Accounting Method

Accounting methods group subledger journal entry rule sets. This facilitates the definition of consistent accounting treatment for each accounting event class, and accounting event type, for all subledger applications.

This grouping enables a set of subledger journal entry rule sets to be assigned collectively to a ledger.

For example:

-

A subledger accounting method can be defined to group subledger journal entry rule sets that adhere to and comply with US Generally Accepted Accounting Principles (GAAP) criteria.

-

By assigning a different subledger accounting method to each related ledger, you can create multiple accounting representations of transactions.

Accounting rules can be defined with either a top-down, or a bottom-up approach.

-

Top-Down: Define the accounting method, followed by components of each rule that must be assigned to it.

-

Bottom-Up: Define components for each rule and then assign them as required.

The Create Accounting process uses the accounting method definition with active journal entry rule set assignments to create subledger journal entries.

When an accounting method is initially defined its status changes to Incomplete. The status will also be Incomplete after modifying a component of any accounting rule associated with the assigned journal entry rule set.

The accounting method must be completed, by activating its journal entry rule set assignments, so that it can be used to create accounting.

The following definitions are used to define the journal entries, and are applied as updates to the accounting method:

-

Updates to the predefined accounting method

-

Assignment of journal entry rule sets for an accounting event class and accounting event type from the accounting methods page

-

Assignment of accounting methods to ledgers

-

Activation of subledger journal entry rule set assignments

Updates to the Predefined Accounting Method

You may update a predefined accounting method by end dating the existing assignment and creating an assignment with an effective start date.

Assignment of Journal Entry Rule Set for Accounting Event Class and Accounting Event Type

You create the assignment of a journal entry rule set for an accounting event class and accounting event type using the accounting method page.

The following should be considered for assigning rule sets:

-

If the accounting method has an assigned chart of accounts you can use journal entry rule sets that:

-

Use the same chart of accounts

-

Are not associated with any chart of accounts

-

-

You can assign to existing journal entry rule sets or create a new one.

Assignment of Accounting Methods to Ledgers

If the accounting method has an assigned chart of accounts, it may only be used by ledgers that use the same chart of accounts.

If the accounting method doesn't have an assigned chart of accounts, the accounting method can be assigned to any ledger.

Activation of Subledger Journal Entry Rule Set Assignments

You can activate the subledger journal entry rule set assignments from the Accounting Method page. You can also submit the Activate Subledger Journal Entry Rule Set Assignments process to validate and activate your accounting set ups.

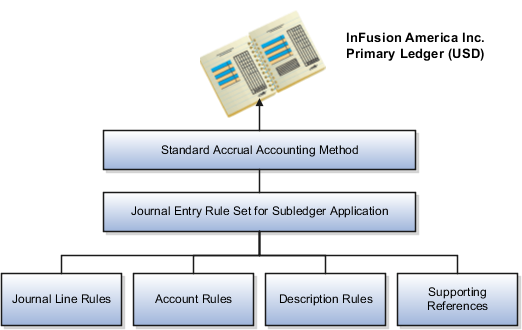

Accounting Method and Accounting Rules

This figure illustrates the relationship of the components used in an accounting method.