Solution Overview

This section discusses the solution overview of the Bank Collections Remittance process.

You can perform these tasks:

- Generate the Bank Collections Remittance file based on the customer invoices payment terms.

- Define and submit corrections, and updates for the remittance files already submitted.

- Import the Bank Collection Return file from the bank.

- Generate receipts and update customer’s balances.

These features are associated with the Bank Collection Remittance process:

- Create Receivables Invoices and Remittance Batch

- Update Collection Documents

- Automatically Create Receipts and Bank Return

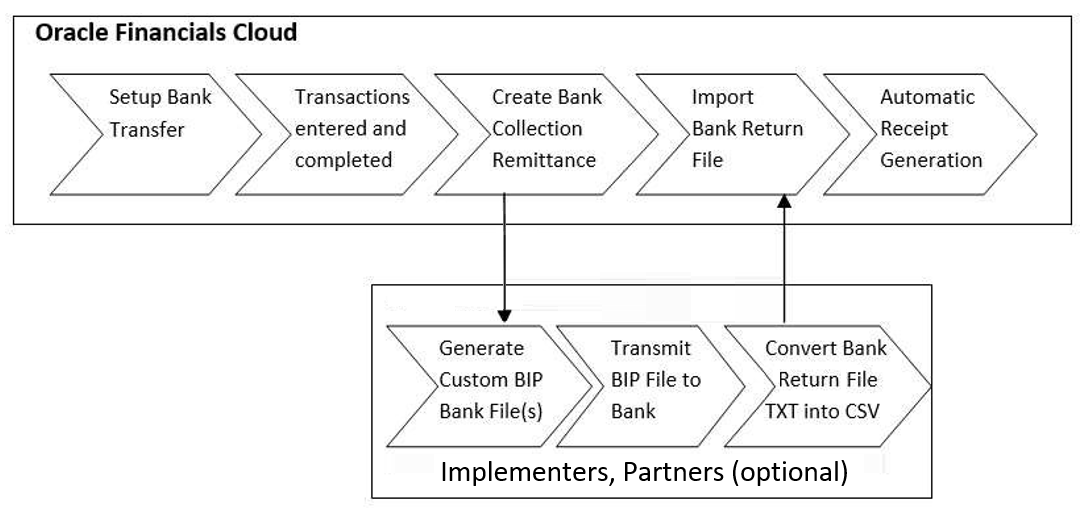

Process Flow

This image shows the steps included in the process flow.

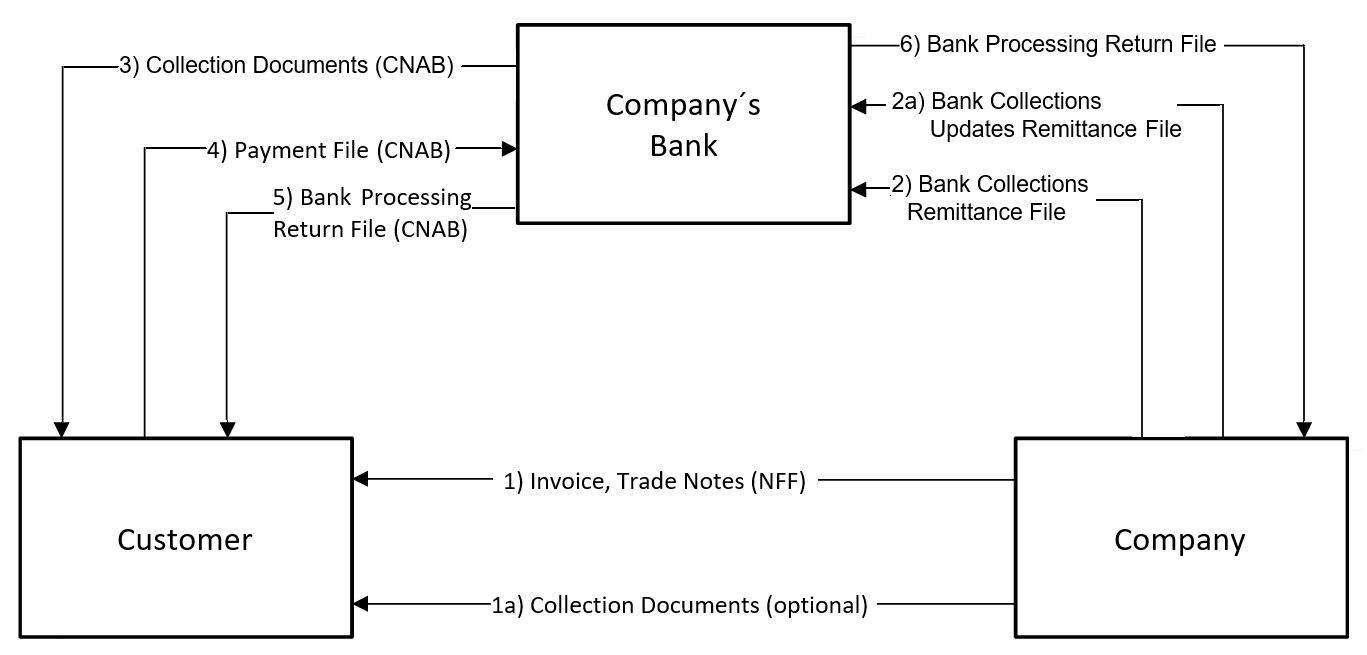

Business Flow

This image shows the steps included in the business flow.

Bank Collection Remittance Process

After you create a Receivables transaction and completes the final approval process of the fiscal document, the Receivables invoice is available for selection in a remittance batch.

Remittance batches are used to send information to the company’s bank for payment collection. The information that is sent to a bank can include instructions for the bank such as the collection of interest charges and protest after due date. You can set the criteria to automatically or manually select the installments and include them in the remittance batch.

The collection documents are created in Receivables for the installments. After you create the collection documents to send to a bank, you can review the collection documents that were selected in the batch and remove any as necessary.

You can define the limit parameters and default information for document selection such as the maximum number of documents per remittance batch, the minimum and maximum amount for each document, and the minimum and maximum total amount for the remittance batch. The specific bank remittance formats can be assigned to each bank. Once the remittance batch details are reviewed, the remittance batch is formatted to send to a bank. If there is an error in the format process, you can make corrections and reformat the batch. A remittance batch can also be cancelled before a bank return is done.

Update Collection Documents

The bank collection updates are used to provide further directions for the collection documents that have already been sent to the bank.

Once the updates are created, a collection updates remittance batch is generated and formatted to send to the bank. You can also set the automatic collection document updates based on certain actions, and also create the collection document updates manually.

Automatically Create Receipts and Bank Return

It is important for the banks to return information about collections in the form of a file that can be imported in the application.

The Import Bank Returns for Brazil program is available to import and validate the bank return details in the file. The same program is used to upload and validate the records that are manually entered in the spreadsheet. Validation is done against the related collection documents. The bank return records that are rejected by this process are shown on the Bank Return Import Report.

Imported bank return records that were rejected during the validation process need to be corrected. A Correct Bank Returns spreadsheet is available in Oracle Financials Cloud to upload the corrected details. The uploaded details are validated the same as in the import process procedure. A Receivables receipt is created automatically after you complete the import process.