Manage Taxes Levied at Ad Valorem Rate

The federal government in Brazil listed all the taxable products and nontaxable products in a table.

This table is known as TIPI (table of IPI) and describes all the product fiscal classifications, an 8 digit numeric identifier, and the associated ad valorem rates. The ad valorem rate is a percentage applied on IPI taxable basis to determine the IPI tax amount.

| Product Fiscal Classification (PFC) | Description | Ad Valorem Rate |

|---|---|---|

| 37012010 | Photograph films | 18 |

| 39173900 | Plastic tubes | 10 |

| 71023100 | Non industrial diamonds | 0 |

| 84091000 | Airplane motor parts | 5 |

| 84122110 | Hydraulic cylinders | 5 |

| 85254000 | Video cameras | 20 |

| 90041000 | Sunglasses | 15 |

You can use product fiscal classification to determine the tax applicability.

Here's an example showing the step by step process:

There are two ad valorem rates, Rate 5 and Rate 15. Rate 5 is applicable on product fiscal classification (PFC) airplane motor parts (84091000) and hydraulic cylinders (84122110). Rate 15 is applicable for PFC sunglasses (90041000). This example uses three PFCs and two rates.

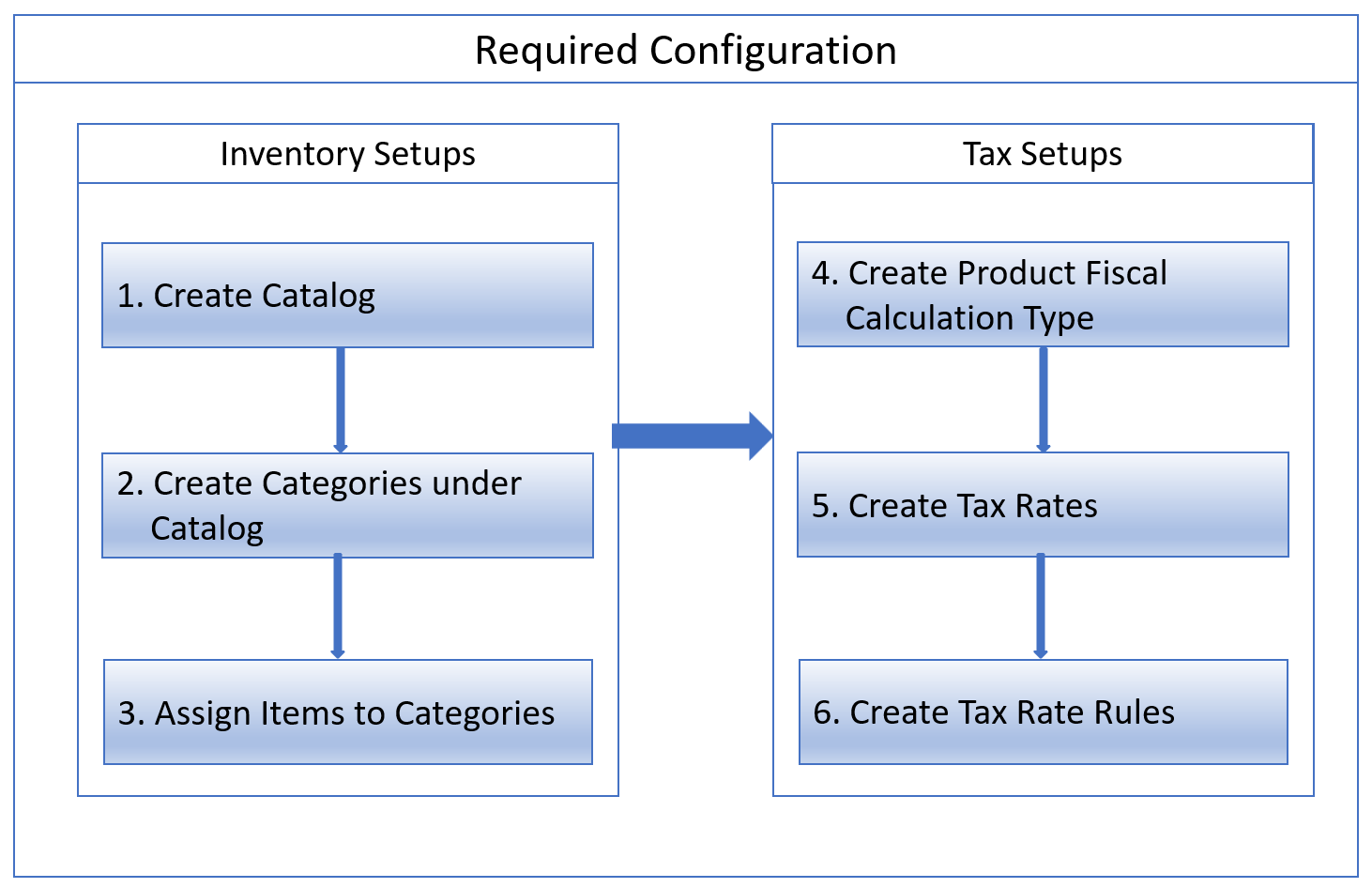

This image shows the required configuration:

