Define a Liability Account Using Subledger Accounting Rules

You can use subledger accounting rules to define a liability account if specifying a liability account in each joint venture definition doesn’t meet your business needs.

Using subledger accounting rules, you set up a mapping set and an account rule, which you add to a journal entry rule set. You then assign the journal entry rule set to an accounting method.

You create a mapping set to map a combination of input values to specific output values. You can use the predefined reference keys for joint ventures as the input source in your mapping set. See Reference Keys for Joint Venture Payables Invoices for more information. For example, you can use Reference key 4 for mapping the joint venture name so that it appears on each invoice line.

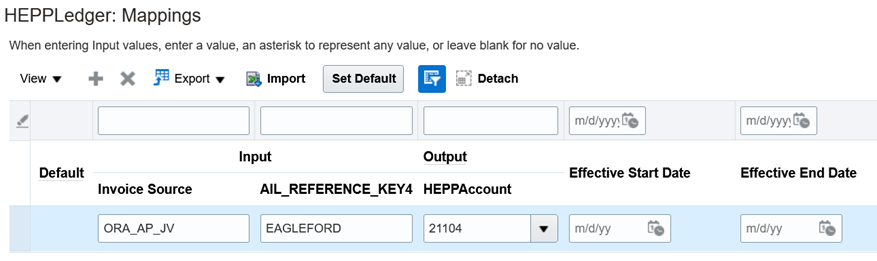

The following example shows a mapping set to define a liability account with the following values selected for the input sources:

- Subledger Application = Payables

- Event Class = Invoice

-

Source = AIL_REFERENCE_KEY4

The source is one of the predefined reference keys, which you can select one or more for the input source.

The following image shows the Mappings section with values entered for the input and output sources. The two input columns named Invoice Source and AIL_REFERENCE_KEY4 are mapped to the values ORA_AP_JV and EAGLEFORD respectively. The output column named HEPPAccount is mapped to account 21104. This means all payables invoices created for joint venture EAGLEFORD will use natural account 21104 for the liability account.