Feature Specific Setup

Complete these common setups for features before using China related tasks in the implementation Projects.

Configure Offerings

Enable the Regional Localization for China before using China related tasks in the implementation Projects.

Follow these steps:- Navigate to Setup and Maintenance.

- Search for and select Configure Offerings.

- In the Configure Offerings window, enable China under the Financials section.

Set Up Security

Complete the setup for necessary security settings.

- Assign the duty role to the related job role to set up security.

- For the duty roles for financial data export are all orphan duty

roles.

This table lists the duty roles for financial data export with examples.

Duty Role Name Duty Role Description Associated Job Role (Exanple) Enterprise Financial and Employee Data Export for China Duty Exports financial and employee data in an XML format for an enterprise. General Accounting Manager

Enterprise Financial Data Export Management for China Duty Manages setup tasks that are required to generate XML files with financial data for an enterprise. General Accounting Manager

Financial Application Administrator

Set Enterprise Financial Data Export Options for China

You must complete these mandatory security settings:

Follow these steps:

- Navigate to Setup and Maintenance.

- Search for and select Enterprise Financial Data Export Options for China.

- Select each of these tabs and complete the setup as needed:

- Financial Information Options: Accounting information

- Financial Information Options: Flexfield Assignment

- Financial Information Options: Cash Flow Item Attribute Assignments

- Accounting Book Information

- Depreciation Method Formula

- Click Done.

Financial Information Options:

- Financial Information Options: Accounting information

You must define financial information options by Chart of Account level, and assign the subsidiary accounts under the chart of account. This setup is used to calculate the account entry and balance along with the subsidiary account.

Set these source types as subsidiary accounts:

- Chart of Account Segments: All segments except balancing segment and natural account segment

- Third Party: Customer, supplier, and employee supplier information

- Project Number: Project number from project.

- Financial Information Options: Flexfield Assignment

You must define a descriptive flexfield to store the settlement method if they have intercompany transactions. This setup is used to collect the settlement method of the cash related intercompany transactions.

- Financial Information Options: Cash Flow Item Attribute

Assignments

You must specify the cash flow statement rows that are used in the cash flow statement and supplementary schedule. Both item source and item attribute are required along with the other cash flow item attributes. This setup is used to export cash flow items in shared information data export part.

Accounting Book Information:

You must define the general information for an accounting book based on a specific legal entity. This setup is used to export accounting book information in shared information data export part.

- Select the Account Book Information tab.

- Create or edit a selected legal entity and modify these values as needed:

- Company Name

- Book Name

- Book Number

- Organization Code

- Enterprise Industry

- Enterprise Quality

- Standard Version

Depreciation Method Formula

You must define the text formula for the depreciation methods they use. This setup is used to export the asset depreciation method formula description in the fixed asset data export part.

Follow these steps:

- Select the Depreciation Method Formula tab.

- Create or edit a selected Depreciation method as needed:

- Depreciation Method: Straight-Line.

- Depreciation Method Formula: Depreciation Amount = Recoverable Amount/Life (for straight line method).

- Start Date

- End Date

Enterprise Additional Account Attributes

Follow these steps:

- Navigate to Setup and Maintenance and select Creating Enterprise Additional Account Attributes.

- Search for and select Creating Enterprise Additional Account Attributes.

- The Create Enterprise Additional Account Attributes for China task is a process

that creates two additional account attributes for natural accounts under the

chart of accounts: Balance Side for China and Cash-Related Account for China:

- The Cash-Related Account for China attribute is used for exporting cash-related journals. While exporting data from the general ledger, cash-related accounts are exported based on the value of this attribute.

- The Balance Side for China attribute is used when exporting data from the general ledger. For some accounts the balance side is different from the balance side attribute, therefore, you need to set the balance side for these accounts to export data correctly.

Profile Options

You must define the four required financial reports like Balance Sheet, Profit Statement, Cash Flow Statement, and Statement of Changes in Owner’s Equity report in Hyperion Financial Reporting. Then, save a snapshot for a specific period range into the catalog.

Follow these steps:- Navigate to Setup and Maintenance.

- Search for and select Financial Report Snapshot Directory for China.

- Select a profile to use for the location of the snapshot where it is saved. You can set it as site, product, and user level.

- Search for and select Manage Administrator Profile Values task.

-

Define the path value in the profile and choose the report under the path you saved in the parameter for the report data export in General Ledger data export report.

