Overview of Payables Withholding Tax by Tax Authority Report

This topic includes details about the Payables Withholding Tax by Tax Authority Report.

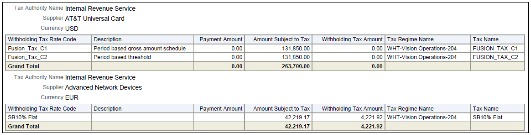

The Payables Withholding Tax by Tax Authority Report lists withholdings for tax codes assigned to a tax authority.

The following figure is an example of the report.

Key Insights

The report lists withholding tax information for withholding tax codes that have amounts withheld.

Frequently Asked Questions

The following table lists frequently asked questions about the Payables Withholding Tax by Tax Authority Report.

|

FAQ |

Answer |

|---|---|

|

How do I find this report? |

From the Reports and Analytics pane, navigate to . |

|

Who uses this report? |

|

|

When do I use this report? |

Periodically, to determine withholding amounts for each withholding authority. |

|

What can I do with this report? |

|

|

What type of report is this? |

Oracle Transactional Business Intelligence |

Related Subject Areas

This report uses the Payables Invoices - Transactions Real Time subject area.