Derive Revenue Cutback Accounts for Carried Interest Journals

To derive the revenue cutback accounts for carried interest journal amounts, you need to perform the following tasks:

- Identify revenue cutback accounts

- Create a mapping set

- Create an account rule

- Create and activate a journal entry rule set

- Associate the journal entry rule set to the accounting method

After you complete these tasks, you must run the Update Subledger Application Options program before creating any events for the primary ledger and Joint Ventures application.

Identify Revenue Cutback Accounts

You need to identify the managing partner’s cutback accounts for debiting revenue amounts from carried interest journals.

Make sure that the cutback accounts are not part of the range of account values that are identified as distributable for the joint venture. This prevents lines from carried interest journals from being identified as joint venture transactions for distribution. However, you can ignore this guidance if you set up your joint venture definitions with the “Exclude joint venture transactions” option enabled. This setup prevents the processing and distribution of transactions generated from Joint Venture Management.

Create a Mapping Set

Perform the following steps to create a mapping set for deriving the revenue cutback account:

- Navigate to Setup and Maintenance and select the Joint Venture Management functional area under the Financials offering.

- Click Show – All Tasks and then select the Manage Mapping Sets task.

- Click Create.

- Complete the following fields in the header area:

- Name.

- Short Name.

- Output Type. Select Segment.

- Description.

Note: The Subledger Application field is set to Joint Ventures by default and can’t be changed. This is because the Manage Mapping Sets task, when accessed from the Joint Venture Management functional area, is designed specifically for setting up journal entries in the Joint Venture subledger. Identify the input source: In the Input Sources area, click “Select and Add” and then complete these fields to search and select the input source:

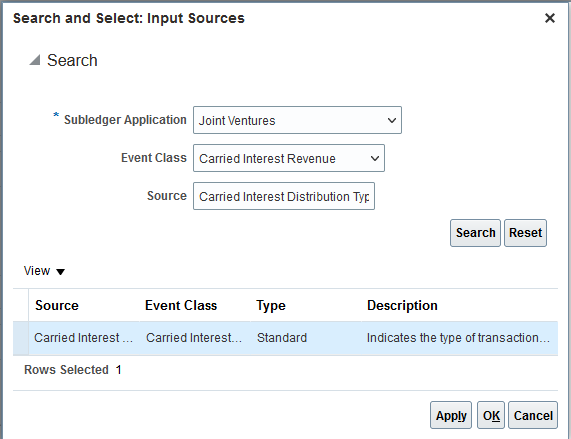

- In the Input Sources area, click “Select and Add” and then enter these

values to search for the input source:

- Event Class. Select Carried Interest Revenue.

- Source. Enter Carried Interest Distribution Type.

- Select the Carried Interest Distribution Type row in the results and click OK.

- In the Input Sources area, click “Select and Add” and then enter these

values to search for the input source:

- In the Chart of Accounts area, enter the chart of accounts of the primary ledger for the joint venture.

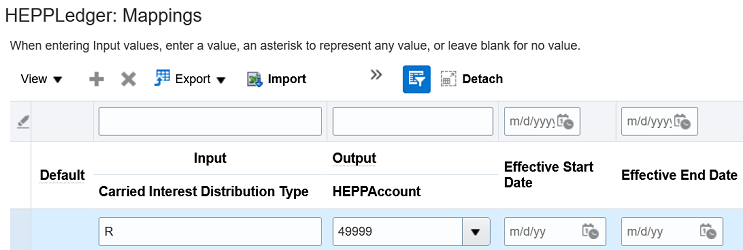

- In the Mappings area, add a row to map the revenue transaction type from carried interest journals to the cutback account:

- Carried Interest Distribution Type. Enter R for Revenue.

- HEPPAccount. Select the cutback account.

The following image shows an example of the mapping for the carried interest distribution type.

Notice in this example, HEPPLedger in the Mappings heading indicates the chart of accounts of the primary ledger of the joint venture. The mapping set is used to map revenue carried interest distributions to the cutback account 49999, which is specified in HEPPAccount segment in this example.

- Click Save and Close.

Create an Account Rule

Create an account rule to enable lines within carried interest journals to be entered as a debit in the revenue cutback account for a joint venture. You associate the mapping set created in the preceding task to this account rule.

- In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the Manage Account Rules task.

- On Manage Account Rules: Joint Ventures, click Add.

