Configure the Joint Venture Transaction Types to Exclude Tax from Receivables Invoices

Create a rule to exclude tax calculation for the joint venture transaction types "JV Invoice” and "JV Credit Memo." This is to disable tax calculation for joint venture receivables invoices and credit memos.

-

Create a tax condition set for the joint venture transaction types.

-

Create a tax rule and assign the tax condition set to the tax rule. This applies the tax rule to the joint venture transaction types.

Create a Tax Condition Set

-

Navigate to Setup and Maintenance.

-

On the Setup page, open the Tasks panel on the right and search for Manage Tax Condition Sets.

-

Click Manage Tax Condition Sets from the search result.

-

On Manage Tax Condition Sets, click Add (+) in the Search Results: Transaction Tax Condition Sets section.

-

On Create Tax Condition Set, enter values in the following fields:

-

Tax Condition Set Code. Remember this code because you will need to select it later in a tax rule.

-

Tax Condition Set Name.

-

-

Click the drop-down list for the Tax Determining Factor Set Code field and click Create to create a rule.

-

On Create Determining Factor Set, enter values in the following fields:

-

Tax Determining Factor Set Code. Remember this code because you will need to select it later in a tax rule.

-

Tax Determining Factor Set Name.

-

- Under Associate Tax Determining Factors, complete the following fields and click OK:

-

Determining Factor Class. Select Transaction generic classification from the drop-down list.

-

Determining Factor Name. Select Transaction Type.

-

Required. Select this checkbox.

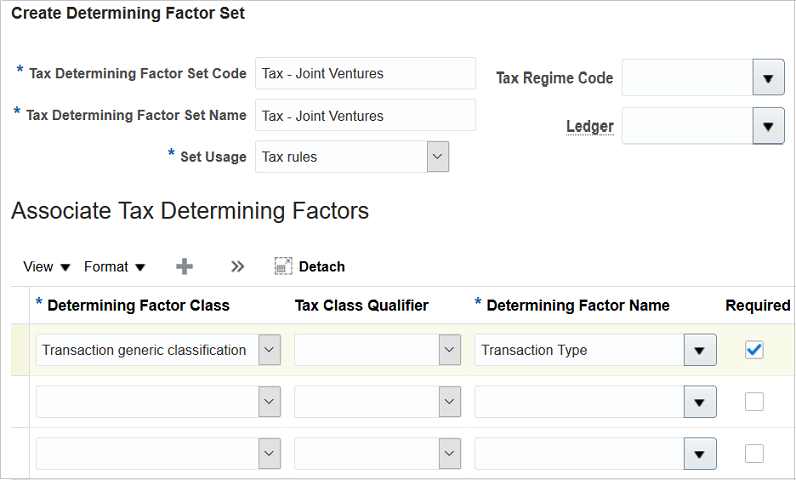

The following image shows the Create Determining Factor Set page with example information entered in the required fields to create a determining factor set. "Tax - Joint Ventures" is the name and code that identifies the set, and "Tax rules" is entered for the set usage. The set is associated with a tax determining factor of class "Transaction generic classification" and name "Transaction Type."

-

-

On Create Tax Condition Set, under Tax Condition Set Details, review the record you created.

-

Click the Operator drop-down list and select In.

-

In the Value or Start from Range column, click the Select and Add button.

-

On Value, click the drop-down list of the first row and click Search.

-

On Search and Select: Value or Start from Range, enter “JV_” in the Transaction Type field and click Search.

The search results will display the joint venture transaction types for both invoice and credit memo.

-

Select the record for JV Invoice from search results and click OK.

-

On Value, click the drop-down list of the second row and click Search.

-

On Search and Select: Value or Start from Range, enter “JV_” in the Transaction Type field and click Search.

-

Select the record for JV Credit Memo from search results and click OK.

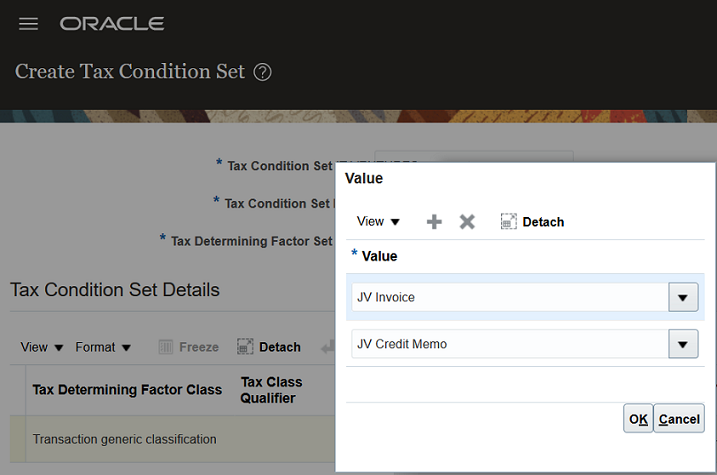

The following image shows that the Value dialog box opened on the Create Tax Condition Set page. The joint venture transaction types for invoice and credit memo are selected as the transaction types to associate with the tax condition set.

