Equivalence Surcharge Support

You can use the Online VAT Reporting for Spain to report on possible equivalence surcharges on Receivables transactions. Equivalence surcharges occur on Receivables transactions related to taxable customers exempt from VAT declaration and not registered for VAT.

Recargo de equivalencia, the Spanish term used for surcharge of equivalence, is a special type of tax under a special VAT regime that is mandatory for certain retailers who do not transform the products they sell. This tax is in addition to VAT (an extra line), and thus the name. Generally, the supplier issues the invoice with the equivalence surcharge for those retailers that have informed the supplier that they are subjected to the surcharge of equivalence regime.

After the required setup, the value and the rate of these equivalence surcharges are listed under specific XML tags <sii:TipoRecargoEquivalencia> and <sii:CoutaRecargoEquivalencia> of the Online VAT Report for Spain, under the standard VAT rate elements to which these surcharges correspond.

The users who need to report the equivalence surcharges of their customers must have these values reported under the corresponding fields in their Online VAT report for Spain, based on the legal requirements of the Spanish Tax authorities.

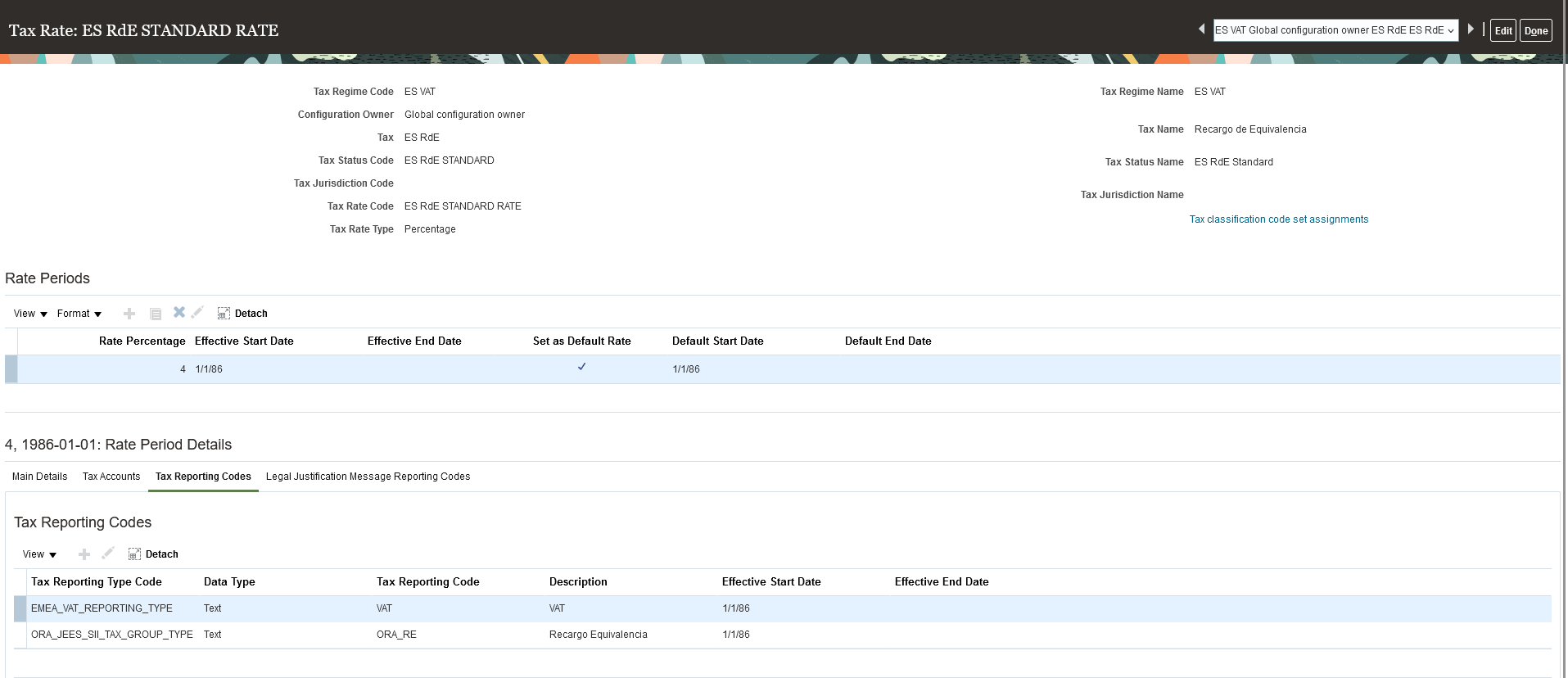

You must use the existing Tax Reporting Type ORA_JEES_SII_TAX_GROUP_TYPE for the SII feature, with the new tax reporting code ORA_RE to identify the tax rates used to calculate the equivalence surcharges. These rates are calculated on Receivables transactions on top of the standard VAT rates.

This image shows the tax rates used to calculate the equivalence surcharges.