Override an Account Segment Value for Partner Accounts in Payable Invoices

To override an account segment value for partner accounts in payables invoices, you need to complete the following tasks:

-

Create a mapping set.

-

Create an account rule.

-

Add journal entry rule sets to an accounting method.

-

Associate the accounting method with the primary ledger of the joint venture business unit.

Create a Mapping Set

Mapping sets are used to map a combination of input source values to specific output values. You specify which input values to use through reference keys that are preconfigured with joint venture attributes for payables invoices. Apart from reference keys, you can also use the Payables Invoice Transaction Source “ORA_AP_JV” as an input value to restrict the mapping to only joint venture payables invoices.

This task describes how to create a mapping set to replace the natural account segment value in joint venture payables invoices that are associated with the payment of revenue. You can use this as an example to override any segment of the account.

After you create the mapping set for payables invoices, repeat the following task to create a separate mapping set for payables debit memos for operated joint ventures.

-

Navigate to Setup and Maintenance and select the Payables functional area under the Financials offering.

-

Select Show – All Tasks and then click the Manage Mapping Sets task.

-

On Manage Mapping Sets: Payables, click Add (+ icon).

-

Enter the following details:

-

Name

-

Short Name. Enter a name that identifies the purpose of this mapping set because you will need to select this mapping set later in an account rule. Make sure that the name identifies whether this is the mapping set for invoice or debit memo.

- Output Type. Change the output type to Segment.

-

-

On Input Sources, click Add (+ icon).

-

On Search and Select Input Sources, enter details for the following search criteria:

- Subledger Application. Select Payables from the drop-down list.

- Event Class. Select Invoices from the drop-down list. If this mapping set is for debit memos, select Debit Memo instead.

- Source. Search for and select all or a combination of the following

input sources.Note: It’s important to select the required input sources as the system displays columns for filtering joint venture invoices only for the input sources that you specify here.

- Invoice Source. This will enable you to select only joint venture payables invoices.

- AI_REFERENCE_KEY1. This attribute will enable you to select joint venture invoices for the joint venture on the invoice header.

- AIL_REFERENCE_KEY4. This attribute will enable you to select joint venture invoices for the joint venture associated with the invoice line.

- AIL_REFERENCE_KEY1. This attribute will enable you to select joint venture invoices by the joint venture distribution ID associated with the invoice line.

- AIL_REFERENCE_KEY2. This attribute will enable you to select joint venture invoices by the joint venture distribution type code associated with the invoice line.

- AIL_REFERENCE_KEY3. This attribute will enable you to select joint venture invoices by the primary segment value associated with the invoice line.

-

On Chart of Accounts, click Add and enter the following details:

- Chart of Accounts. This is the chart of accounts in the primary ledger associated with the business unit of your joint venture. This chart of accounts must include the account you are using as an override.

- Segment. Select the segment you want to use.

-

On "your chart of accounts name": Mappings, click Add.

The Input section displays columns based on your input sources

-

Under Input, enter the following input values to filter and select joint venture payables invoices for which you want to replace the natural account segment value:

- Invoice Source Name. Enter ORA_AP_JV. This is the Payables invoice source that distinguishes joint venture payables invoices from other invoices.

- AI_REFERENCE_KEY1. Enter the joint venture to use for selecting payables invoices at the invoice header level.

- AIL_REFERENCE_KEY4. Enter the joint venture to use for selecting payables invoice lines.

- AIL_REFERENCE_KEY1. Enter the joint venture distribution ID to use for selecting payables invoice lines.

- AIL_REFERENCE_KEY2. Enter the joint venture distribution type “R” to use for selecting payables invoice lines for operated joint ventures. For nonoperated joint ventures, enter “A”, “E”, “H”, or “F”.

- AIL_REFERENCE_KEY3. Enter the primary segment value to use for selecting payables invoice lines.

-

Under Output, in the Account field, enter an account to override the natural account segment value for the selected joint venture payables invoices.

