Overview of Payables Withholding Tax Report

This topic includes details about the Payables Withholding Tax Report.

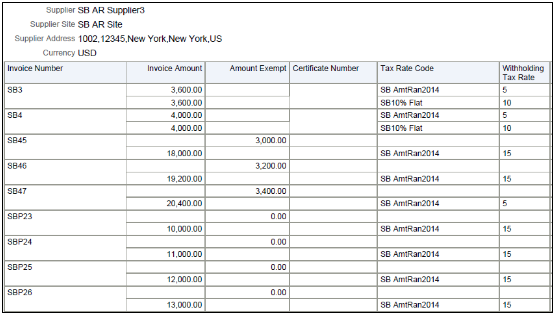

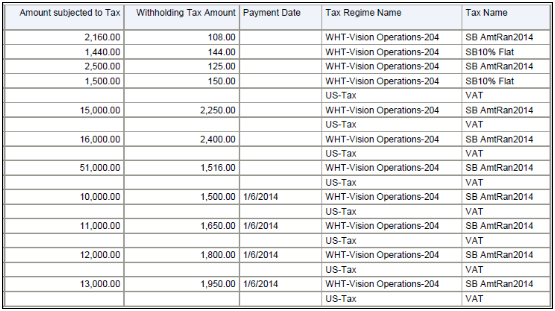

The Payables Withholding Tax Report lists the withholdings for a supplier. The report has an invoice view and a supplier view. The invoice view is used to review detailed withholding tax information by invoice. The supplier view is used to review withholding information for a range of suppliers.

The following figures provide an example of one page from the report.

Key Insights

The report lists the invoices that have withholding deductions.

Frequently Asked Questions

The following table lists frequently asked questions about the Payables Withholding Tax Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

From the Reports and Analytics pane, navigate to . |

|

Who uses this report? |

|

|

When do I use this report? |

Periodically to get details of the withholdings that were deducted an invoice. |

|

What can I do with this report? |

|

|

What type of report is this? |

Oracle Transactional Business Intelligence |

Related Subject Areas

This report uses the Payables Invoices - Transactions Real Time subject area.