Deductible VAT Declaration Report for France

This topic includes details about the Deductible VAT Declaration Report for France.

Overview

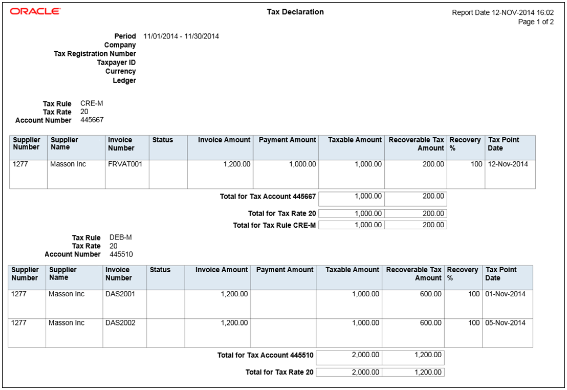

In France, companies must report deductible VAT on purchase of goods and services, by applying the relevant rule to determine if VAT is deductible during invoice creation and payment time. The Deductible VAT Declaration Report for France lists the deductible VAT amounts and totals of invoices for France, grouped by deductible VAT rule, tax rate, and account number.

The following figure is an example of the report.

Key Insights

The VAT processing is based on tax point basis, tax point date, and marked as reportable. Only tax lines with the reportable option set to yes are reported.

The Deductible VAT Declaration Report for France prints deductible VAT amounts and groups transactions by deduction tax rules such as:

-

DEB-M tax rule: VAT deductible on received invoices for goods or services.

-

CRE-M tax rule: VAT deductible on invoice payments.

For transactions to which the CRE-M rule applies, the tax point basis is set to Payment and are reported when they are either partially or fully paid.

The report displays two separate sections for DEB-M and CRE-M tax rules and lists details of transactions that are not posted to general ledger. Invoices with deferred tax rates are reported as a part of CRE-M only after the invoice is paid. Invoices that have tax rates with tax point basis set to invoice, accounting, or delivery are reported under the DEB-M section.

Report Parameters

The following table lists selected parameters for the Deductible VAT Declaration Report for France:

|

Parameters |

Description |

|---|---|

|

Reporting Level |

Choose the level on which you want to run the report. You can choose from three different levels, Ledger, Legal Entity, and Tax Registration Number. |

|

Reporting Context |

Specify the context for the report. The list of values for this parameter depends on the reporting level you selected.

|

|

Tax Registration Number |

Specify the registration number that is assigned to first party or first-party site by the tax authority when it is registered. A party or party site is identified by this registered number. |

|

From Tax Point Date and To Tax Point Date |

Print all the transactions based on the selected tax point date range. Note: When CRE-M rule is applicable on transactions, the

tax point date is the payment date.

|

Frequently Asked Questions

The following table lists frequently asked questions about the Deductible VAT Declaration Report for France.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

Schedule and run this report from the Scheduled Processes work area on the Navigator menu. |

|

Who uses this report? |

|

|

When do I use this report? |

Use the Deductible VAT Declaration Report for France to produce the VAT declaration at the end of each reporting period, listing the deductible VAT amount for each purchase invoice and also the total VAT amounts for the period. |

|

What type of reports are these? |

Oracle Analytics Publisher |