Important: Make sure that the account you enter isn’t an account that’s identified as distributable in your joint venture definition. This prevents invoice and journal transactions generated by Joint Venture Management from being identified and processed by Joint Venture Management again. As an alternative to this setup, you can enable the "Exclude joint venture transactions" option in your joint venture definition. This option automatically excludes invoice and journal transactions generated by Joint Venture Management from being identified for distribution. See Exclude Joint Venture Invoices and Journals from Oracle Joint Venture Management Processing for more information. -

Click Save.

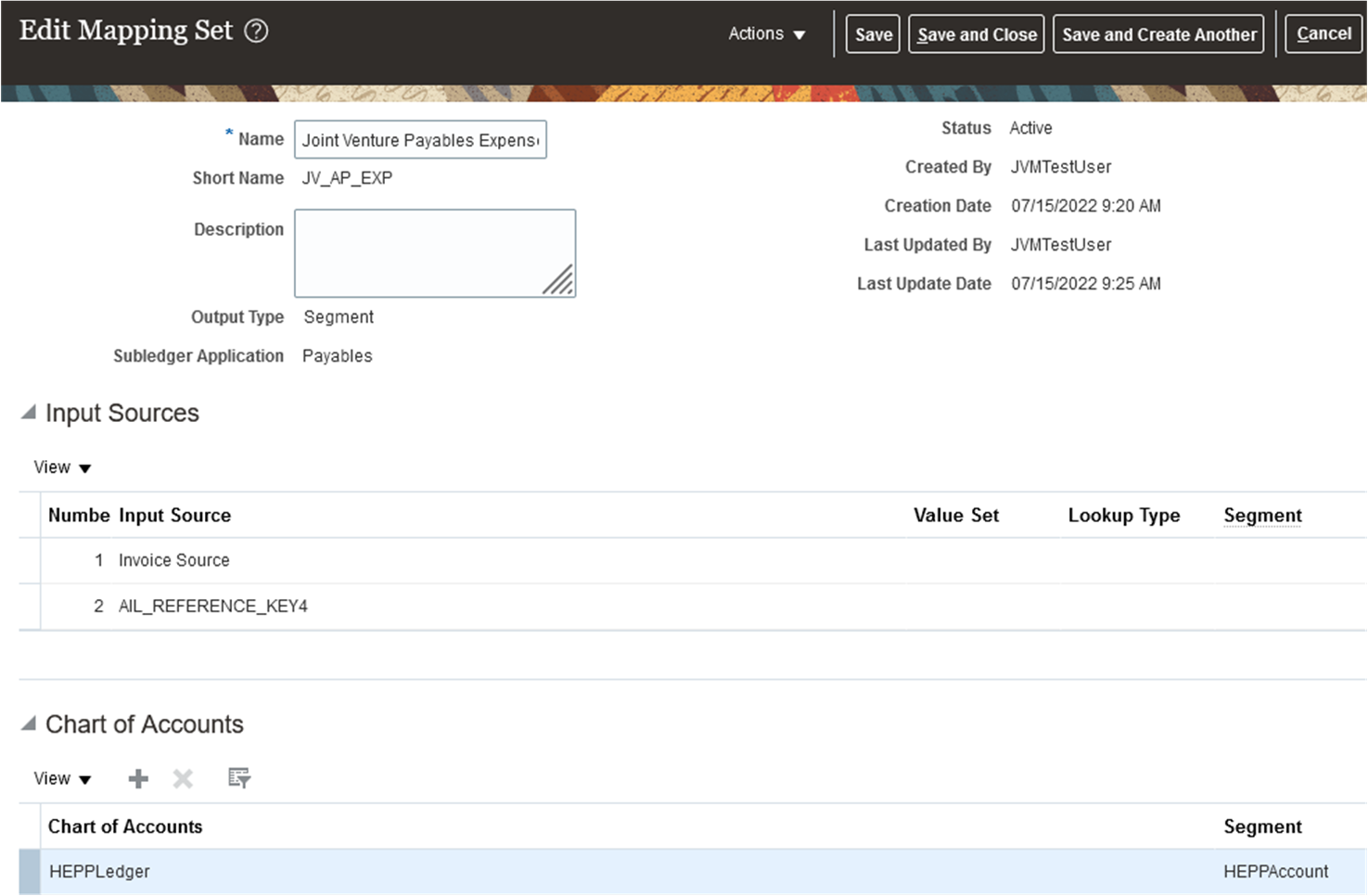

The following image shows the Edit Mapping Set page for a mapping set that has "Joint Venture Payables Expense Account - Invoice" as the name and output type "Segment." The input sources selected for the mapping set are Invoice Source and AIL_REFERENCE_KEY4. HEPPLedger is specified as the chart of accounts that includes the natural account that will override the original natural account. The following image shows the Mappings section of the page with values entered

for the input and output sources. The two input columns named Invoice Source and

AIL_REFERENCE_KEY4 are mapped to the values "ORA_AP_JV" and "EAGLEFORD"

respectively. The output column named HEPPAccount is mapped to the account

56666. This means that all payables invoices created for the joint venture

EAGLEFORD will be recorded in the natural account 56666.

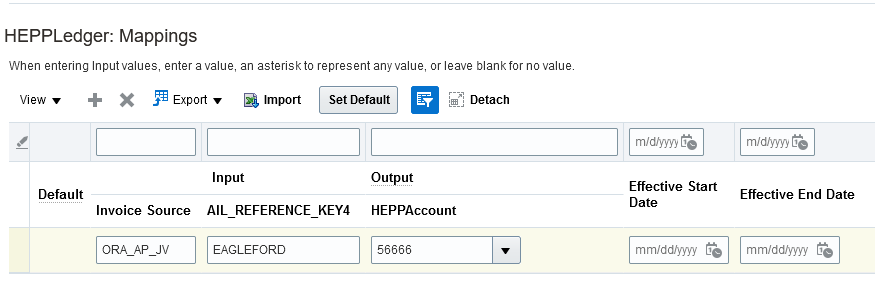

The following image shows the Mappings section of the page with values entered

for the input and output sources. The two input columns named Invoice Source and

AIL_REFERENCE_KEY4 are mapped to the values "ORA_AP_JV" and "EAGLEFORD"

respectively. The output column named HEPPAccount is mapped to the account

