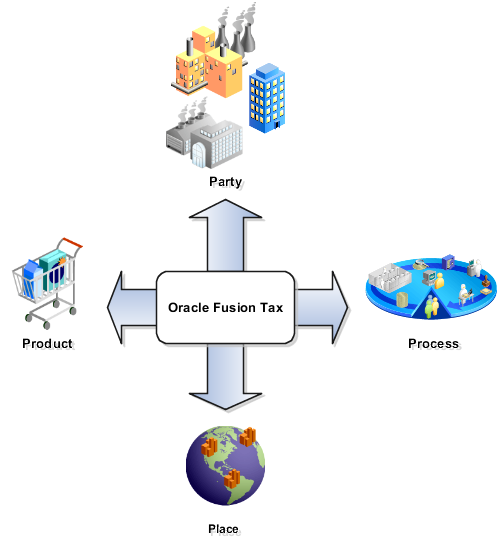

Party, Product, Place, and Process as Determining Factors

Determining factors are the key building blocks of the tax rules. They're are the variables that are passed at transaction time derived from information on the transaction or associated with the transaction.

They're used within tax rules logic to determine the conditions under which specific tax rules are applicable to a specific transaction.

The four groups are described as:

-

Party: Information about the parties on or associated with a transaction such as party fiscal classification, tax registration, and tax exemptions.

-

Product: Information of the types and classifications of the goods and services on or associated to items on a transaction.

-

Place: Information on the addresses of the locations associated to the party and party locations on the transaction.

-

Process: Information on the type of tax services that are being requested such as purchase invoice and debit memo.

How Tax Is Determined Using Party, Product, Place, and Process Transaction Attributes

The following table describes how the party, product, place, and process transaction attributes contribute to the outcome of the tax determination process:

|

Group |

Transaction Attributes |

Process |

|---|---|---|

|

Place |

|

Restrict your tax rules based on the location where the transaction took place. For example, you may only want to apply a tax rule to goods that are delivered from an EC country into the UK. The tax determination process uses the countries associated with the transaction to select the tax regimes associated with the first parties defined for those countries. The tax determination process also uses the transaction location corresponding to the location type derived from the tax rule for the candidate tax or the rule default location type. It then identifies the tax jurisdiction of the candidate tax to which the location identified belongs. If the location doesn't belong to any tax jurisdiction of this tax, then the tax doesn't apply to the transaction. |

|

Party |

|

Restrict your tax rules based on the party of the transactions. For example, the supplier must be registered in another EC country for this tax rule to be applied. The tax determination process determines the first party of the transaction which is either the legal entity or business unit. It uses the first-party legal entity or business unit to identify the tax regimes to consider for the transaction. It also identifies other configuration options, if defined, to use in processing taxes for the transaction. The tax determination process also determines the party whose tax registration is used for each tax on the transaction, and, if available, derives the tax registration number. If the tax registration or registrations are identified, the process stamps the transaction with the tax registration numbers. |

|

Product |

|

Restrict your tax rules to apply to a specific product in the transaction. The tax determination process then applies these rules to transactions with those specific attributes. For example, the product type must be goods for this tax rule to apply. For each tax, the tax determination process determines if a product tax exception applies to the transaction. It looks for an exception rate specific to the inventory item or fiscal classification of the item and adjusts the rate appropriately. |

|

Process |

|

Restrict your tax rules to apply to a specific type of transaction. The tax determination process then applies these rules to transactions with those specific attributes. For example, the tax rule is limited to purchases. For each tax, the tax determination process determines if a customer tax exemption applies to an order-to-cash transaction and updates the tax rate accordingly. |