How Authorizations for Credit Cards Are Processed

Oracle Fusion Payments processes authorization requests that are received from source products. An authorization is a real-time process that:

-

Validates credit card information

-

Reserves funds through the payment processor and issuing bank

Settings That Affect Authorizations for Credit Cards

The following table describes the options that affect authorization processing:

|

Page or Dialog Box |

User Interface Element |

Action |

|---|---|---|

|

Create or Edit Funds Capture Process Profiles Page |

Formats tab, Authorization section: Outbound Format choice list and Inbound Response Format choice list. Accounts tab: Authorization Transmission Configuration choice list |

Controls the formats and transmission configurations used to communicate with the payment system. |

|

Create Routing Rules Page |

All fields. |

|

|

Reorder Priority of Routing Rules Dialog Box |

All fields |

Reorders priority of routing rules. |

|

Set Rules Page |

All fields |

Specifies default payment systems that are used if no routing rules are set up or if none of the conditions in the routing rules are met for the funds capture transaction. |

How Authorizations for Credit Cards are Processed

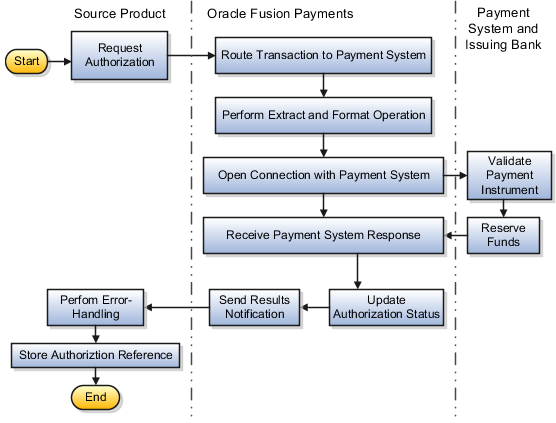

The following diagram illustrates the steps performed in the authorization process.

The authorization process for credit cards includes the steps described in the following table.

|

Step |

Description |

|---|---|

|

Request authorization. |

The source product requests authorization. Oracle Fusion Receivables creates an automatic receipt. This process determines the payment system to which a transaction is sent, as well as the funds capture process profile. |

|

Route transaction to payment system. |

Routing rules are applied in the order of their priority. Payments performs settlements or refunds through the same payment system used for authorizations. |

|

Perform extract and format operation. |

This process:

|

|

Open connection with payment system. |

Payments:

|

|

Validate payment instrument. |

The payment system or the issuing bank:

|

|

Reserve funds. |

After the issuing bank determines that the credit card is valid, it reserves funds. |

|

Receive payment system response. |

Payments receives a response from the payment system and closes the connection. The response contains a variety of information, depending on the success or failure of the transaction. |

|

Update authorization status. |

Authorization information received from the payment system is stored in the Transaction Authorization Entity table owned by Payments. This table creates a unique reference identifier for the transaction. For example, a credit card that receives a successful authorization stores the following data in the table.

The preceding information is used during the settlement process. |

|

Send results notification. |

Payments:

|

|

Perform error-handling. |

Receivables displays any errors. You can resolve errors returned by Payments. |

|

Store authorization reference. |

The source product stores the unique authorization reference. |