56666. This means that all payables invoices created for the joint venture

EAGLEFORD will be recorded in the natural account 56666.

Create an Account Rule

Create an account rule to assign the mapping set for invoices that you created in the preceding task. Repeat the following steps to create a separate account rule for debit memos.

-

Navigate to Setup and Maintenance and select the Payables functional area.

-

Select Show – All Tasks and then click the Manage Account Rules task.

-

On Manage Account Rules: Payables, click Add (+ icon).

-

On Create Account Rule, enter the following details:

- Name.

- Short Name. Enter a name that identifies the purpose of this account rule because you will need to select this account rule later in a journal entry rule set. Make sure that the name identifies whether this is the account rule for invoice or debit memo.

- Chart of Accounts. This is the chart of accounts in the primary ledger that’s associated with the business unit of your joint venture.

- Rule Type. Select Segment from the drop-down list.

Then, select Natural Account Segment.

-

In the Rules section, click Add and enter the following details:

- Value Type. Select Mapping set from the drop-down list.

- Value. Enter the name of the mapping set for payables invoices that you created in the preceding task. If this account rule is for debit memos, you must enter the mapping set for debit memos.

-

In the Rule 1: Conditions section, enter the following condition directly in the field or use the buttons to search and select each value of the condition:

"Invoice Source"(AP,S,S) = ORA_AP_JV 'And' ( ( "AIL_REFERENCE_KEY2" = E ) 'Or' ( "AIL_REFERENCE_KEY2" = A ) 'Or' ( "AIL_REFERENCE_KEY2" = H ) 'Or' ( "AIL_REFERENCE_KEY2" = F ) 'Or' ( "AIL_REFERENCE_KEY2" = R ) )

This condition specifies that the mapping set will only be applied to payables invoices created for operating expenses (E), capital assets (A), overhead (H), fees and other charges (F), and revenue (R).

