Overview of Managing General Fiscal Documents

Fiscal documents must comply with the regulations of the Brazilian tax authorities. They also help to register a transfer of ownership of a good or a commercial activity provided by a company to an individual or to another company.

You can create and manage fiscal documents for sales invoices, internal transfer shipments, returns to vendor shipments, and internal transfer of fixed assets. You can manage the entire fiscal document lifecycle that includes these capabilities:

- Generate a sequential fiscal document number with the corresponding series and a unique fiscal document key.

- Extract and send the fiscal document information to partners, who communicate with the tax authorities.

- Process the tax authority return information, such as fiscal document approval, validation errors, or rejection.

- Complete the Receivables invoice automatically or allow the shipment to be confirmed, after the fiscal document is approved by the tax authority.

- Print the DANFE (Auxiliary Document for Electronic Fiscal Document) for it to be shipped with the goods.

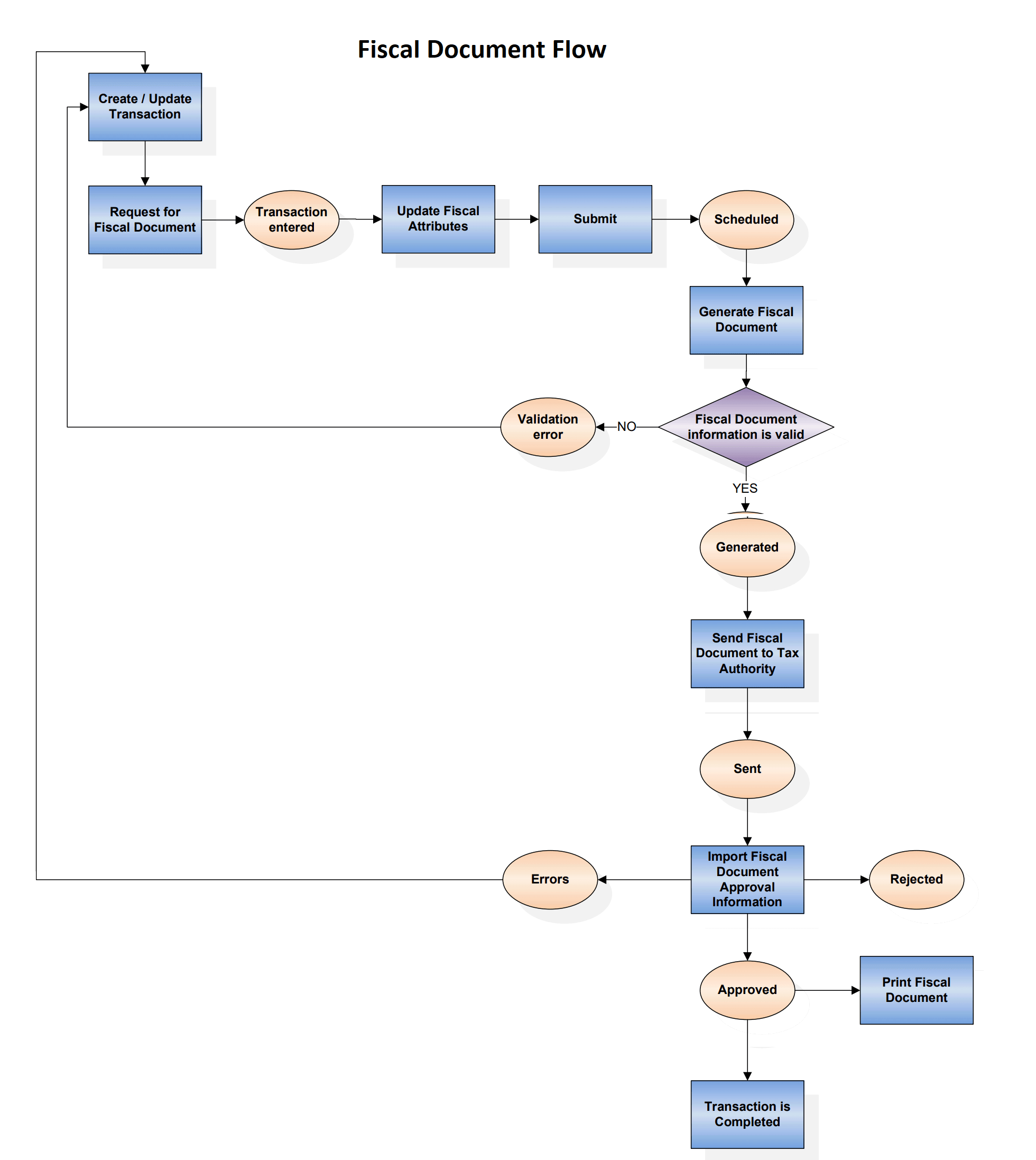

This image depicts the general fiscal document flow, and summarizes the main tasks necessary to generate and approve a regular fiscal document:

Enable Fiscal Document After a Transaction in Receivables

Fiscal documents are always based on a transaction. After you create the transaction, follow these steps:

- Select the Request for Fiscal Document action from the main

transaction page (such as the Edit Shipment page in Inventory Management, or the

Edit Transaction page in Receivables). If taxes are not previously calculated, they

are calculated on this page.Note: Once you select the Request for Fiscal Document action, the transaction cannot be updated.

- Click Update Fiscal Attributes, where you can enter additional transaction information required for the fiscal document.

- Click Submit. The status of the fiscal document changes to Scheduled.

- Click Generate Fiscal Document to verify if the information

required for fiscal document generation is available. If there are no validation

errors, a fiscal document key and a fiscal document sequential number are provided,

and the fiscal document status changes to Generated.

If there are validation errors, the fiscal document status changes to Validation error. After correcting the errors, click Request for Fiscal Document again, and repeat the same steps until there are no validation errors, and the status of the fiscal document is Generated.

- The fiscal document is now available to be extracted and used by a third party who submits the request for tax authority approval. The Send Fiscal Document to Tax Authority process creates an extract file containing the fiscal document information, and change the status of the fiscal document to Sent.

- Partners generate the fiscal document XML file based on the extract file and send it to the tax authority.

- The tax authority can approve, reject, or raise validation errors for the fiscal documents.

Partners communicate the tax authority response through the Import Fiscal Document

Approval Information process.

- If the fiscal document is approved, the status changes to Approved. If the fiscal document was generated in Receivables, the transaction is automatically completed. If the fiscal document was generated based on a shipment, the Ship Confirm action is enabled. Click Print Fiscal Document to print the DANFE, and send it with the shipment.

- If the fiscal document has errors raised by the tax authority, the status changes to Errors. You must correct the setup or transaction information and click Request for Fiscal Document again.

- If the fiscal document is rejected by the tax authority, the status changes to Rejected. Then the corresponding Receivables transaction cannot be completed or the corresponding shipment cannot be confirmed until your company resolves the unexpected legal or tax issues with the tax authority.

For more information on the fiscal document generation usage in different business flows, see the Quick Reference for Oracle ERP Cloud Documentation for Brazil (2329725.1) on My Oracle Support at https://support.oracle.com.

You can perform these tasks before invoices are completed:

- Enter the appropriate fiscal attributes.

- Calculate taxes.

- Generate a fiscal document for sales invoices.

You can perform these tasks after this feature is integrated with Shipping:

- Capture and validate the fiscal attributes.

- Generate and manage the fiscal documents before the internal transfers and RTV shipments are released.