Account Analysis Reports

This topic includes details about how you use account analysis reports.

Overview

You can use account analysis reports to provide a complete set of reports that support fiscal verification processes in countries in Europe and South America. You can also use these reports to inform shareholders about the financial results in other countries, including the United States.

Account analysis reports include the following reports:

-

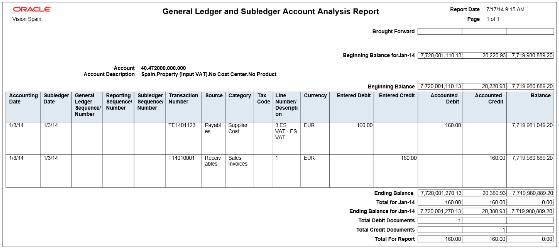

General Ledger and Subledger Account Analysis Report: You can view account balances by account with subledger journal details. The report displays entered amounts, third-party information, sequences, and total number of debit and credit documents.

Here is a screenshot of the General Ledger and Subledger Account Analysis Report.

-

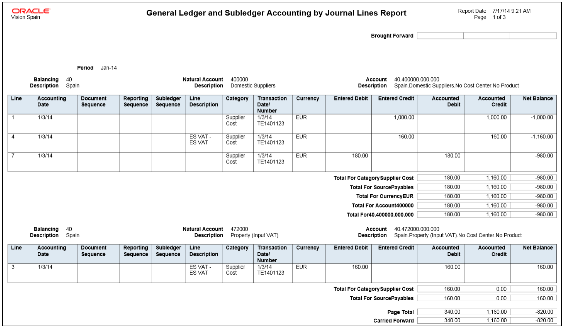

General Ledger and Subledger Accounting by Journal Lines Report: You can view account balances or selected segment balances with subledger journal details including entered amounts, third-party name, journal source, journal category, and reporting and accounting sequences. Total number of debit and credit documents is also listed in this report.

Here is a screenshot of the General Ledger and Subledger Accounting Journal Lines Report.

-

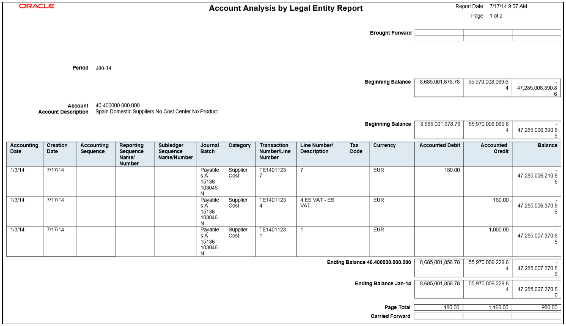

Account Analysis by Legal Entity Report: Use this report to view account balances by account combination and selected segments with subledger journal details, including third-party information and sequences. Flexible grouping and sorting options are provided at submission.

This is a screenshot of the Account Analysis by Legal Entity Report.

Key Insights

The account analysis reports enable you to do these tasks:

-

Provide a legal account ledger

-

Reconcile subledger balances with the general ledger balances

-

Maintain an audit trail

-

Allow a periodic internal verification

You can view these information for each account:

-

Account identification

-

Account beginning balances for the reporting period

-

Period transactions with subledger and general ledger information

-

Resulting account ending balances

In addition, you can use the General Ledger and Subledger Accounting by Journal Lines Report to get these information:

-

Details of subledger accounting entry lines, regardless of the general ledger journals summarization.

-

Audit trail information about the original business documents or transactions to support each accounting entry line. This information varies across countries.

Report Parameters

Let's look at the common parameters for the account analysis reports.

|

Parameter |

Description |

|---|---|

|

Ledger |

Specify the ledgers for the selected data access set. Ledger is required for all general ledger reports. |

|

Legal Entity |

Specify the legal entity. You can control the report output through this parameter only if you have associated balancing segment values to your legal entities. |

|

From Period and To Period |

Indicate the period range for the report data. |

|

Flexfield Filter Conditions |

Enter the filtering conditions on the accounting flexfield. You can select all segments for the selected ledger and define conditions including account value ranges. |

Here are some selected General Ledger and Subledger Accounting account analysis report parameters.

|

Parameter |

Description |

|---|---|

|

Include Legal Entity Information |

Select Yes to print the legal entity on the report. |

|

Balance Type |

Specify whether the balance type is budget, encumbrance, or actual amounts. |

|

Display Tax Rate Code |

Select Yes to include the tax rate code details. |

|

Document Sequence Name |

Enter the name of the document sequence used to generate unique number for the journal. |

Here area some selected parameters of the General Ledger and Subledger Accounting journal lines report.

|

Parameter |

Description |

|---|---|

|

Accounting Sequence Name |

Indicate the name of the sequence used to generate a unique number for the subledger journal. |

|

Posting Status |

Indicate whether the posting status is transferred but not posted, not transferred, or posted. |

|

Journal Entry Status |

Indicate whether the journal entries are in draft, final or invalid status. |

|

Third-Party Type |

Select the party type as customer or supplier. Optional parameter. May be blank. |

|

Journal Source |

Enter the source of journal entries, such as payables, receivables, or manual. |

|

Journal Category |

Select journal category when you want to report on a specific subledger journal category. Leave it blank when you want to include all the journal categories. |

Let's look at some account analysis by legal entity report parameters.

|

Parameter |

Description |

|---|---|

|

Balance Type |

Specify whether the balance type is budget, encumbrance, or actual amounts. |

|

Include Zero Amount Lines |

Indicate whether the report should include accounts with no activity in the selected period or zero amount lines. |

|

Report Heading |

Accept the default value or modify the report page heading by selecting one of the available values. The default value is the legal entity name. |

Frequently Asked Questions

Theses are some frequently asked questions about account analysis reports.

|

FAQ |

Answer |

|---|---|

|

How do I find these reports? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses these reports? |

|

|

When do I use these reports? |

Use the account analysis reports to:

|

|

What type of reports are these? |

Oracle Analytics Publisher |