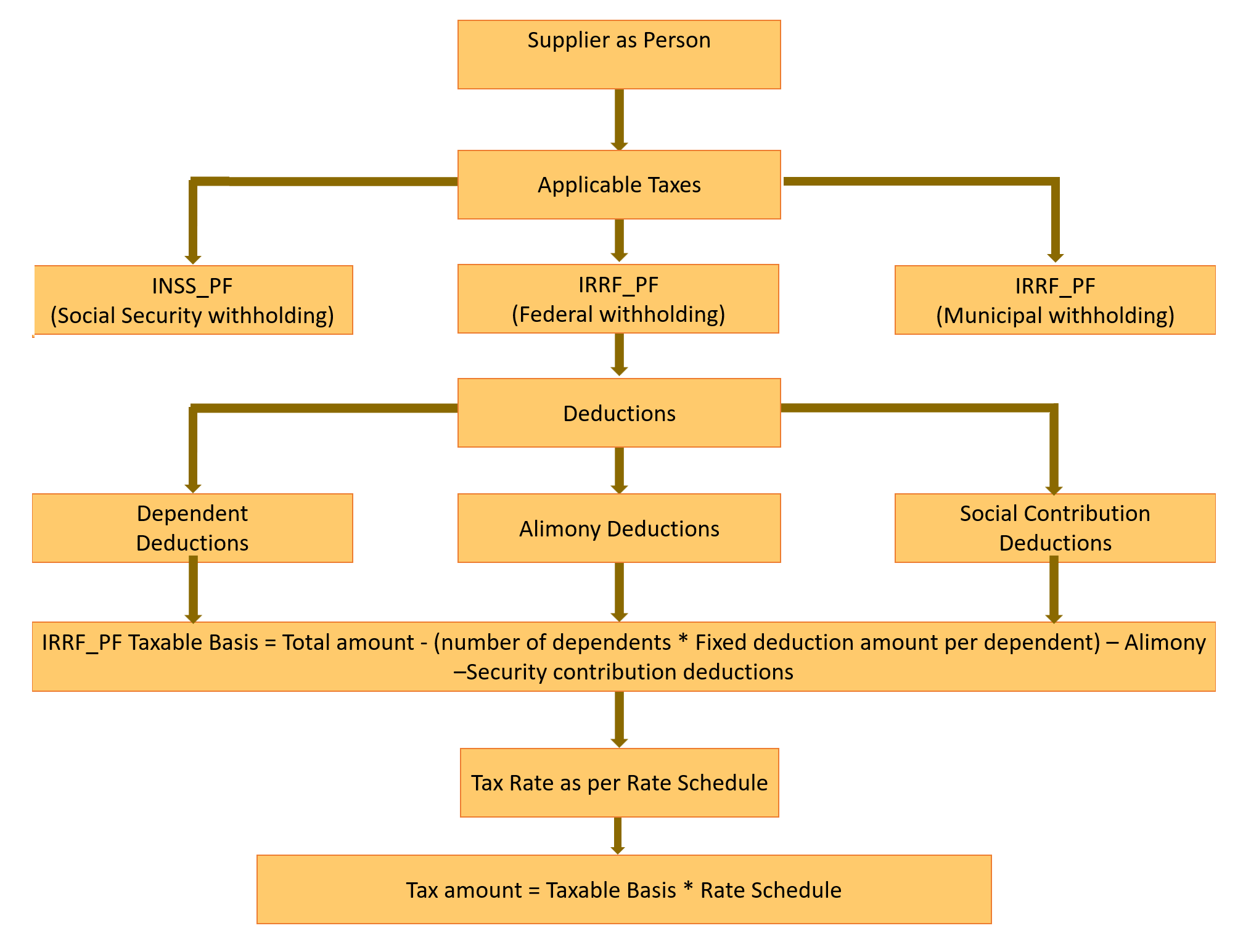

Deductions

In Brazil, dependent deductions are applicable during the withholding tax calculation for a supplier as a person providing services.

A deduction reduces the taxable base amount during the withholding tax calculation process.

