Tax Box Allocation Rules

Tax box allocation rules represent the association between tax determining factors and user-defined reporting categories called tax boxes.

Tax or taxable amount is allocated a specific tax box number based on tax determining factors and rules applied to transactions. This number is used for tax box reporting.

You can also define the tax box allocation rule to be used for annual allocations or periodic allocations by determining the reporting frequency for which the tax boxes are used. The possible values are Periodic and Annual. For the implementations with the same set of tax boxes for periodic and annual reporting and the same rules of their designation, create the tax box allocation rules with the Report Periodicity either Periodic allocation or Annual allocation. In this case the tax box allocation rules defined with the Report Periodicity Annual allocation becomes valid for periodic reporting and the other way around.

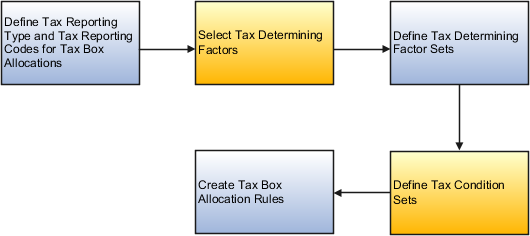

The following figure illustrates the steps involved in defining the tax box allocation rules for transactions. This involves defining the tax reporting type and codes, selecting the tax determining factors, defining the tax determining factor sets, defining tax condition sets, and finally creating the tax box allocation rules.

Tax Reporting Type and Tax Reporting Codes

Tax reporting codes represent tax box numbers that are used in the tax box allocation rules. These tax reporting codes are assigned to taxable transactions.

Define tax box numbers as tax reporting codes. For example, assume you have to report recoverable tax amount to the tax authority. Therefore, define tax reporting type with tax reporting type purpose as tax box allocation. Create tax reporting code with box type as recoverable tax box, for example, 11 - Tax Recoverable Box.

Tax Determining Factors and Tax Determining Factor Sets

Select the tax determining factors you want to use for defining tax box allocation rules. For our example, define tax box allocation rules that are based on the following tax determining factors:

-

Country: Helps you determine the country from which goods are shipped and the country to which goods are shipped.

-

Transaction Business Category: Helps you determine the type of transaction, such as purchase or sales transaction.

These tax determining factors together are called tax determining factor set.

Tax Condition Sets

Assign the values to the tax determining factors. For our example, determine the recoverable tax amount on standard purchase invoices from Italy. Assign the following values to the tax determining factors:

-

Ship-to Country = Italy

-

Ship-from Country = Italy

-

Transaction Business Category = Standard Purchase Invoice

Tax Box Allocation Rules

Create the tax box allocation rules. For our example, create a rule that assigns the tax box 11 when the following conditions are met:

-

Country from where the goods are shipped is Italy

-

Country to which goods are shipped is Italy

-

Transaction type is a standard purchase invoice