Derive Partner Contribution Accounts for Journal Entries Created to Close Partner Contributions

Journal entries created to close partner contributions include three journal lines:

-

A credit to the agreement default charge account if an agreement default charge applies

-

A credit to the account to which you want to hold the balance to be refunded

-

A debit to the joint venture’s partner contribution account for the open amount in the partner contribution

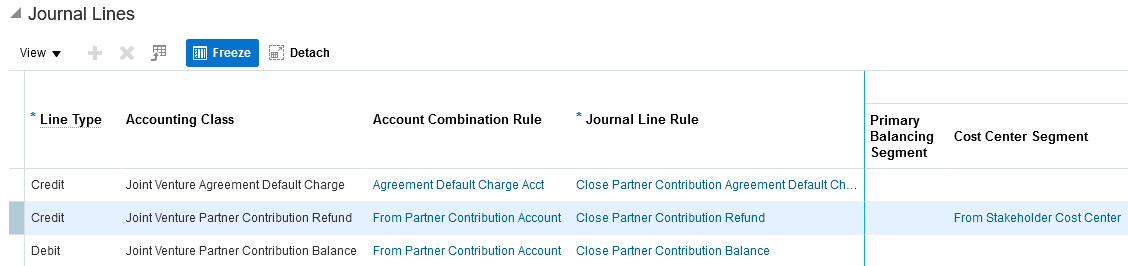

To derive the accounts for these journal lines, create a copy of the Partner Contribution Close journal entry rule set. This journal entry rule set includes these predefined journal lines as shown in the following image:

- The credit journal line for recording the agreement default charge, which is assigned the Agreement Default Charge Acct account rule

- The credit journal line for recording the refund amount, which is assigned two account rules: From Partner Contribution Account and From Stakeholder Cost Center

- The debit journal line for recording the open amount, which is assigned the From Partner Contribution Account account rule

Subledger accounting uses the “From Partner Contribution Account” and “Agreement Default Charge Acct” account rules to retrieve the joint venture partner contribution account and the agreement default charge account, respectively, from partner contributions. It uses the “From Stakeholder Cost Center” account rule to retrieve the stakeholder’s cost center to which the balance will be refunded.

You can use your copy of this journal entry rule set as is, or you can modify it to meet your needs. For example, to record the refund amount to a different segment, you can create an account rule to override that segment.