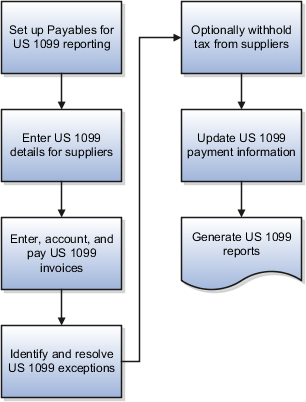

How You Use US 1099 Reporting

In the United States (US), you must report to the Internal Revenue Service certain types of payments that you make to US 1099 reportable suppliers.

You can designate suppliers as federally reportable in the supplier setup. When you enter invoices for the supplier, you classify invoice distributions by US 1099 miscellaneous type using the Income Tax Type field. At year end, you can report accumulated US 1099 payment information to the Internal Revenue Service, other tax agencies, and your suppliers, in standard format.

If you're using combined filing, the US 1099 electronic format produces K records and B records. The K records provide information for tax regions or states participating in combined filing that have qualifying payments. The B records are for suppliers with US 1099 payment amounts that equal or exceed the tax region reporting limit in qualifying states.

Overview of US 1099 Reporting

-

Set up Payables for US 1099 reporting: Refer to the following section for details.

-

Enter US 1099 details for suppliers: On the Income Tax tab on the Supplier page, you can specify federal and state information.

-

Enter, account, and pay US 1099 invoices: You can specify the income tax type and income tax region on each applicable invoice distribution, or accept the default values from the supplier.

To automatically create invoice distributions, you can enter a distribution set or match to a purchase order. If you're using a distribution set that doesn't have income tax types, the invoice distribution gets the income tax type from the supplier. If the distribution set has an income tax type that's different from the supplier, the distribution set tax type is used. You can also enter distributions manually.

You can adjust the Income Tax Type and Income Tax Region on each invoice distribution. You can also clear the Income Tax Type field for distributions that aren't federally reportable. If you enabled the Use supplier tax region tax option, the default region is the state in the supplier site address for the invoice. Alternatively, you can also specify a default income tax region on the Manage Tax Options page. The income tax region is used to group distributions by type and region on US 1099 reports. If you enable combined filing, when you run US 1099 reports, all reportable distributions are grouped by state.

-

Identify and resolve US 1099 exceptions: Submit the US 1099 Invoice Exceptions and Supplier Exceptions reports. Generate Tax Information Verification Letters for each supplier that hasn't furnished or confirmed the tax identification number or tax reporting region.

-

Optionally withhold tax from suppliers: You can withhold tax if Tax Identification Numbers (TIN) are invalid or missing and if you haven't met legal requirements of requesting a valid TIN.

-

Update US 1099 payment information: You can adjust invoice distributions manually on the Manage Distributions page, or you can submit the Update and Report Income Tax Details process.

-

Generate US 1099 reports:

-

US 1099 Forms: Reports the total US 1099 miscellaneous payments for US 1099 suppliers, and generates US 1099 forms for each tax reporting entity in an organization.

-

US 1096 Form: Summarizes each US 1099 form type that's transmitted on paper, as required by the United States Internal Revenue Service. The report is generated on a preformatted Internal Revenue Service form.

-

US 1099 Electronic Media: Generates summarized US 1099 information in electronic format as required by the United States Internal Revenue Service.

-

US 1099 Payments Report: Lists payments made to US 1099 reportable suppliers.

-

Payables Setup for US 1099 Reporting

-

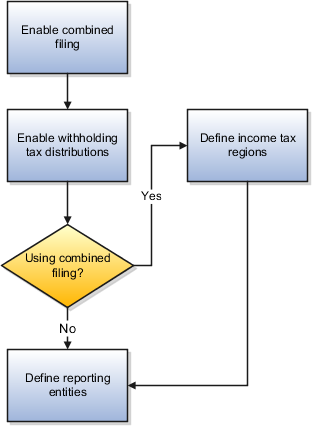

Enable combined filing: To use combined federal and state US 1099 filing, select the Use combined filing program option on the Manage Tax Options page.

Note: If you file US 1099 tax information electronically and don't participate in the Combined Filing Program, leave the combined filing option disabled. -

Enable withholding tax distributions: To automatically create withholding tax distributions, select the Include withholding distributions in income tax reports option on the Manage Tax Options page. The income tax type for these distributions is automatically set to MISC4. If you use combined filing, the income tax region is also provided.

-

Define income tax regions: If you use combined filing, define the tax regions on the Manage Tax Regions page.

-

Define reporting entities: Set up reporting entities on the Manage Reporting Entities page. For each reporting entity, you assign one or more balancing segment values. When you submit US 1099 reports for a tax entity, the paid invoice distributions with the balancing segment values in their accounts are added together.