-

Click Save.

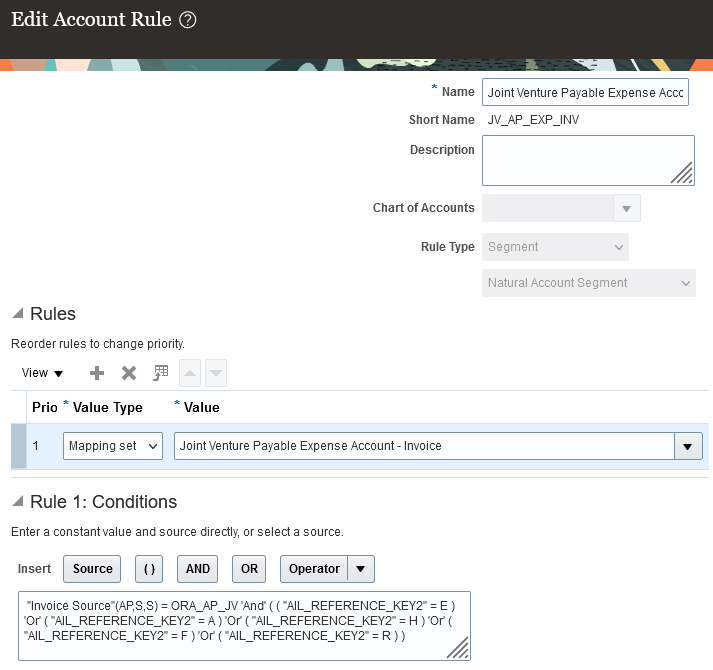

The following image shows the Edit Account Rule page for an account rule with the Rule Type “Natural Account Segment.” A mapping set is specified in the Value field. This indicates that the mapping set referenced in this account rule is for the natural account segment for payables invoices. The Rule 1: Conditions section includes a condition that the natural account will be updated only for payables invoices associated with operating expenses (E), assets (A), overhead expenses (H), fees and other charges (F), and revenue (R).