Deductions applied to the IRRF_PF taxable basis include:

- Deductions for Dependents:

Number of dependents is multiplied by the fixed amount specified by tax authorities. For example, if the supplier has three dependents, 3 * 150.69 BRL = BRL 452.07 is deducted from the IRRF_PF withholding taxable basis.

- Deductions for Alimony:

Amount paid in the previous month is deducted from the IRRF_PF withholding taxable basis.

- Deductions for Social Security Contributions:

Amount paid in the previous month is deducted from the IRRF_PF withholding taxable basis.

This image shows the process flow:

Configure Deductions for Dependents

Set up deductions for dependents by configuring the deduction amount per dependent at the tax level.

Follow these steps:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Manage Taxes.

- Search for IRRF_PFTax.

- Click the Tax Deductions tab and add a row.

- Enter these values:

| Attribute | Value | Comments |

|---|---|---|

| Fixed Deduction per dependent | 150.69 | In Brazil, the deduction amount per dependent is fixed by law which varies from year to year. This setup is configured at the tax level. |

| Effective Start Date | 01/01/17 | Date from which the deductions are effective. |

After configuring the deduction amount per dependent at the tax level, specify the number of dependents that the supplier as a person has on the Third Party Tax Profile page.

Configure Number of Dependents

Follow these steps:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Manage Party Tax Profiles.

- Search for Third Party Tax Profile for an existing party or create a new one.

- Click the Withholding Tax Deductions tab and add a row.

- Enter these values:

Attribute Value Comments Tax Regime Code <User-defined withholding tax regime> - Tax IRRF_PF - Deduction Type Number of Dependents - Number of Dependents 3 Number of dependents provided by the supplier. Start Date 04/01/17 Date from which the deductions are effective.

Example

The supplier as a person provides services and invoices for the services rendered during the month to a company. This supplier has three dependents. The clerk enters this invoice, validates and approves the invoice, then makes a payment in Payables. Here is the Payables Invoice transaction line.

| Invoice Date | Invoice Number | Product Type | Amount |

|---|---|---|---|

| 05/01/17 | 700 | Service | 2600.00 |

| - | - | Total | 2600.00 BRL |

Tax Determination Process

In Brazil, IRRF_PF tax is calculated at the time of payment as follows:

IRRF_PF taxable basis = Total amount – Social security contribution deduction

Here is the IRRF_PF Tax Computation:

| Total invoice amount | 2600 BRL |

| Number of dependents | 3 |

| Fixed deduction amount per dependent | 150.69 BRL |

| IRRF_PF taxable basis | 2600- (3*150.69) = 2147.93 BRL |

| IRRF_PF tax amount as per rate schedule | 48.65 BRL |

| Amount From | Amount To | Rate Percentage |

|---|---|---|

| 0 | 1499.15 | 0 |

| 1499.15 | 2246.75 | 7.5 |

| 2246.75 | 2995.70 | 15 |

| 2995.70 | 3743.19 | 22.5 |

| 3743.19 | - | 27.5 |

Withholding Tax Line

After the tax determination process successfully completes, it creates this tax line.

| Tax Line | Tax Regime | Tax Name | Tax Status | Tax Jurisdiction | Effective Tax Rate | Tax Amount |

|---|---|---|---|---|---|---|

| 1 | <User-defined withholding tax regime> | IRRF_PF | Standard | Brazil | 2.265% | -48.65 BRL |

Configure Alimony Deductions

Setup the deduction for alimony paid by supplier in the previous month by configuring the deduction amount for the Third Party Tax Profile.

Follow these steps:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Manage Party Tax Profiles.

- Search for Third Party Tax Profile for an existing party or create a new one.

- Click the Withholding Tax Deductions tab and add a row.

- Enter these values:

| Attribute | Value | Comments |

|---|---|---|

| Tax Regime Code | <User-defined withholding tax regime> | - |

| Tax | IRRF_PF | - |

| Deduction Type | Alimony Amount | - |

| Deduction Amount | 500 | Alimony amount provided by the supplier. |

| Start Date | 04/01/17 | Date from which the deductions are effective. |

Example

The supplier as a person provides services and invoices for the services rendered during the month to a company. This supplier has provided the previous month’s alimony amount paid to the company. The clerk records this amount in the Party Tax Profile. The clerk enters this supplier invoice, validates and approves the invoice, then makes a payment in Payables.

Payables Invoice Transaction Line

| Invoice Date | Invoice Number | Product Type | Amount |

|---|---|---|---|

| 05/07/17 | 800 | Service | 3000 |

| - | - | Total | 3000.00 BRL |

Tax Determination Process

In Brazil, IRRF_PF tax is calculated at the time of payment per the IRRF_PF Tax Computation:

| Total invoice amount | 3000 BRL |

| Alimony paid amount provided by supplier | 500 |

| IRRF_PF taxable basis | 3000- 500 = 2500 BRL |

| IRRF_PF tax amount as per rate schedule | 94.05 BRL |

IRRF_PF_Tax_- rate schedule table

| Amount From | Amount To | Rate Percentage |

|---|---|---|

| 0 | 1499.15 | 0 |

| 1499.15 | 2246.75 | 7.5 |

| 2246.75 | 2995.70 | 15 |

| 2995.70 | 3743.19 | 22.5 |

| 3743.19 | - | 27.5 |

Withholding Tax Line

After the tax determination process successfully completes, it creates the withholding tax line:

| Tax Line | Tax Regime | Tax Name | Tax Status | Tax Jurisdiction | Effective TaxRate | Tax Amount |

|---|---|---|---|---|---|---|

| 1 | <User-defined withholding tax regime> | IRRF_PF | Standard | Brazil | 3.762% | -94.05 BRL |

Configure Social Security Contribution Deduction

Set up the deductions for social security contributions paid in the previous month by configuring the deduction amount for the Third Party Tax Profile.

Follow these steps:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Manage Party Tax Profiles.

- Search for Third Party Tax Profile for an existing party or create a new one.

- Click the Withholding Tax Deductions tab and add a row.

- Enter these values:

| Attribute | Value | Comments |

|---|---|---|

| Tax Regime Code | <User-defined Withholding Tax Regime> | - |

| Tax | IRRF_PF | - |

| Deduction Type | Social Security Contribution | - |

| Deduction Amount | 300 | Social contribution amount provided by the supplier. |

| Start Date | 04/01/17 | Date from which the deductions are effective. |

Example

The supplier as a person provides services and invoices for the services rendered during the month to a company. This supplier has provided the previous month’s social security contribution amount paid to the company. The clerk has recorded this amount in the Third Party Tax Profile. The clerk enters this supplier invoice, validates and approves the invoice, then makes a payment in Payables.

Payables Invoice Transaction Line

| Invoice Date | Invoice Number | Product Type | Amount |

|---|---|---|---|

| 05/20/17 | 900 | Service | 2500 |

| Total | 2500.00 BRL | ||

Tax Determination Process

In Brazil, IRRF_PF tax is calculated at the time of payment per these formula:

IRRF_PF taxable basis = Total amount – Social security contribution deduction

| Total invoice amount | 2500 BRL |

| Social security contribution deduction | 300 |

| IRRF_PF taxable basis | 2500- 300 = 2200 BRL |

| IRRF_PF tax amount as per rate schedule | 52.56 BRL |

| Amount From | Amount To | Rate Percentage |

|---|---|---|

| 0 | 1499.15 | 0 |

| 1499.15 | 2246.75 | 7.5 |

| 2246.75 | 2995.70 | 15 |

| 2995.70 | 3743.19 | 22.5 |

| 3743.19 | - | 27.5 |

Withholding Tax Line

After the tax determination process successfully completes, this tax line is created:

| Tax Line | Tax Regime | Tax Name | Tax Status | Tax Jurisdiction | Effective Tax Rate | Tax Amount |

|---|---|---|---|---|---|---|

| 1 | <User-defined withholding tax regime> | IRRF_PF | Standard | Brazil | 2.389% | -52.56 BRL |