Example of When a Credit Memo Increases the Invoice Balance

Typically, costs are debit in nature. However, there might be cases when you have costs in both credit and debit.

For example, you create a payables invoice of $10000 to pay the equipment cost of an oil well. That’s a debit amount. If the supplier gives a discount by issuing a credit of $1000 on the payables invoice, you have both a debit and credit for this cost transaction that you bring into Joint Venture Management. Then, you create a receivables invoice to reimburse the actual cost, which is $9000.

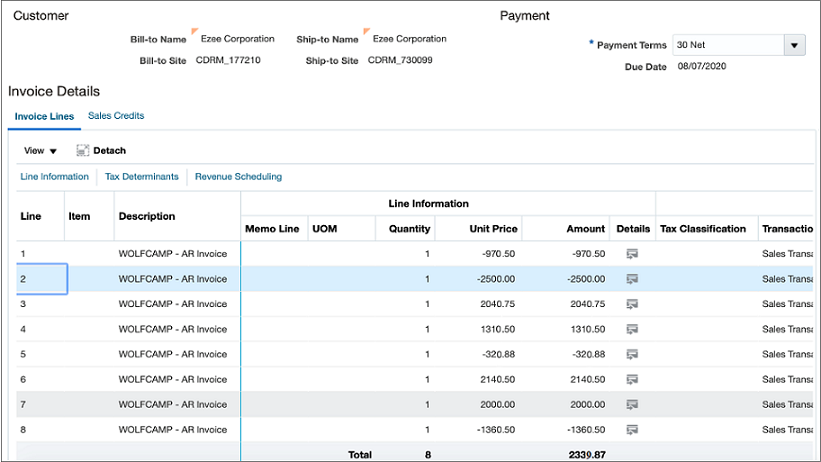

The following example also shows a joint venture receivables invoice that has both debit and credit invoice lines. The invoice amount is $2339.87. Due to a change in the ownership definition, you must reverse the joint venture distributions associated with invoice lines 2 and 7 and create a partial credit memo.

The original and reversed distributions for invoice lines 2 and 7 are as below:

| Debit | Credit | |

|---|---|---|

| Original Distribution D1 (invoice line 2) | 2500 | None |

| Original Distribution D2 (invoice line 7) | None | 2000 |

| Reversed Distribution D1RV (invoice line 2) | None | 2500 |

| Reversed Distribution D2RV (invoice line 7) | 2000 | None |

The credit memo is created for $500 (2500-2000=500). Because this amount is a credit (negative in sign), it should increase the invoice amount instead of reducing it. The invoice amount after applying the credit memo is $2839.87 {2339.87-(-500)=2839.87}.

You can create such a credit memo in Oracle Receivables only if the “Natural application only” checkbox is not activated for the joint venture credit memo transaction type. This checkbox is selected by default. With this default setting, Receivables only applies payment to a transaction that brings the balance close to or equal to zero. It won't create a credit memo such as the one in this example, but will issue an error instead.