Create a Catalog

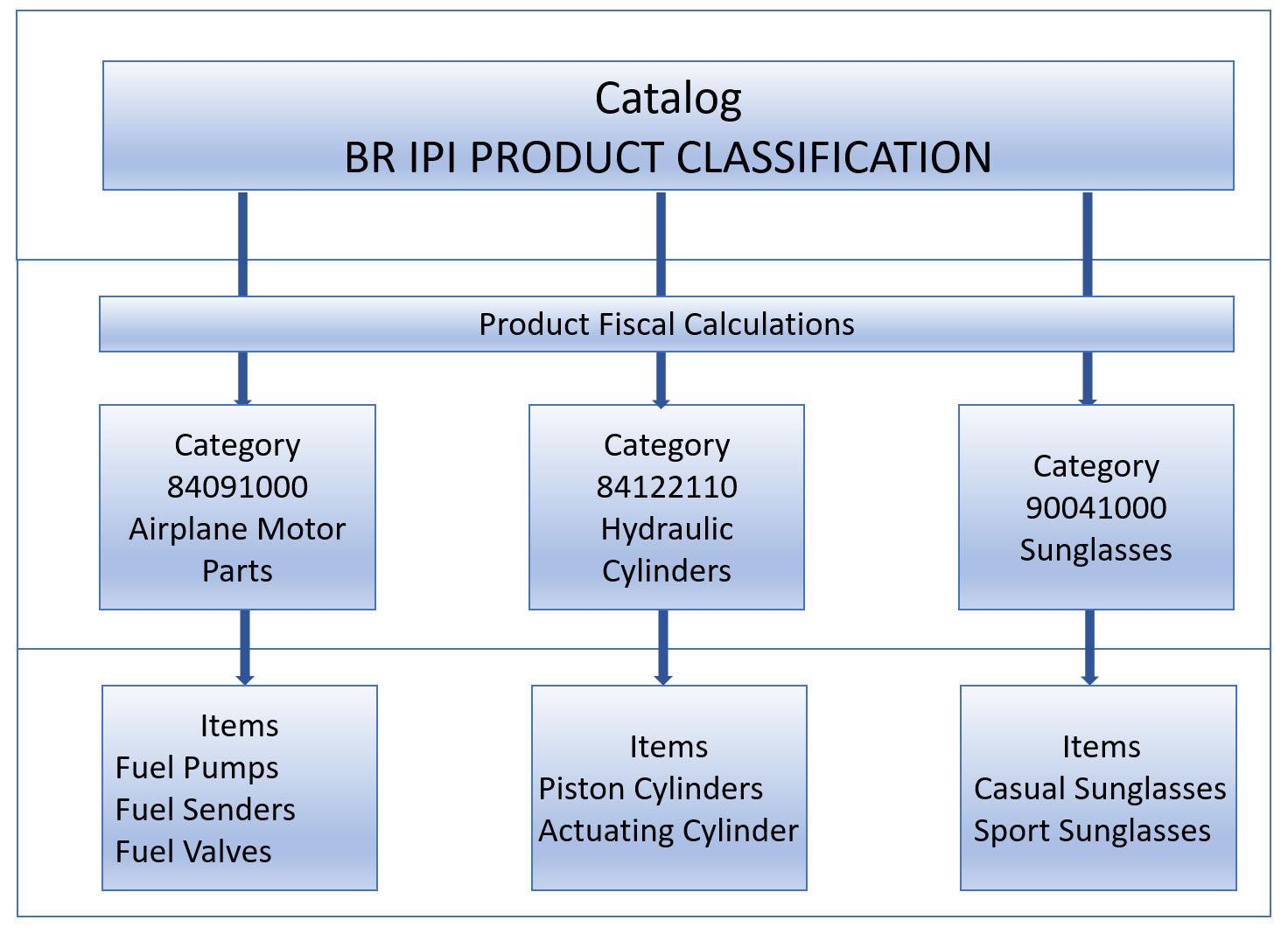

A catalog is a collection of categories to classify items. You can create one catalog specifically for transaction tax IPI with a meaningful name, for example, BR IPI PRODUCT CLASSIFICATION.

Follow these steps:- Sign in as a Product Manager.

- Navigate to Product Management, Product Information Management, Item management menu, Manage Catalogs.

- Click Add.

- Create Categories under Catalog.

Every 8 digit numeric identifier in TIPI is defined as a category under the catalog. A category code can be an 8 digit numeric identifier in TIPI and name. This example requires three categories.