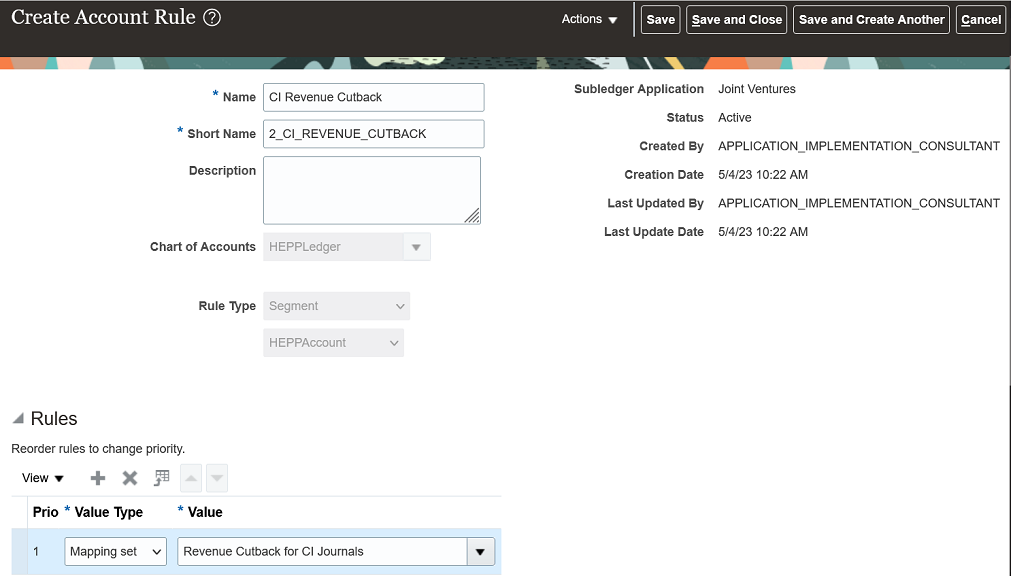

- On Create Account Rule, complete these fields:

- Name.

- Short Name.

- Description.

- Chart of Accounts. Select the chart of accounts of the primary ledger of your joint venture.

- Rule Type. Select Segment from the drop-down list.

- Click the field that appears below the Rule Type field and select the natural account segment value from the drop-down list.

- In the Rules area, click Add and specify the following values in the first

row:

- Value Type. Select Mapping Set.

- Value. Select the mapping set that you created in the preceding task.

- Click Save and Close.

The following image shows an example of a new account rule that’s defined with a mapping set named Revenue Cutback for CI Journals. The rule type for the account rule is Segment, which enables it to derive the value for the HEPPAccount segment in the HEPPLedger chart of accounts.

Create a Journal Entry Rule Set

The Manage Subledger Journal Entry Rule Sets task in FSM includes an example journal entry rule set that contains journal line rules for deriving:

- Cutback accounts for costs and revenue

- Consenting stakeholder accounts for costs and revenue

The journal line rule for consenting stakeholder accounts works as delivered. You only have to modify the journal line rule for the cutback account by assigning it with the account rule created in the preceding task.

- In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the “Manage Subledger Journal Entry Rule Sets” task.

- Select the row with the example Carried Interest Revenue journal entry rule set

and click Duplicate to copy it. Caution: You must copy and rename the example, and then modify it for your setup.

- In the dialog box, complete these fields:

- Name.

- Short name.

- Description.

- Chart of accounts. Select the chart of accounts of the primary ledger of your joint venture.

- Click Save and Close.

- Select the row with the new journal entry rule set and click Edit.

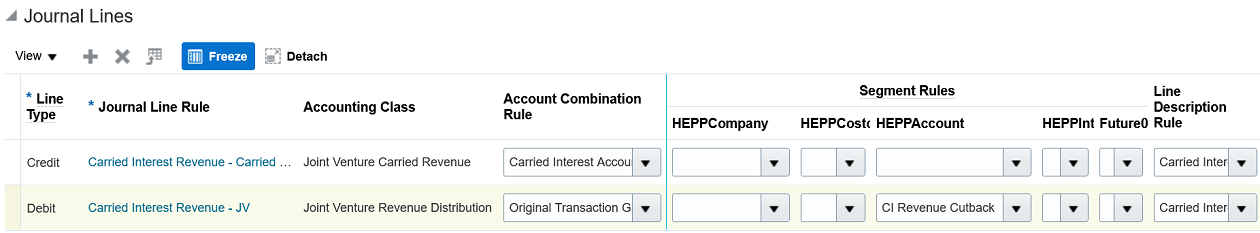

- On Edit Subledger Journal Entry Rule Set, access the Journal Lines area and

highlight the Debit row for deriving the revenue cutback account.

The columns in the Segment Rules represent the segments in the primary ledger for identifying the accounts that contain the original joint venture transactions.

- In the column representing the natural account segment of the chart of accounts,

select the account rule that you set up in the preceding task.Caution: Do not change the Credit row.

The account rule contains the mapping set that ensures that amounts in carried interest journals are entered into the appropriate revenue cutback account.

The following example shows a Debit journal line rule, in which the HEPPAccount column represents the natural account segment of the chart of accounts. An account rule named CI Revenue Cutback was selected for the HEPPAccount. The Credit journal line rule was not modified because by default, the account is defined to credit carried interest amounts to the consenting stakeholder accounts.

- Click Save and Close.

- After setting up the rule set, return to the “Manage Subledger Journal Entry Rule Sets: Joint Ventures” page and use the Actions menu to activate the new journal entry rule set.

Associate the Journal Entry Rule Set to the Accounting Method

Identify the accounting method of the primary ledger and associate the new journal entry rule set to this method.

- In the Joint Venture Management functional area in FSM, select Show – All Tasks and then click the Manage Accounting Methods task.

- Select the accounting method for the primary ledger of your joint venture, and click Edit.

- On the Joint Ventures tab in the Journal Entry Rule Set Assignments area, click

Add Row and complete these fields:

- Event Class. Select Carried Interest Revenue.

- Event Type. Select All.

- Rule Set. Select the journal entry rule set that you created in the preceding task.

- Click Save and Close.

- To complete the setup, run the Update Subledger Application Options program. You must run this program before you can create any events for the primary ledger and Joint Ventures application.