-

Click Save and Close.

Create a Tax Rule and Assign Your Tax Condition Set

-

Navigate to Setup and Maintenance.

-

On the Setup page, open the Tasks panel on the right and search for Manage Tax Rules.

-

Click Manage Tax Rules from the search result.

-

On Manage Tax Rules, click Add (+) in the section Search Results: Transaction Tax Applicability Rules.

The application displays the Create Determine Tax Applicability Rule: Tax Determining Factors page. You complete the three-step process shown on this page to create a tax rule.

-

On Tax Determining Factors step, enter information for the following sections:

Rule Details

-

Configuration Owner. Select Global Configuration Owner or your joint venture business unit from the drop-down list.

-

Rule Code. Enter a value that identifies the tax rule.

-

Rule Name. Enter a name for the tax rule.

-

Tax Regime Code. Select a tax regime code from the drop-down list.

-

Tax. Select a tax for the selected regime from the drop-down list.

-

Start Date. Make sure that this date is not before the date on the tax regime.

Event Class

-

Event Class. Select Invoice from the drop-down list.

Tax Determining Factor Set

-

Code. Enter the tax determining factor code that you created in the preceding task.

You can use the drop-down list to search for and select your code.

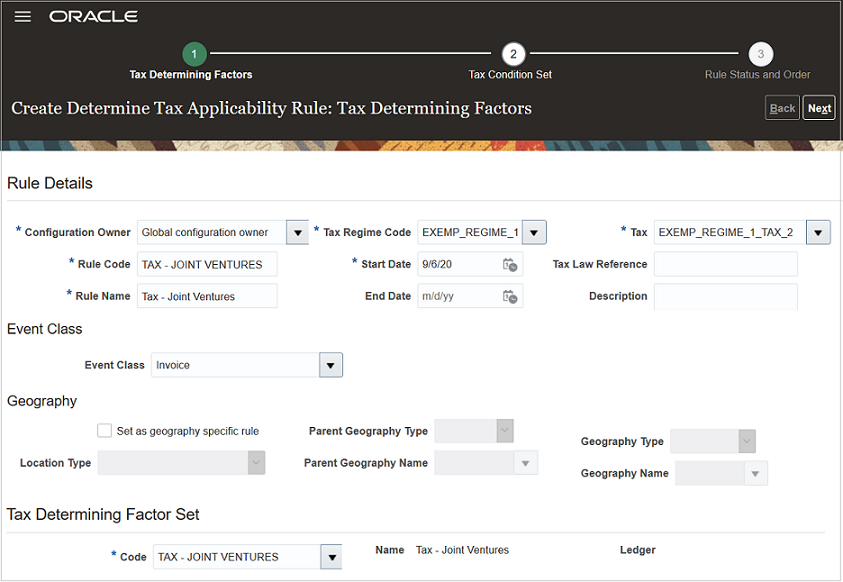

The following image shows the first page of Create Determining Tax Applicability Rule with example information entered in the required fields. The rule name and code entered to identify the rule is "Tax - Joint Ventures"; the tax regime code associated with the rule is EXEMP_REGIME_1; and the tax selected for this regime is EXEMP_REGIME_1_TAX_2. This rule applies to the event class "Invoice" and uses the tax determining factor set code "Tax - Joint Ventures."

-

-

Click Next to get to the Tax Condition Set step.

-

On Tax Condition Set, enter values in the following fields:

-

Tax Condition Set Code. Enter the code for the tax condition set you created. You can click the drop-down list to search for and select your tax condition set code.

-

Applicable. Select Not Applicable from the drop-down list.

This setup excludes tax calculation for the joint venture transaction types.

-

Enabled. Select this checkbox.

This setup enables the tax condition set.

-

-

Click Save and Next to get to the Rule Status and Order step.

-

Under Rule Status and Order, review your rule and select the Enabled checkbox.

This setup enables the rule.

-

Click Submit.