Category Code Category Name 84091000 Airplane Motor Parts 84122110 Hydraulic Cylinders 90041000 Sunglasses To create categories, follow these steps:- Sign in as a Product Manager.

- Navigate to Product Management, Product Information Management, Item management menu, Manage Catalogs.

- Search for the catalog and click on a catalog name..

- Click Add.

- Assign Items to Categories.

Identify the items for a particular TIPI PFC and assign them to the respective category. For example, hydraulic cylinders can be piston-type or cushioned type. Both items are taxable at the same rate of 5%. These two types of cylinders in the item master are assigned to category 84122110 hydraulic cylinders.

To assign a category to an item, follow these steps:- Sign in as a Product Manager.

- Navigate to Product Management, Product Information Management, Item management menu, Manage Item.

- Search for the desired Item and click an Item name.

-

Click Add to assign the item to a category.

For more information on defining catalogs, categories, items, and assigning categories to items, see the Manage Product and Service Data: Define Catalogs chapter in the Oracle SCM Cloud Implementing Product Management guide at http://docs.oracle.com.

Here's a pictorial representation of how an item catalog is assigned to an item.

The next steps are for Tax Setup.

-

Create Product Fiscal Classification Type.

To create a product fiscal classification type, follow these steps:- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Manage Product-Based Fiscal Classifications.

- Click Add to create a new product fiscal classification type with

these attributes.

Attribute Value Comments Inventory Category Set BR IPI PRODUCT CLASSIFICATION Assign the catalog created in step 1. This is where you link inventory categories and tax product fiscal classification. Number of Levels 1 Every 8 digit numeric identifier in TIPI is defined as an inventory category. There are no sub categories under a category, therefore only one level is sufficient. Type Code TIPI Enter a user-defined value to meet your requirements. Type Name Table of IPI Enter a user-defined value to meet your requirements. Start position 1 Verify if the tax engine recognize a category code from the first digit. Number of characters 8 The naming convention for the category name in step 2 is an 8 digits numeric identifier. Verify if the tax engine recognize a category code till the last digit. Tax Regime Code IPI Attach a tax regime to use in the tax rules.

- Create Tax Rates. Create a tax rate for each unique ad valorem rate. You can create two

tax rates for 5 and 15. Define a tax rate rule with these attributes to default

a tax rate based on the item category. Steps in creating a Tax Rate Rule include:

- Create Determining Factor Set.

- Create Tax Condition Set.

- Create Tax Rate Rule.

Here inventory categories are used as product fiscal classifications. This table describes the determining factor details for mapping this scenario.

Attribute Value Comments Tax Determining Factor Class Product inventory linked Allows product fiscal classification to be used as a tax determining factor to create tax rules. Tax Determining Factor Name Product fiscal classification type Oracle ERP Cloud inventory catalog-category item functionality that derives an inventory category from an item on the transaction line. Create Tax Determining Factor Set.

To create a tax determining factor set, follow these steps:- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Tax Determining Factor Sets.

-

Click Add to create a tax determining factor set with these attributes.

Attributes Values Comments Tax Determining Factor Set IPI_DFS User Discretion. Tax Regime Code IPI Choose IPI Regime Tax Determining Factor Class Product inventory linked This factor class allows using product fiscal classification determining factor to create tax rules. Tax Class Qualifier Level 1 Product Fiscal Classification defined above has only one level Tax Determining Factor Name Table of IPI Product Fiscal Classification defined above.

- Create Tax Condition Set.

To create a tax condition set, follow these steps:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Tax Condition Sets.

- Click Add to create a tax condition set with these

attributes.

Tax Condition Set 1

Attribute Values Comments Tax Condition Set Code IPI_TCS_I User Discretion. Tax Determining Factor Set Code IPI_DFS Tax Determining Factor Set created above. Operator In Inventory Category value matches with Value 84091000 84122110 - Tax Condition Set 2

Attribute Value Comments Tax Condition Set Code IPI_TCS_II User Discretion. Tax Determining Factor Set Code IPI_DFS Tax Determining Factor Set created above. Operator Equal To Inventory Category value equal to Value 90041000 - - Create Tax Rule

To create a tax rate rule, follow these steps:

- Sign in as a Tax Manager.

- Click Navigator, Setup and Maintenance.

- Search for Tax Rules.

- Select Tax Rate Rules as Rate Type.

- Click Add to create a Tax rule with these attributes.Here are the tax rate rules:

Attributes Values Comments Rule Code IPI_TPI_RATES User Discretion Tax Determining Factor Set Code IPI_DFS Tax Determining Factor Set created above Here are the tax conditions:

Tax Condition Set Code Result Comments IPI_TCS_1 Tax Rate 5% If category is 84091000 or 84122110 then the tax engine defaults to tax rate 5%. IPI_TCS_2 Tax Rate 15% If category is 90041000 then the tax engine defaults to tax rate 15%.