Use Subledger Accounting Rules to Derive Cutback Accounts for Carried Interest Journals with Revenue Amounts

This topic describes how to use subledger accounting rules to override the source transaction account with a different account.

For this setup, use your copy of the Carried Interest Revenue journal entry rule set to set up subledger accounting rules to override the account from the source transaction. Here are the tasks that you need to perform, followed by an example of a mapping set for mapping revenue in carried interest journals to revenue cutback accounts:

- Identify revenue cutback accounts.

-

Create a mapping set to map the following distribution types from internal transfer journals to the cutback accounts:

- R – Revenue

- V – Manual revenue joint venture source transactions created in Joint Venture Management

- Create an account rule for the mapping set.

- Add the account rule to your copy of the provided Carried Interest Revenue journal entry rule set.

-

Assign the journal entry rule set to the accounting method in the primary ledger of the joint venture.

When you assign the journal entry rule set to the accounting method, you must select Carried Interest Revenue for the event class.

To complete the setup, run the Update Subledger Application Options application before creating any events for the primary ledger and Joint Ventures application.

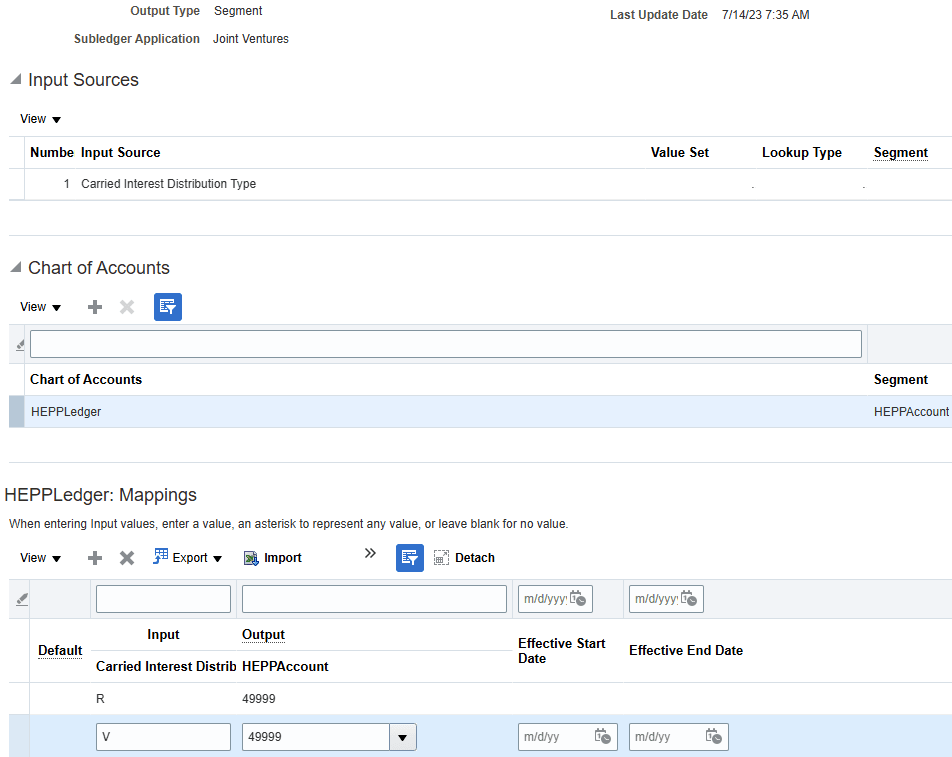

The following image shows an example of a mapping set for overriding the account from the source transactions for the revenue distribution types. The purpose of the mapping set is to replace the natural account segment on the transaction with the cutback account.

As shown in the example, specify these values in your mapping set:

-

Output Type. Select Segment.

Note: When you access Create Mapping Sets from the Joint Venture Management functional area, Joint Ventures is selected by default for the subledger application. It can’t be changed.

- Input Source. Search for and select Carried Interest Distribution Type, the one that’s associated with the Carried Interest Revenue event class.

- Chart of Accounts. Select the chart of accounts associated with the primary ledger of the joint venture, which is HEPPLedger in this example.

- Mappings. Add a row with the following values to map the revenue

transaction type from carried interest journals to the cutback

account:

- Input. For Carried Interest Distribution Type, enter R for Revenue.

- Output. For the natural account segment, select the cutback account. In this example, the natural account segment is HEPPAccount and the cutback account is 49999.

Also, as shown in the preceding example, if you’re using manual revenue joint venture source transactions, you’ll need to add a row to map distribution type V to the cutback account.

-