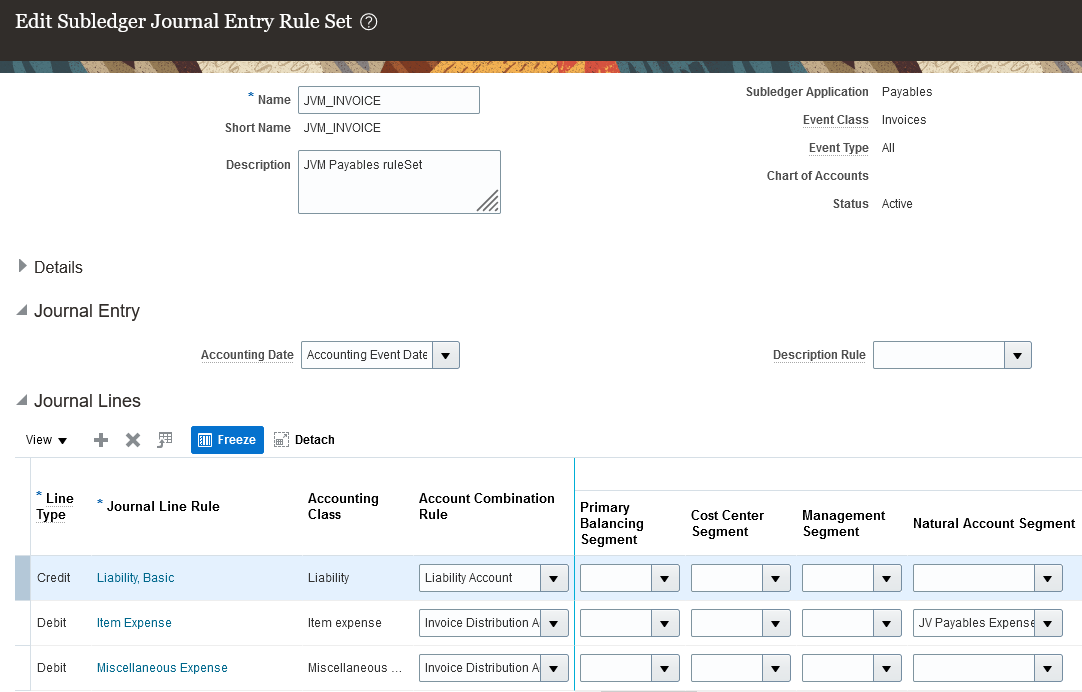

Add Journal Entry Rule Sets to an Accounting Method

The account rules that were created in the previous tasks must be assigned to journal entry rule sets. Journal entry rule sets provide the definition for generating a complete subledger journal entry for an accounting event. For joint venture payables invoices, you must create journal entry rule sets for the accounting events, invoice and debit memo, and assign the rule sets to an accounting method.

Accounting methods are specific to chart of accounts. Therefore, you will assign journal entry rule sets for Joint Venture Management to the accounting method that is defined with the chart of accounts used in your joint venture.

You can create journal entry rule sets before you assign them to accounting methods. The following steps show how to create or edit journal entry rule sets within an accounting method.

-

Navigate to Setup and Maintenance and select the Payables functional area.

-

Select Show – All Tasks and then click the Manage Accounting Methods task.

-

On Manage Account Methods: Payables, select your accounting method, click the Actions drop-down menu and click Duplicate.

-

On Create Accounting Method, enter the following details:

- Name.

- Short Name.

-

Click Save and Close. The application returns you to the Manage Account Methods: Payables page.

-

Under Search Results, select the duplicate accounting method and click Edit.

-

In the Journal Entry Rule Set Assignments section for Payables, check if a record already exists for event class “Invoices” and event type “All”. If it exists, click the rule set to edit it. If it doesn’t, you need to create the record. To do so, click Add (+ icon) and enter the following details:

- Event Class. Select Invoices from the drop-down list.

- Event Type. Select All from the drop-down list.

- Rule Set. If a rule set already exists with the following information, then you just need to select the rule set. If it doesn’t exist, click Create from the drop-down list and enter the following details:

-

In the Create Subledger Journal Entry Rule Set page, enter the Name and Short Name that identifies that the journal entry rule set is for joint venture invoices.

-

Under Journal Lines, you can add a new journal line or edit existing journal lines.

Note: If this is an existing rule set, it might already contain a journal line for Debit line type and Item Expense journal line rule. If this is the case, you just need to edit the journal line to assign the correct account rule in the Natural Account Segment field.To add a new journal line, click Add (+) and enter the following details:

- Line Type. Select Debit from the drop-down list.

- Journal Line Rule. Select Item Expense from the drop-down list.

- Account Combination Rule. Enter the predefined account rule “Invoice Distribution Account.”

- Natural Account Segment. Search for and select your account rule for payables invoices that you created in the preceding task.

-

Click Save and Close.

-

Similarly, assign the appropriate account rule for debit memos in the rule set for debit memos. In the Journal Entry Rule Set Assignments section for Payables, check if a record already exists for the event class “Debit Memos” and event type “All”. If it exists, click the rule set to edit it. If it doesn’t, create the record following the instructions provided in the previous step for the event class “Invoices.”

In the Natural Account Segment column, remember to search for and select your account rule for payables debit memos. This step is not applicable for payables invoices created for nonoperated joint ventures because you don’t create debit memos for such invoices.

-

Verify that the journal entry rule sets for the other systems that you stored in this accounting method are intact.

-

To activate the journal entry rule sets, click Activate.

-

Make sure the status of the accounting method is Active and then save it.

-

Click Save and Close.

Associate the Copied Accounting Method with the Primary Ledger of the Joint Venture Business Unit

-

In Functional Setup Manager, access the General Ledger functional area under the Financials offering.

-

Click the Specify Ledger Options task.

-

On Specify Ledger Options: <your ledger name>, in the Accounting Method field, enter the name of your copied accounting method. You can search for and select the accounting method from the drop-down list.

-

Click Save and Close.