- You can find this value at the Financial Reporting Center:

- Navigate to General Accounting Financial Reporting Center.

- Search for and select Open Workspace for Financial Reports task.

- Browse and locate the value.

Cash Flow Statement

You must complete both common setup and Subledger Accounting setup.

Common SetupYou must define the common tasks before using the cash flow statement.

Follow these steps:

- In Chart of Account, assign a new segment label:

- Navigate to Setup and Maintenance.

- Search for and select Manage Chart of Account Structure task.

- Create a segment, Local Use Segment.

This segment label indicates which segment in the chart of account is the cash flow item segment.

- Define a specific segment in the chart of account structure for cash flow items.

- Assign a new subledger accounting method which is ‘Standard Accrual for China’

for the ledger. This subledger accounting method should be used to collect the

cash flow segment for each subledger transaction.

- Navigate to Setup and Maintenance.

- Search for and select Specify Ledger Options task.

- Choose either Standard Accrual for China account method or copy a

new one based on it for the ledgers.

A set of accounting rules are available for the local use segment under Standard Accrual for China account method to collect the correct cash flow amount.

- Create a new accounting method based on Standard Accrual for China accounting method and add some additional setup if they also use Oracle Procurement Cloud.

- Create a mapping set for the cash flow segment items.

- Navigate to Setup and Maintenance and select Manage Mapping Sets.

- Search for and select Subledger Accounting Method task.

- Create a new mapping set with these settings:

- Owner: User

- Application: Cost Management

- Description: PO Accrual Account Mapping Set

- Mapping Set Code: JA_CN_CST_ACCRUAL_MAPPING_SET

- Mapping Set Name: PO Accrual Account Mapping Set

- Input Value Set: User defined “Local Use” segment Value

- Chart of Accounts: User defined Chart of Accounts

This table displays the settings to be defined for a mapping set:

Priority Value Type Value Input source Segment 10 Mapping Set PO Accrual Account Mapping Set

Cost Management Default Account

Local Use Segment

- Create a new account derivation rule:

- Navigate to Setup and Maintenance and select Manage Account Rules.

- Search for and select Subledger Accounting Method task.

- Create a new account derivation rule with these settings:

- Owner: User

- Application: Receipt Accounting

- Code: JA_CN_CST_ACCRUAL

- Name: China PO Accrual Rule

- Description: PO Accrual Account Rule for China

- Chart of Accounts: User defined Chart of Accounts

- Output Type: Segment

- Output Type Value: Local Use Segment

This table displays the settings to be defined for the account derivation rule:

Priority Value Type Value Input source Segment 10 Mapping Set PO Accrual Account Mapping Set

Cost Management Default Account

Local Use Segment

- Assign the account derivation rule to the local use segment rule of the

Accrual journal line rule under Receipt Accounting application

China Receipt into Inspection journal line rule set with these

settings.

- Owner: User

- Event Type: Receipt into Inspection

- Code: JA_CN_ACCRUAL_RCPT_INSP

- Name: China Receipt into Inspection

- Description: Receipt into Inspection for China

- Chart of Accounts: Null

*Journal Line Rule

Segment Account Derivation Rule Code Account Derivation Rule Code Name Account Derivation Rule Description Accrual Local Use JA_CN_CST_ACCRUAL

China PO Accrual Rule

PO Accrual Account Rule for China.

Accounting Rules

The basic rule of the cash flow collection is getting the cash flow segment amount from the opposite side of the cash account. By using this way we get the amount from each cash transaction entry. And then summarize them to each cash flow rows of the cash flow statement in Hyperion Financial Report.

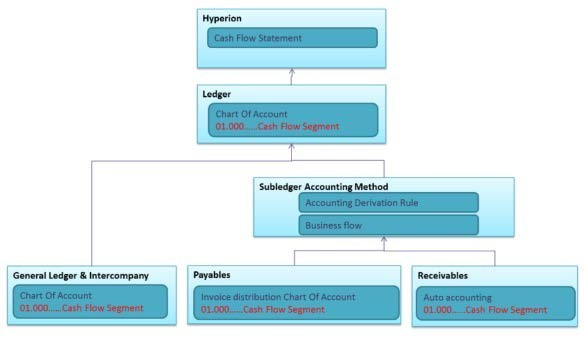

This image displays the flow diagram for Accounting Rules:

Oracle Payables

In Payables, you can get the cash flow item and amount from each payment. The source of the cash flow item will be derived from each invoice distribution line cash flow segment.

