Define a Receivable Account Using Subledger Accounting Rules

You can use subledger accounting rules to define a receivable account if the other two methods don’t meet your business needs.

Using subledger accounting rules, you set up a mapping set and an account rule, which you add to a journal entry rule set for the event "Invoice" and journal line "Invoice Default Receivable." You then assign the journal entry rule set to an accounting method.

In the mapping set, use the Transaction Cross Reference field on the invoice as the input source. This field records the joint venture name in the invoice header. You can then map the joint ventures to their respective receivable accounts.

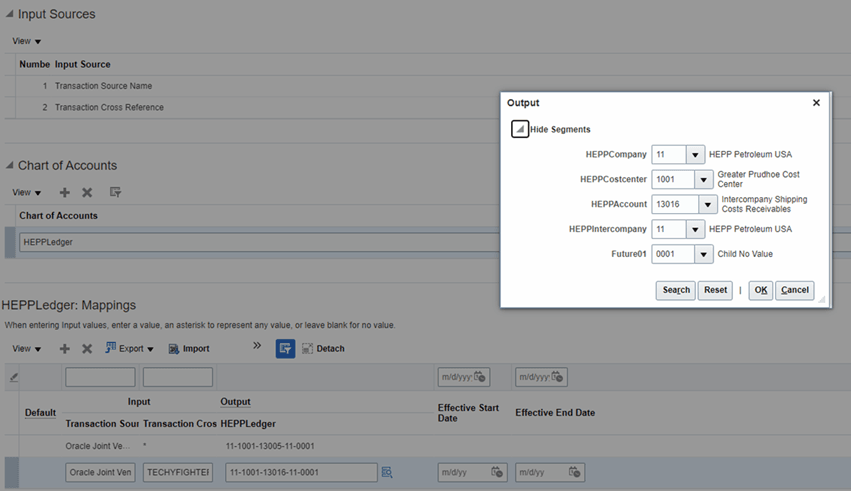

The following example shows a mapping set to define a receivable account. In the mapping set, the input sources are Transaction Source Name and Transaction Cross Reference. The chart of accounts is HEPPLedger. Values have been identified for the input sources and the output source, with the Output dialog box displayed to show the segments that make up the account.