You might need to override the default receivable account derived from AutoAccounting

rules. Based on your business needs, you can set up an account override using subledger

accounting rules or on the joint venture definition for each joint venture.

Note: If you set up an account override in both the joint venture definition and

subledger accounting rules, the account specified in the subledger accounting rules

will be used for the joint venture receivables invoice.

To use subledger accounting rules to override the receivable account, you need to set

up mapping sets, account rules, journal entry rule sets, and accounting method. You

use mapping sets to map a combination of input values to specific output values. To

derive a receivable account for your joint venture, you can use the Cross Reference

field on the invoice as the input source in your mapping set. This field records the

joint venture name in the invoice header. Then, you can map the joint venture to a

receivable account.

-

Navigate to Setup and Maintenance and select the Receivables functional area

under the Financials offering.

-

Select Show – All Tasks and then click the Manage Mapping Sets task.

-

Click Create.

-

Complete the following fields in the header area:

- Name.

- Short Name.

- Output Type. Select Segment.

- Description.

-

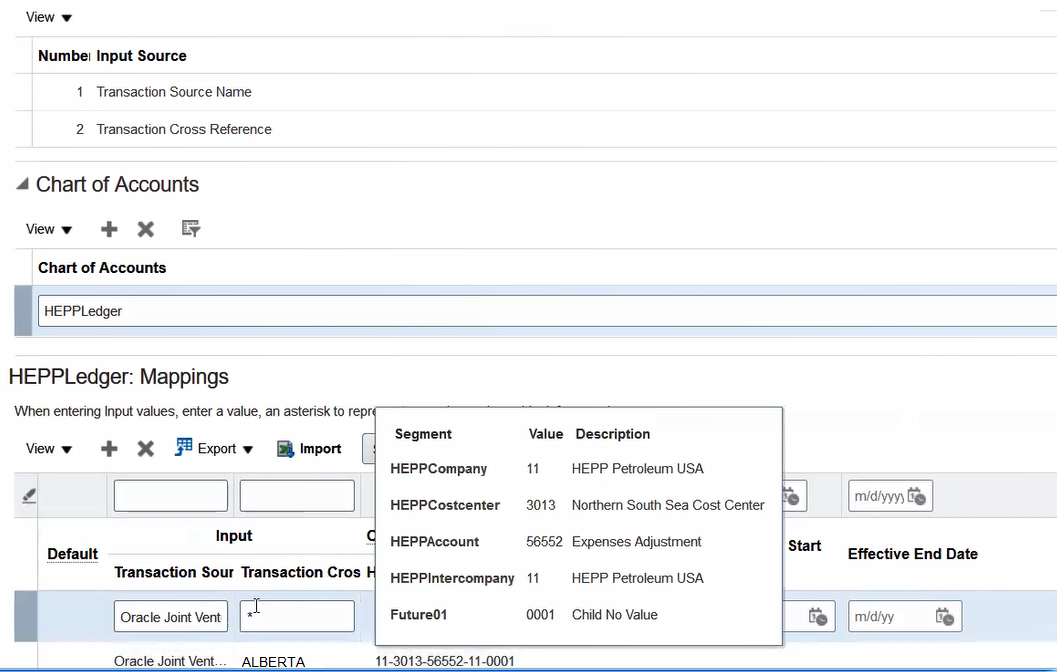

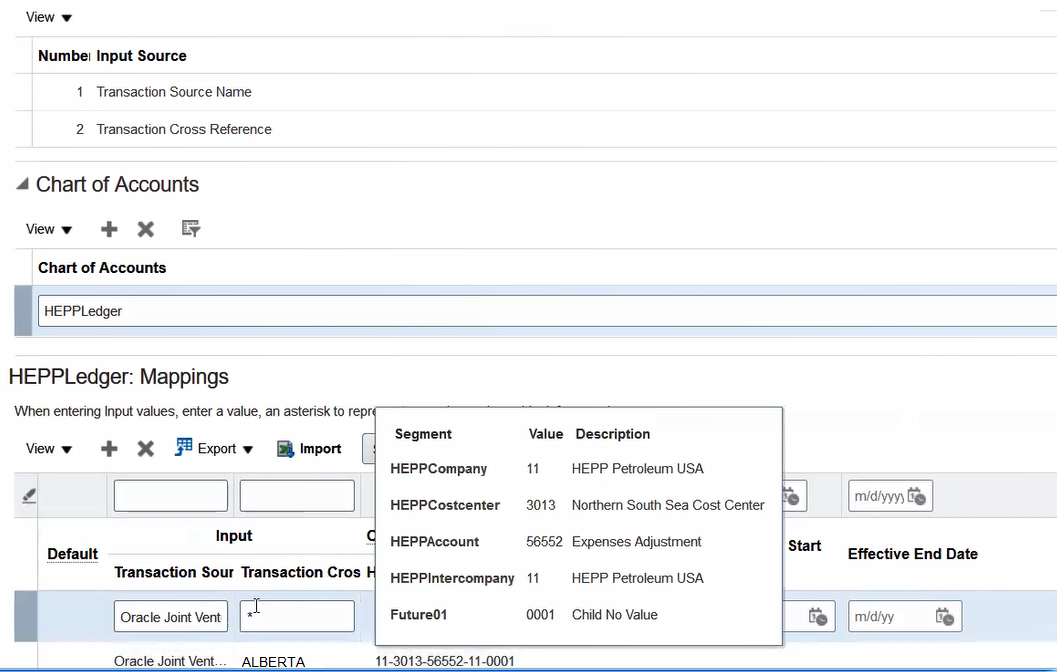

On Input Sources, click Add (+ icon).

-

On Search and Select Input Sources, enter details for the following search

criteria:

- Subledger Application. Select Receivables from the drop-down list.

- Event Class. Enter Invoice from the drop-down list.

- Source. Search for and select Transaction Cross Reference as the input

source.

-

On Chart of Accounts, enter the chart of accounts of the primary ledger for the

joint venture.

-

On <your chart of accounts name>: Mappings, click Add (+ icon) to add a row

to map the transaction cross reference from a joint venture to a receivable

account, as shown in the following example:

After creating the mapping set, you assign it to an account rule. The account

rule is then added to a journal entry rule set for the event "Invoice" and

journal line "Invoice Revenue." You then assign the journal entry rule set to an

accounting method.