About Creating and Sending Cost Adjustments to Oracle Project Costing

In Project Costing, a project accountant tracks the costs for a project from cost-related transactions in Oracle Fusion Cloud Financials to capture the gross amount of costs for the project. A managing partner of a joint venture uses Oracle Joint Venture Management to split cost-related transactions from Oracle Financials according to each partner’s percentage of ownership in the joint venture. Distributions that contain each partner's share of costs are used to generate invoices or journal entries for recouping the costs from the joint venture partners.

You can use both applications separately to process the same cost-related transactions from Oracle Financials. But with an integration between Project Costing and Joint Venture Management, you can create cost adjustments from joint venture distributions that originate from project-related cost transactions. A project accountant can then import the cost adjustments to Project Costing. When imported into Project Costing from Joint Venture Management, original distribution cost adjustments are negative amounts that get subtracted from the gross amount, enabling the project accountant to realize the accurate capitalized cost.

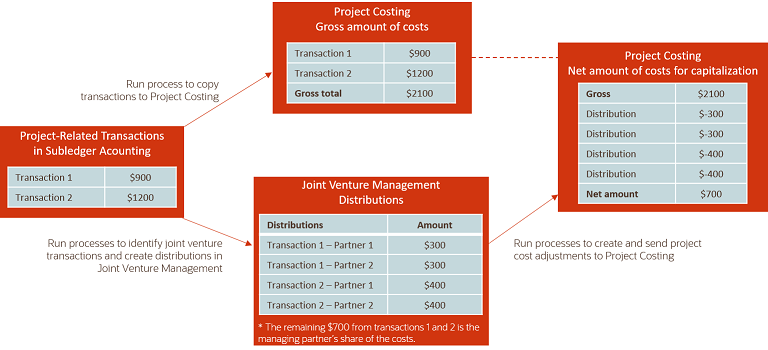

The following illustration shows how transaction amounts are captured separately in both applications, and then brought together in Project Costing to realize the accurate capitalized costs for a project.

In the preceding example, notice that the managing partner’s $700 share of the costs aren’t passed to Project Costing as cost adjustments. In Joint Venture Management, distributions are created for a managing partner’s internal stakeholder, but cost adjustments are not created for internal stakeholders.