How Oracle Joint Venture Management Works

Joint Venture Management processes transactions from Oracle Fusion Cloud Financials. It also supports processing transactions from third-party financial systems, as long as those transactions are first imported into Oracle Financials through Oracle Accounting Hub.

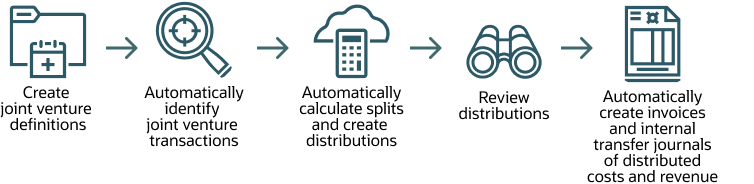

This illustration and the details that follow describe each part of the process to identify and distribute joint venture transactions in Joint Venture Management:

Create Joint Venture Definitions

A joint venture accountant or accounting manager sets up a joint venture definition for each joint venture. A joint venture definition contains the information Joint Venture Management uses to identify joint venture financial transactions in Oracle Financials. It also includes an ownership definition for identifying the partners in a joint venture and each partner's percentage of ownership. Joint Venture Management uses the information in the ownership definition to calculate the split of transactions and create distributions with each partner's share of the transaction.

Automatically Identify Joint Venture Transactions

The Identify Joint Venture Transactions process is a scheduled process that uses the details in a joint venture definition to identify transactions for processing. You can schedule this process to identify transactions for one or all of your active joint ventures. This process helps to ensure that transactions previously identified and processed by Joint Venture Management aren't processed again.

The Joint Venture Transactions work area enables you to review transactions identified by the Identify Joint Venture Transactions process. You can review transaction details, such as the assigned ownership definition that will be applied to transactions to calculate the split. The Transactions work area gives you the option to associate a different ownership definition to a transaction. Or you can associate a direct billed partner to a transaction to distribute an entire transaction amount to a single partner.

Automatically Calculate Splits and Create Distributions

The Create Joint Venture Distributions process is a scheduled process that calculates the split of transactions and generates distribution records. This process uses details in the joint venture definition, specifically stakeholder ownership percentages in the ownership definition, to calculate the split and create distributions.

An ownership definition has two requirements: the ownership percentages of all stakeholders must total 100 percent and it must have an effective date range. The effective date range enables you to set up multiple ownership definitions with successive date ranges to account for any changes in the joint operating agreement over the life cycle of a joint venture. When processing transactions, the Create Joint Venture Distributions process compares the transaction date in each transaction against the effective dates in the ownership definitions to determine which ownership definition to use to calculate the split.

Review Distributions

The Joint Venture Distributions work area displays distribution records generated from the Create Joint Venture Distributions process. Each record contains a partner's share of transactions to be processed. Distribution records also include partner information, the original transaction amount, and the transaction date that represents the date of service for which the transaction was originally created. It also includes other important details to help you troubleshoot any issues or resolve any disputes over distribution amounts.

Automatically Create Invoices and Internal Transfer Journals of Distributed Costs and Revenue

The Create Joint Venture Invoices and Journal Entries process is a scheduled process that creates receivable and payables invoices from distributions that contain each stakeholder’s share of costs and revenue. It also creates journal entries from distributions that contain the share of costs and revenue for internal stakeholders. These journal entries are referred to as internal transfer journals because they're generated for a stakeholder that's part of the same enterprise as the managing partner. Processed distributions are associated with costs and revenue recorded in transactions in the primary ledger. The costs can be operating expenses, capital expenditures, overhead, or fees and other charges.

Invoices and journal entries include information from the joint venture such as the business unit, joint venture name, stakeholder details, the distribution amount, currency, and account type of the distribution. These details enable you to identify the associated distribution when you're reviewing invoices and journal entries.

The Joint Venture Distributions work area also displays invoice and journal information in processed distributions. You can use these details to review the associated invoices and journals in Oracle Financials.