Overview of Managing Transaction Tax Application on Advanced Receipts in Oracle ERP Cloud

You can manage transaction tax on advance receipts in an Order to Cash cycle in Oracle ERP Cloud.

This is applicable to India Taxes.

In India, tax regulations mandate the transaction tax to be calculated on advances received and offset the prepaid tax computed on advance receipts with the tax liability on the invoice. You can manage transaction taxes on advance receipts given to customers before the actual transaction. Advances received are applied to the sales invoice generated by the enterprise after the transaction, thereby reducing the outstanding amount from the customer.

Here are the prerequisites required to configure Transaction Tax Application on Advanced Receipts in Oracle ERP Cloud:

- Enable Receipt Class for Advance Receipt:Follow these steps:

- Navigate to Manage Receipt Classes and Methods

- Query the receipt class and choose Yes for the header lever GDF segment Advance Receipt.

- Configure Tax Prepaid Account:Follow these steps:

- Enter Tax Prepaid Account code combination on the manage taxes user interface.

- In the Tax Accounts tab, enter account code combination for Tax Prepaid Account.

- The same combination flows to tax rate and tax jurisdiction level.

- Enable Security Privilege Manage Advance Receipt Tax:Follow these steps:

- Navigate to the Security console.

- Create a role with Manage Advance Receipt Tax for India

(JA_MANAGE_ADVANCE_RECEIPT_TAX_FOR_IND) function security privilege

and assign it to the user account for creating advance

receipts.

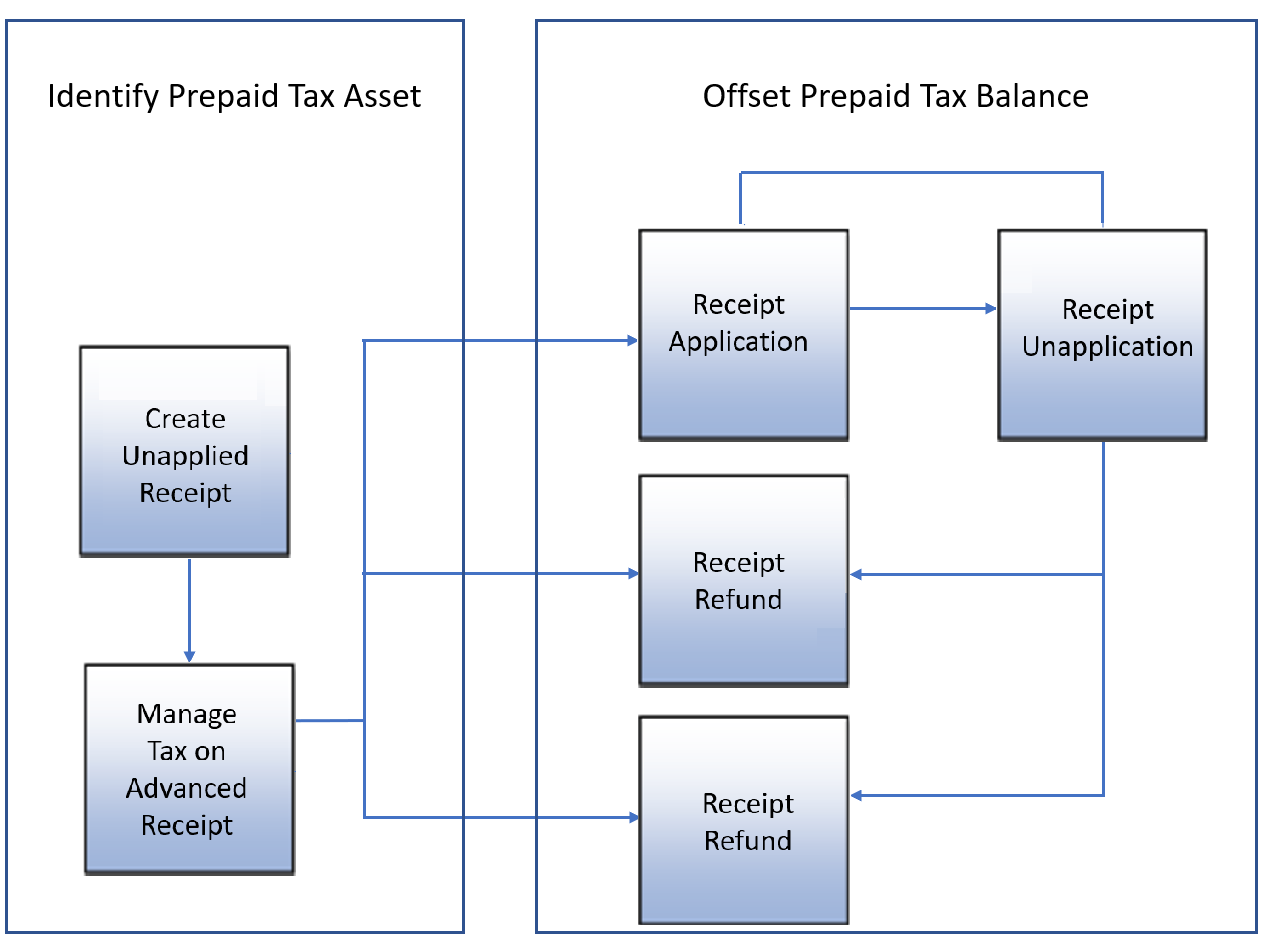

This image describes the Manage Tax on Advance Receipts process flow: