- Using Financials for the Americas

- Withholding Tax Applicability Based on Supplier Type

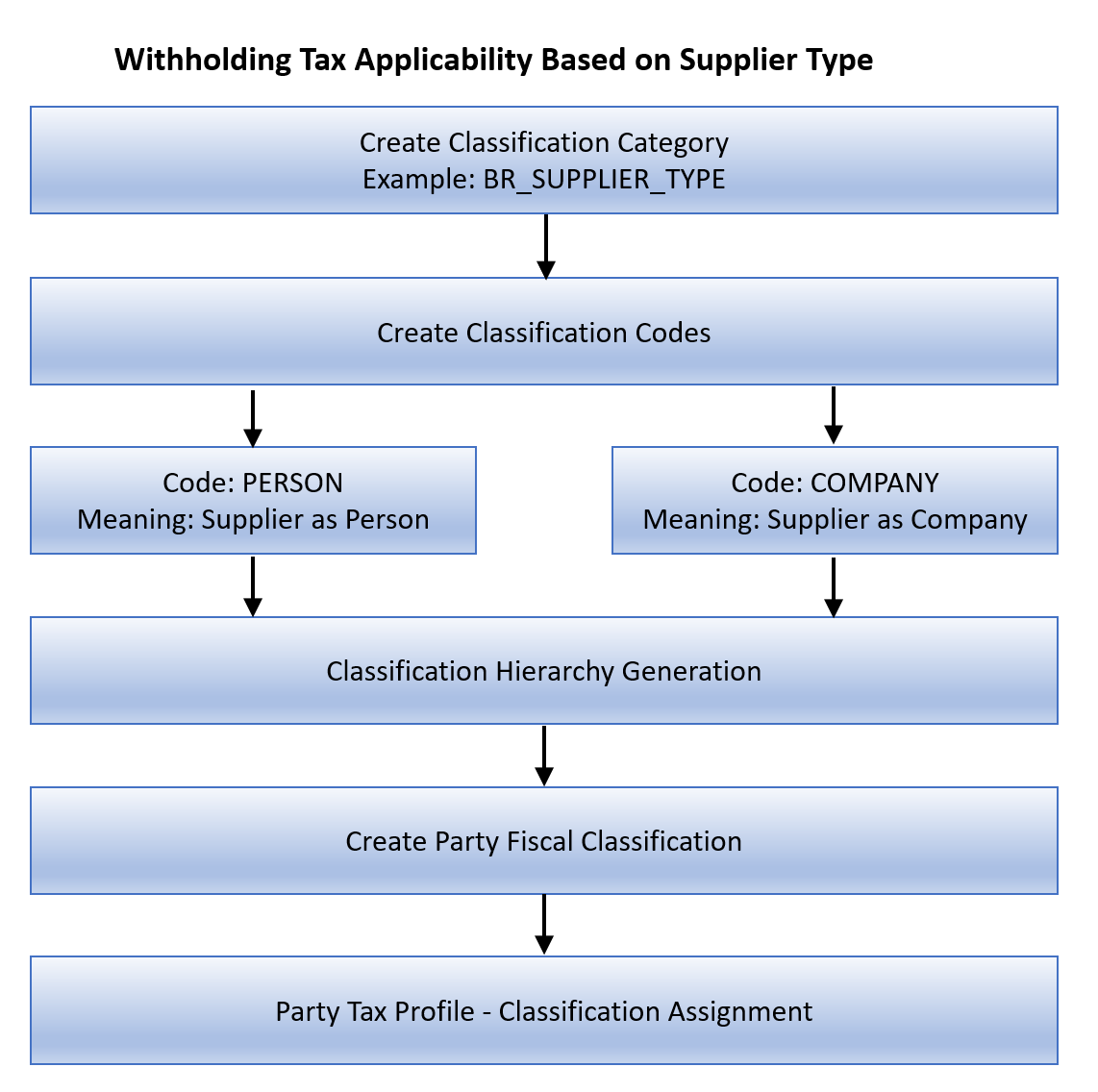

Withholding Tax Applicability Based on Supplier Type

In Brazil, withholding tax applicability varies based on the supplier type.

These are the withholding taxes based on supplier type.

- IRRF_PF is a federal withholding tax that is applicable only on services provided by persons.

- IRRF_PJ is a federal withholding tax that is applicable only on services provided by companies.

- INSS_PF is a withholding tax that is applicable on certain services provided by persons.

- INNS_PJ is a withholding tax that is applicable on certain services provided by companies.

Here is the pay cycle for the Payables' process flow:

To configure withholding tax applicability for the procure to pay cycle for Payables, based on supplier type follow these steps:

-

Create a Classification Category.

- Sign in as an Implementation Consultant.

- Click Navigator, Setup and Maintenance.

- Search for Manage Classification Categories.

- Click Add.

- Enter these values to create a classification category: This table displays the Classification Category attributes and values:

Attribute Value Comments Classification Category BR_SUPPLIER_TYPE Enter a user-defined value to meet your requirements. Classification Category Meaning BR_SUPPLIER_TYPE Enter a user-defined value to meet your requirements. Classification Category Description Brazil Supplier Type Enter a user-defined value to meet your requirements. Allow Parent Code Assignment Enabled Allow Multiple Class Code Assignment Enabled - Enter these values to create an entity assignment:

This table displays the Entity Assignment attributes and values:

Attribute Value Comments Table Name HZ_PARTIES Assign newly created category to TCA parties. Where Clause WHERE PARTY_TYPE =‘ORGANIZATION’ Enter the newly created category, which is the party type.

-

Create the classification codes:

- Click Create Classification Codes on the Classification Categories page.

- For data source, select Party Classification Hierarchy.

- Click Next.

-

Enter these values:

This table displays the Classification Codes' attributes and values:

Attribute Value Comments Classification Code COMPANY Classification code for the company. Classification Code Meaning Supplier as Company Classification Code Description Supplier as Company Classification Code PERSON Classification code for the person. Classification Code Meaning Supplier as Person Classification Code Description Supplier as Person

-

Create a classification generation hierarchy:

- Navigate to Tools, Scheduled Processes, Schedule New Process.

-

Run the Classification Hierarchy Generation ESS program with these

parameters:

This table displays the Classification Generation Hierarchy attributes and values:

Attribute Value Comments Classification Category BR_SUPPLIER_TYPE Use the classification category created in the preceding steps. Flattening Method Incremental Flattening

-

Create a party fiscal classification:

- Sign in as an Implementation Consultant.

- Click Navigator, Setup and Maintenance.

- Search for Manage Party Fiscal Classification.

- Click Add.

- Enter these values:

This table displays the party fiscal classification attributes and values:

Attributes Values Comments Party Classification BR_SUPPLIER_TYPE Assign the TCA category in the previous section. This links TCA category and party fiscal classification. Number of Levels 1 This classifies the supplier as a person and company. There is no further classification so one level is sufficient. Type Code BR_SUPPLIER_TYPE Enter a user-defined value to meet your requirements. Type Name BR_SUPPLIER_TYPE Enter a user-defined value to meet your requirements. Start Dates 01/01/01 Date from which the party fiscal classification type codes are effective. Related fiscal classification codes appear as Fiscal Classification Codes such as PERSON and COMPANY.

- Assign regimes that use this classification for tax rules.

-

Assign a party fiscal classification to a supplier. A third party tax profile includes main and default tax information such as

tax registration, tax exemptions, and party fiscal classifications:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Manage Party Tax Profiles.

- Search for the party to which you will assign the classification.

- Click the Classifications tab.

- ClickAdd.

- Enter these values to assign a party fiscal classification to the supplier:

This table displays the party fiscal classification to a supplier' attributes and values:

Party fiscal classifications classify suppliers as a person or company for tax determination. A tax determining factor can be a geographical location, party fiscal classification (Supplier Type) and product fiscal classification (Product Type). A tax determining factor is an attribute that contributes to the outcome of a tax determination process. Tax determining factors are categorized into logical groupings called tax determining factor classes. Each tax determining factor class contains determining factor names that constitute the contents of the class.Attribute Value Comments Fiscal Classification Type Code BR_SUPPLIER_TYPE Assign the party fiscal classification type code created in the previous section. Fiscal Classification Type Name BR_SUPPLIER_TYPE Automatically defaults based on the fiscal classification type code value. Fiscal Classification Code PERSON Select the applicable supplier type person/company. Fiscal Classification Name Supplier as PERSON Automatically defaults based on the fiscal classification code value. This table explains the tax determining factor details required to map the given scenario:

Attribute Value Comments Tax Determining Factor Class Party Fiscal Classifications This factor class allows party fiscal classification to be used as a tax determining factor to create tax rules. Tax Determining Factor Name BR_Supplier_TYPE The newly created party fiscal classification classifies suppliers as a person or company.

-

Create the tax determining factor set:

- Sign in as a Tax Manager.

- Click Navigator , Setup and Maintenance.

- Search for Tax Determining Factor Set.

- Click Add.

- Enter these values:

This table displays the tax determining factor set's attributes and values:

Attributes Values Comments Tax Determining Factor Set Code PARTY_TDF User discretion. Tax Regime Code <User defined withholding Tax Regime> Choose Brazil Withholding Tax Regime. Tax Determining Factor Class Party Fiscal Classification This factor class allows using party fiscal classifications as a tax determining factor to create tax rules. Tax Class Qualifier Bill From Party Bill From Party is selected as class qualifier. Tax Determining Factor Name BR_SUPPLIER_TYPE Party fiscal classification type defined above.

-

Create a tax condition set:

- Sign in as a Tax Manager.

- Click Navigator , Setup and Maintenance.

- Search for Tax Condition Set.

- Click Add.

- Enter these values:

This table shows data for Tax Condition Set 1:

Attributes Values Comments Tax Condition Set Code PARTY_TCS_P User discretion. Tax Determining Factor Set Code PARTY_TDF Tax Determining Factor Set created previously. Tax Determining Factor Class Party Fiscal Classification Default, based on Tax Determining Factor Set Code. Tax Class Qualifier Bill from Party Default, based on Tax Determining Factor Set Code. Tax Determining Factor Name BR_SUPPLIER_TYPE Default, based on Tax Determining Factor Set Code. Operator Equal to Party Fiscal Classification value equal to. Value PERSON PERSON TYPE chosen. This table shows data for Tax Condition Set 1I:

Attributes Values Comments Tax Condition Set Code PARTY_TCS_C User discretion. Tax Determining Factor Set Code PARTY_TDP Tax Determining Factor Set created previously. Tax Determining Factor Class Party Fiscal Classification Default, based on Tax Determining Factor Set Code Tax Class Qualifier Bill from Party Default, based on Tax Determining Factor Set Code Tax Determining Factor Name BR_SUPPLIER_TYPE Default, based on Tax Determining Factor Set Code Operator Equal to Party Fiscal Classification value equal to Value COMPANY PERSON TYPE chosen

-

Create a tax applicability rule:

- Sign in as a Tax Manager.

- Click Navigator , Setup and Maintenance.

- Search for Manage Tax Rules.

- Select the Tax Applicability Rules rule type.

- Click Add.

-

Enter these values:

This table displays the Tax Applicability Rule attributes and values:

Attributes Values Comments Tax Regime <User defined withholding Tax Regime> Brazil Withholding Tax Regime Tax IRRF_PF Withholding tax for the services rendered by persons. Rule Code WHT_IRRF_PF User discretion Tax Determining Factor Set Code PARTY_TDF Tax Determining Factor Set created previously This table displays the Tax Conditions:

Attributes Values Comments Tax Condition Set Code PARTY_TCS_C Tax Condition Set Code created previously Condition Set Result Applicable ISSWithholding Tax applicable based on transaction tax

Note: Codes mentioned in the preceding table are for demonstration purposes only. Users can create their own codes.With the preceding setup, Oracle ERP Cloud derives the supplier type person or company during the tax determination process based on the supplier chosen in the invoice workbench, and applies withholding tax.