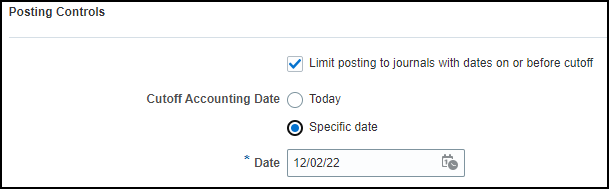

Time Zone Date and Time Today Coordinated Universal Time (UTC) November 16, 2022, 5:00 p.m. November 16, 2022 Sydney Eastern Time (AEST) November 17, 2022, 3:00 a.m. November 17, 2022 Set the cutoff accounting date to Specific date to set a fixed date as the cutoff for journal batch posting. For a batch to be eligible for posting, all journals in that batch must have an accounting date that's on or before the specified cutoff date. The default value is the current system date. You can update the date as needed.

This image shows an example of the specific date set to December 2, 2022.

Note: You can use the ERP Integrations REST Endpoint to update the date when the cutoff accounting date is set to Specific date. This is helpful to advance the cutoff accounting date after the required daily period close processes have completed. You can also use the REST to set the cutoff accounting date to Today with a specific time zone.

Note: You can use the ERP Integrations REST Endpoint to update the date when the cutoff accounting date is set to Specific date. This is helpful to advance the cutoff accounting date after the required daily period close processes have completed. You can also use the REST to set the cutoff accounting date to Today with a specific time zone.

In the Manage Journals page, you can review journal pages that were excluded from posting due to posting control settings. Select the Postable Detail column from the View Columns menu in the Search Results section. The postable detail value for such journals is Not Postable – Batch isn’t eligible per primary ledger setup.

You can also review a summary of the excluded journal batches using the Posting Validation report.