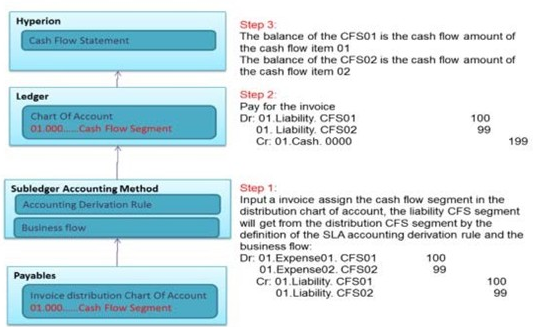

This image displays the flow diagram for Payables:

- Owner: User

- Application: Payables

- Description: Default Cash Flow Segment Source for China

| Accounting Class | CFS Source | Accounting Definition |

|---|---|---|

| Item expense-for ERS and PO matched invoices | PO category\item category accrual account and the expense account | PO category\item category accrual account and expense account definition. |

| Item expense-For expense report and iExpense invoices | Expense report item account | Expense report item account definition in the expense report template. |

| Refund invoice from AR | Refund account | “Refund type” account in the receivables activities definition. |

| Intercompany invoice | Intercompany account | Intercompany account definition |

| Prepayment | Supplier site | If there are two CFS for one supplier, separate the supplier site. |

Oracle Receivables

In Receivables, you can get the cash flow item and amount from each receipt and apply application. The source of the cash flow item will be derived from each transaction receivable account cash flow segment.

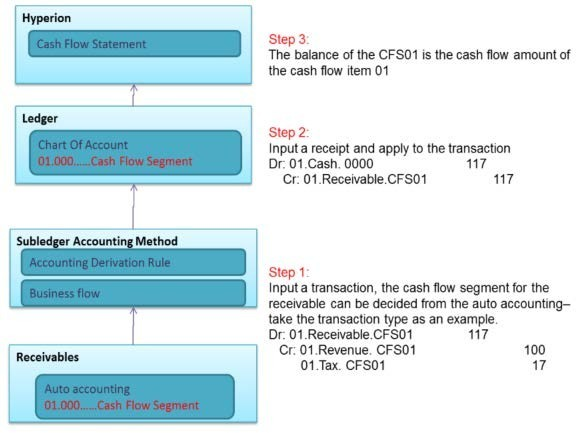

This image displays the flow diagram for Receivables:

Segment 1

- Owner: User

- Application: Receivables

- Description: Default CFS Source for China

| Accounting Class | CFS Source | Accounting Definition |

|---|---|---|

| Receipt Bank Charges | Bank charge account | “Bank Charges” account in the bank account definition, and the “Bank Charges” account in the receipt method. |

| Receipt On Account Application | On account | “On account receipts “account in the receipt method. |

| Receipt Refund Application | Refund account | “Refund type” account in the receivables activities definition. |

| Receipt Unapplied Cash | Unapplied account | “Unapplied receipts “account in the receipt method. |

Segment 2

- Owner: User

- Application: Receivables

- Description: Default CFS Source for China

| Accounting Class | CFS Source | Accounting Definition |

|---|---|---|

| Receipt Unidentified Cash | Unidentified account | “Unidentified receipts “account in the receipt method. |

| Receipt Write-Off Application | Write-Off account | “Receipt Write-Off type” account in the receivables activities definition. |

| Receivable\Revenue\Tax | Transaction type |

Receivable\Revenue\Tax account definition in receivables transaction type ; and the auto accounting for these accounting class by the “Transaction Type” |

|

Miscellaneous Receipt Miscellaneous Cash |

Miscellaneous Receipt account | “Miscellaneous Cash Type” account in the receivables activities definition. |

Oracle General Ledger

You must input the Cash flow segment in the chart of account in the opposite side of the cash line in the cash related journal lines. The cash line should be the default value: 0000 no cash.

Here's an example:

Dr: 01.Expense.CFS01 20

Cr: 01.Cash.0000 20- Owner: User

- Application: General Ledge

- Description: Default CFS Source for China

| Accounting Class | CFS Source | Accounting Definition |

|---|---|---|

| Cash account | No cash flow segment in cash related account | Cross validation for such COA. |